According to Make Lemonade, there are more than 44 million borrowers who collectively owe $1.5 trillion in student loan debt in the U.S. Student loans are now the second highest consumer debt category – behind mortgages, but ahead of credit card debt.

Tag Archives: consumer bankruptcy data

Government Shut Down & BK Courts

On December 22, 2018, the federal funding for certain agencies lapsed, and the United States government entered into a partial shutdown. The U.S. Department of Justice (DOJ), including the United States Trustee Program (USTP), was one of the agencies that shut down. United States Trustees (“UST”) representing the USTP appear and litigate in a multitude of bankruptcy proceedings. USTs also actively participate in out-of-court settlement discussions, plan negotiations, and the like. Pursuant to the partial shutdown, regular operations at the USTP ended, with only “excepted employees” continuing work on limited matters.

USTP excepted employees comprise a total of 35 percent of its employees. Excepted employees work without pay during the shutdown but will receive back pay after the government reopens. Remaining USTP employees who are not excepted are furloughed and will only receive compensation if Congress passes a bill allowing for it.

The contingency plan sets forth changes in the duties of DOJ employees. The contingency plan directs that civil litigation be halted except where the safety of human life or protection of property are at stake. Much of the civil litigation in which the USTP is a party does not involve such issues. The contingency plan further notes that DOJ attorneys should request stays in civil cases and reduce civil litigation staffing only to that necessary to protect human life and property. Several UST and DOJ attorneys involved in bankruptcy litigation have filed motions seeking stays of proceedings and extension of deadlines until the government reopens.

As the USTP continues to operate with its skeletal staff, certain bankruptcy processes will likely encounter delays. Although federal courts have rearranged funds to remain operational through January 18, should the shutdown extend beyond that date, bankruptcy matters such as plan confirmations and other court hearings will encounter similar delays.

Proceedings involving Chapter 7 and 13 trustees, including out-of-court discussions or negotiations, are unlikely to be delayed as these parties receive payments outside of government assistance.

