Top 10 Chapter 7 Discharges by States – Find Bankruptcy Records with BEBdata

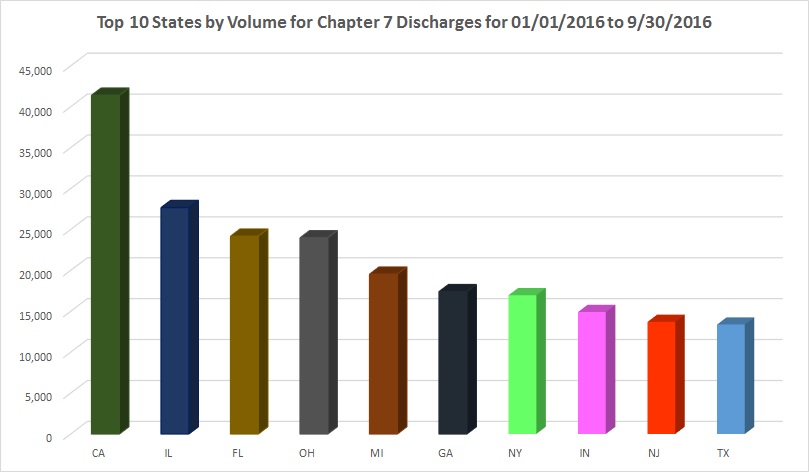

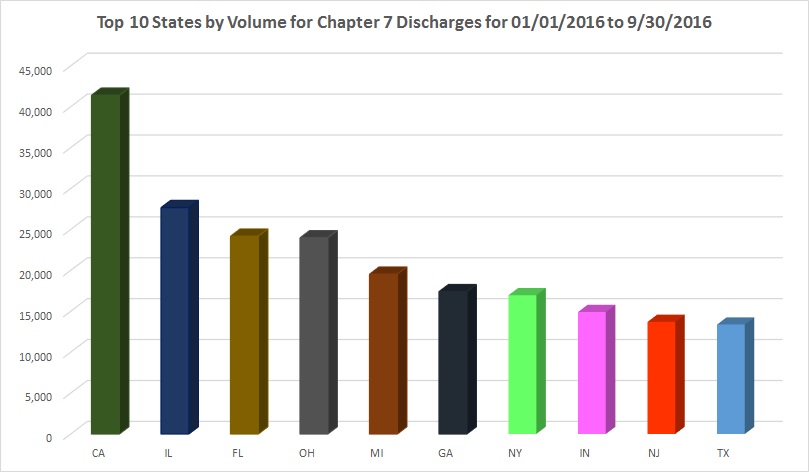

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

In most instances, the obligation remains to repay student loans despite filing Chapter 7 or Chapter 13 bankruptcy.

In most instances, the obligation remains to repay student loans despite filing Chapter 7 or Chapter 13 bankruptcy.

During a bankruptcy case, the debtor is exempt from collection on the student loan, this is called an Automatic Stay. The automatic stay immediately goes into effect upon the filing of the bankruptcy petition and prevents collectors from taking any action against the debtor to collect.

Interest continues to build, even during a pending bankruptcy. As a result, the ultimate balance for a student loan is higher with additional interest. In some situations, the interest on the loan may be excused. The type of bankruptcy filed combined with other factors determine whether interest is forgiven. Chapter 7 and Chapter 13 bankruptcies treat student loans differently.

In a Chapter 7 bankruptcy, a debtor’s assets are sold, and debts are paid from sales proceeds in accordance with a priority system of seniority. The priority scheme is set in the bankruptcy code and based upon the order of liens, rather than preferences of the debtor. The most senior debts may be the only debts repaid due to the larger number of debts compared to asset sale proceeds. Student loans are often classified as senior debts and are paid in first priority.

In Chapter 13, debtors enter into a reorganization plan and make payments over several years to repay a percentage of total debts. The Chapter 13 plan establishes new terms for the repayment of debts, and lenders must consent to the plan’s terms. While a complete discharge of a student loan is nearly impossible, it is probable that the loan will be restructured through the bankruptcy plan, and the borrower’s payments each month will be lowered to a more affordable sum.

While it would be nice to have Chapter 7 or 13 bankruptcy eliminate outstanding student loan debt, total discharge of that debt seldom occurs. More often, student loans are paid first as senior debts or paid through installments in Chapter 13.

*from a recent blog at attorneys.com

Our Bankruptcy file provides robust and comprehensive data including the most current data available combined with rich history as our records date back to 2002. We compile our database, which is over 20 million records today and contains a wide array of information such as filing dates, dismissals, discharges, Chapter 7 and Chapter 13.

BEB Data had its parent branch found in the year 1949, and since then has been the leading organization when it comes to having the best services and expertise in bankruptcy records compilation having its very own bankruptcy database with genuine and up to date, reliable bankruptcy records. Currently situated in the Mid-Town / Museum District of Houston, TX, BEB Data has its very own corporate offices established along with 15,000 square ft. of operations facility. With signing up for our services here at BEB Data, rest assured that you are in the safest hands of some of the well-known experts that are willing to provide some of the finest services when it comes to the bankruptcy records.

Are you someone who is looking for or, in fact, in need to have the latest and up to date bankruptcy records? You have to look no further as you have come to the right place. Here at BEB Data, we have people that not only know how to get the job done, but get it done professionally without leaving the room for an error or mistake. One might ask that how can we be so sure about our services. Well, it is always the case that factual data tends to stand out more against just a paragraph filled information that is literally someone just bragging about how good they are in the services they provide. Let us be in the one to fill you in on the fact that, here at BEB Data, our database as of today holds over 20 million bankruptcy records and these numbers only seem to get higher each and every day as we speak. Here at BEB Data, us being a team of highly skilled professionals with experience and expertise in data compilation of bankruptcy records highly contributes to the fact that these 20 million bankruptcy records stored in our database are highly accurate, reliable and up to date to be used by anyone who is, in fact, looking to receive the most accurate and latest bankruptcy records available out there.

With all that being said, there is not really much left for you to do. As an organization that is aiming to continue to lead the market, it is our objective to bring ease to our customers. Therefore, we strive to make this process as easy for our customers as just having to fill out a sign up form to have your very own account created at BEB Data. Let us know what you need and leave the hard part of it all to us. We, here at BEB Data, promise to deliver you with the latest, up to date, accurate and reliable bankruptcy records.

Bankruptcy forecast or a prediction is an art that involves the prediction of bankruptcy and various measures of financial distress which public firms may be expected to face in the near future. This complex data analysis involves vast research of finance and accounting.

One of the most popular models for bankruptcy prediction was published by Edward I Altman in 1968 and was known as the Z-score formula for predicting bankruptcy. The Z-score formula uses balance sheet values as well as multiple corporate incomes to get a picture of the financial health of any company and thus helps in predicting the probability of a firm filing bankruptcy within two years.

Fitch’s rating report projects 2016 bankruptcy filings to reduce by 6 – 8% from levels which were observed in 2015. Recession and other negative income shocks and various economic and institutional factors have contributed to the rise in bankruptcy filings. The level of filings is hence, driven by many elements including unemployment, housing environment, consumer indebtedness and interest rate to name a few. This overall decline in the filing of bankruptcy statistics can be supported by the sustained growth of jobs and low jobless claims.

Accountants and economists have been making bankruptcy forecasts for decades. In the United States, personal bankruptcy filings as per the bankruptcy records have had a dynamic history. During the first half of the 20th century, bankruptcy filings averaged 0.15 per 1000 people. Its average annual growth rate subsequently was 2.4 percent. The growth rate of bankruptcies increased during the 1960s, and since 1980, the growth has increased dramatically growing at an average rate of 7.7 percent per year till 2004. Since then the filing rate has been 5.3 per 1000 people.

BEBData is a 40 year old veteran leader in the field of bankruptcy data compilation and a bankruptcy database of over 20 million records. Our accurate and up-to-date bankruptcy list allows us access to information regarding filing dates, discharges and dismissals. With our years of expertise and support, our clients can identify highly responsive bankruptcy leads to help them grow.

Bankruptcy cases, in the United States, are filed in the United States Bankruptcy Courts with federal law governing procedures in these cases. The bankruptcy lists and the bankruptcy statistics are maintained by the courts and are available for public viewing.