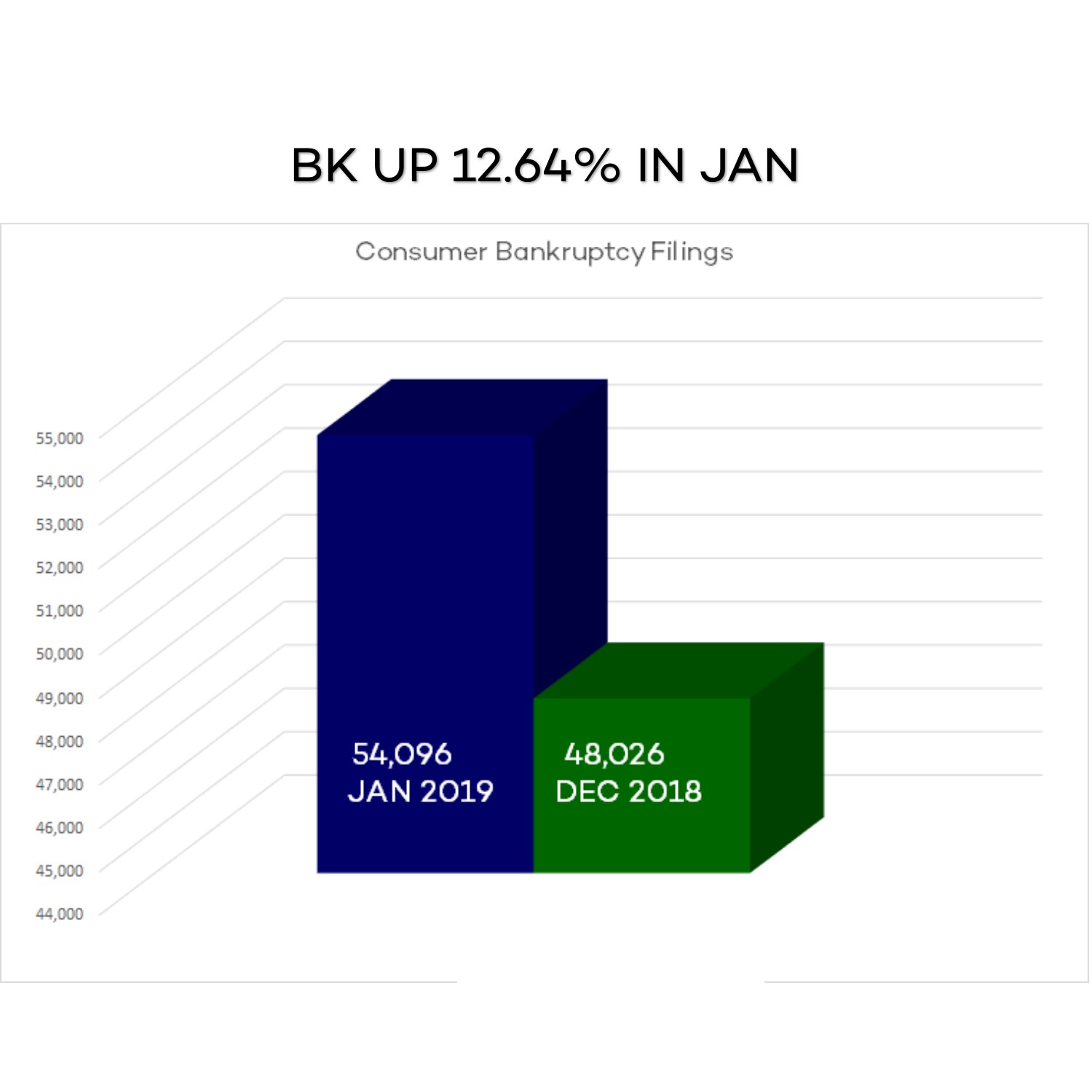

BK Up 12% in January

Medical Problems & Consumer Bankruptcy

Medical problems contributed to 66.5% of all bankruptcies, a figure that is virtually unchanged since before the passage of the Affordable Care Act (ACA), according to a study published yesterday as an editorial in the American Journal of Public Health. The findings indicate that 530,000 families suffer bankruptcies each year that are linked to illness or medical bills.

The study, carried out by a team of two doctors, two lawyers, and a sociologist from the Consumer Bankruptcy Project (CBP), surveyed a random sample of 910 Americans who filed for personal bankruptcy between 2013 and 2016, and abstracted the court records of their bankruptcy filings. The study, which is one component of the CBP’s ongoing bankruptcy research, provides the only national data on medical contributors to bankruptcy since the 2010 passage of the ACA. Bankruptcy debtors reported that medical bills contributed to 58.5% of bankruptcies, while illness-related income loss contributed to 44.3%; many debtors cited both Read more here.

Alternative Loans Performing Well

Two-thirds of consumers active in the alternative loan market fall in the subprime risk category, the riskiest of all credit tiers. Data from a new TransUnion study found that many of these consumers perform well when opening traditional credit products such as credit cards, auto and personal loans. Read more here.

Two-thirds of consumers active in the alternative loan market fall in the subprime risk category, the riskiest of all credit tiers. Data from a new TransUnion study found that many of these consumers perform well when opening traditional credit products such as credit cards, auto and personal loans. Read more here.

Car Subscriptions? Yes!

Of the 17 million cars expected to be sold in the U.S. this year, about a third are leased. The rest are purchased. But there’s a new option for drivers coming on strong in 2018 – car subscriptions.

There are several companies offering drivers a monthly fee to access a variety of vehicles they can change up when they want. The fee varies depending on the company, and range from $400 to as much as $3,700 per month! The fee usual includes maintenance, insurance, roadside assistance, pickup and drop-off. And in most cases the subscription can be ended at any time.

Cadillac, Volvo, BMW, and Mercedes are all offering subscriptions today. In an interview with David Liniado of Cox Automotive (part owner of Flexdrive), he said that the market is tiny today (subscriptions between 100K – 150K) but anticipates it growing into the millions within the next 12 months! Read more about this new concept here.

Direct Lending

It’s bank lending without the bank. As traditional banks have cut back on business lending a new opportunity for a growing group of asset managers who are making loans to mid-market companies has been created. Investors find Direct Lending an increasingly popular answer to low-yield problems. Companies that are robust enough to dip into the syndicated debt market are choosing direct lending instead, and regulators are asking if the market can sustain such growth without creating a mess.

Here’s how it works. Asset managers raise pools of money from investors interested in debt. The managers hunt for advisers with investment opportunities, or private-equity funds looking to finance acquisitions. The fund does its own research before deploying its money.

Borrowers are typically, mid-market-sized businesses that banks are no longer interested in lending to. Their need for credit and lack of good alternatives means direct lenders can get higher interest rates.

About $13.3 billion was raised globally in the first quarter of 2017, more than half the total for 2016, according to Deloitte. The U.S. is the biggest center for direct lending, with a 61 percent share of the market. As of June 2016, private credit providers had $595 billion in assets under management, according to research firm Preqin.

Read the entire article from Bloomberg here.

Living Between Paychecks

Reported in August of 2017, 78% of US Full-Time workers say they are living from paycheck to paycheck. Read more here.

Vehicles Not Core to Inventory Needs

UID’s Explained

A unique identifier (UID) is a numeric or alphanumeric string that is associated with a single entity within a given system. UIDs make it possible to address that entity, so that it can be accessed and interacted with.

A unique identifier (UID) is a numeric or alphanumeric string that is associated with a single entity within a given system. UIDs make it possible to address that entity, so that it can be accessed and interacted with.

Examples of Unique Identifiers:

URI-Uniform Resource Identifier is a unique identifier that makes content addressable on the Internet by uniquely targeting items, such as text, video, images and applications.

URL-Uniform Resource Locator is a particular type of URI that targets Web pages so that when a browser requests them, they can be found and served to users.

UUID-Universal Unique Identifier is a 128-bit number used to uniquely identify some object or entity on the Internet.

GUID-Global Unique Identifier is a number that Microsoft programming generates to create a unique identity for an entity such as a Word document.

UDID-Unique Device Identifier is a 40-character string assigned to certain Apple devices including the iPhone, iPad, and iPod Touch.