Here are the top five bankruptcies in the history of the country.

BEBdata, experts in the field of bankruptcy data collection, are the most trusted and reputed company for accurate and up-to-date bankruptcy records of companies and individuals spread across the length and breadth of the United States. We have at our disposal over 20 million bankruptcy records in our bankruptcy database and are in the best position to provide you highly reliable bankruptcy leads. With data gathered from courthouses nationwide on a daily basis, we ensure accurate bankruptcy data for our clients.

Cases of bankruptcy are not new here in the United States. Many companies and organizations have faced bankruptcy in the country from time to time. Innumerable court cases have run regarding the cases. While some companies have been able to recover from the stage of bankruptcy and returned to normal business, some companies are lost into oblivion due to bankruptcy. All bankruptcy records need to be stored properly so that the data can be utilized later for some purpose or the other. What is new is the amount of data now available at hand on bankruptcy filings, and applicant companies.

Studying bankruptcy leads help in understanding the trends of bankruptcy in United States quite clearly. For instance, from 1980-2016 United States bankruptcies averaged at 47014.02 companies. It was in the fourth quarter of 1987 that bankruptcy in companies reached all time high of 82446 companies in the United States. The reasons behind the bankruptcies are varied. While some seem really authentic, some declared the organization to be bankrupt to save their backs.

Having a bankruptcy database is very important as it will contain all the details and data of the organizations or companies that have filed for bankruptcy. All kinds of bankruptcy data will be there in the database from the name of the company, the filing dates of bankruptcy, discharges report, dismissal reports, Chapter 13 case, and Chapter 7 case and so on. Other than these facts, other relevant information regarding the bankruptcy case is also found in the database. If anyone wants to find true and reliable bankruptcy statistics, it is always recommended to look for a good database that enlists bankruptcy cases efficiently.

BEB Data is an organization that creates bankruptcy list compilation and database of companies that faced bankruptcy in United States. The company has a database of 20 million such cases and has all the data regarding the case organized in a very systematic manner. Any data regarding bankruptcy cases in the United States are available with the organization.

There may be many reasons why anyone would be interested in finding out if an individual or a business firm has filed bankruptcy. Bankruptcy lists and records help a person to make financial decisions of potential business partners, businesses, insurance companies, financial institutions, banks, and individuals seeking loan.

Bankruptcy hearings are processed in Federal Courts and the case records are accessible by the public. Some of the ways to access the records are:

Getting bankruptcy statistics from case records can be simple but time consuming, gathering all the information necessary may become a tedious task. For any information on bankruptcy cases, one can to call the automated VCIS number of the bankruptcy court and run a search by either social security number, complete name or case number. The automated system reads out the information about the required case. The VCIS is available 24-hours a day. To gather many records it may be simpler to use a Bankrupcty List.

One can also get a PACER account. The Public Access to Court Electronic Records (PACER) is the electronic access of the Federal Judiciary’s centralized registration, technical and billing support to the US District, Bankruptcy and Appellate court records. The user can either view or print the case documents online.

The divisional office of each bankruptcy court has public access terminals which allow the public to view bankruptcy records.

Certified copies of bankruptcy case records can be obtained either in person or by mail from the divisional office where the bankruptcy case was filed. In order to do so, the user needs to have the bankruptcy case number and also the docket number of the document which is to be certified.

BEBData, has core competency in bankruptcy data compilation. Our bankruptcy database, which holds over 20 million bankruptcy records, has accurate and up-to-date bankruptcy records collected daily from courthouses nationwide for effective utilization of the records for various intelligence purposes. So one no longer has to figure out how to find bankruptcy records, BEBData has years of experience compiling bankruptcy data. Our expertise and reliable data allows for highly responsive bankruptcy leads. The required specialization and knowledge in bankruptcy data compilation has made us the trusted partners of individuals and a wide range of industries including automobiles and financial marketing firms.

Bankruptcy is usually initiated by the debtor and imposed by a bankruptcy court order. It serves to inform creditors of financial restructuring to avoid total loss for creditors. Filing bankruptcy helps these people to make a fresh start either by liquidating their assets to repay debts or by the creation of a new repayment plan.

The bankruptcy records, which are maintained, are also available for the public. These records give you accurate financial history about any person that you are interested. The information is also easy to obtain and easy to access.

There are many ways in which you can obtain the bankruptcy statistics of a bankruptcy case:

Bankruptcy records are available for public viewing in every Bankruptcy Court divisional office with the help of the public access terminals.

You can also avail information about any case through the court’s toll free automated Voice Case Information System (VCIS) which is available 24 hours a day. You will need the case number, complete name or a social security number to get details about the case.

The electronic public access service, Public Access to Court Electronic Records (PACER), gives access about the case and docket information to any user with internet connections and a PACER account. You can print copies of the record that you want, download it or search information related to your case. A fee will be charged for each page that you access and view. To use the PACER services you need to register yourself first at its website http://www.pacer.gov.

Cases which have been closed for a year or more are transferred to the National Archives and Records Administration (NARA). In case you require any case information or copies of documents from the bankruptcy list, you will need the Transfer Number, Box Number and Location Number. These details will have to be obtained from the office of the clerk where the bankruptcy case had been filed. Archived case information can be obtained in person, over phone or by writing to the Records Department where the case was filed.

With over 20 million bankruptcy records in our Bankruptcy database, BEBData, the leaders in bankruptcy data compilation, have the expertise to offer you a range of information on various cases from filing dates, discharges and dismissals to bankruptcy leads.

Bankruptcy happens to be amongst the most undesired business occurrences. Take a look at the most dependable bankruptcy databases, and you will come across numerous business establishments and individual debtors declaring bankruptcy. While it leaves an adverse impact on an organization’s creditworthiness, the declaration of bankruptcy makes things somewhat better for harried creditors or banks.

However, they will require keeping a note of such bankruptcy cases and have all the crucial details about them. With scores of bankruptcy declarations throughout the US, it becomes quite painstaking to keep track of the complete bankruptcy database.

And it’s here that a trustworthy bankruptcy database leader will extend the most useful support. By providing clients with accurate, precise, and valuable bankruptcy data, the database vendor can help them get full value for their dollar with their helpful services.

Building associations with the leading data leader will ensure ample benefits. But, you will get to realize and reap these benefits only after associating with the leading companies. Some of the essential tips for choosing the most efficient service providers include:

With a database comprising of nearly 20 million bankruptcy cases and records, BEB Data is undoubtedly the most efficient and experienced bankruptcy data leaders in the United States. All data offered by us have CASS certifications and are also standardized. And we also provide accurate information on discharges, filings, and dismissals.

Get in touch with us at BEB Data, and get access to the complete database of US bankruptcy cases updated to the most recent ones as well.

The case of bankruptcy is usually initiated by the debtor and then imposed via a court order. Hundreds of companies are declared bankrupt every year, not being able to repay the debts that they take from various creditors. A bankruptcy list is maintained by each country meticulously recording every detail of the case. With the help of the available bankruptcy records and a bankruptcy database, it is possible to understand the cause of bankruptcy. Also if the organization recovers from this status, it can always refer back to the data and check what went wrong.

Bankruptcy data is confidential and companies who have faced bankruptcy might not want the data to become public. However, there are companies who excel in creating a bankruptcy database. Millions of data regarding bankruptcy are compiled in the database. Minute details like case number, chapter of bankruptcy, dismissal or discharge, bankruptcy filing date and final status of the case is mentioned in the database. Ensure that the database you are using for gathering information contains accurate and proper bankruptcy leads so that there is no compliance issue. While creating the database, the data should be collected from local courthouses via authentic sources so that right information is obtained. The database should be made available to people on round the clock basis. Not only this, it should be easily navigable so that everyone can use the same with equal ease.

Though there are many databases that enlist bankruptcy cases, BEB Data excels in the same. The bankruptcy statistics offered by us are updated and highly accurate. Our database has more than 20 million bankruptcy records and each record is compiled in the most scientific manner. Therefore when you are searching for a particular bankruptcy case, you will have no problem whatsoever. From case number to bankruptcy filing date, from bankruptcy chapter to final status, everything is there in the database in the most organized way. All the data in the database are DPV coded, CASS certified and standardized.

b2bYellowpages.com – Free listing allows buyers and sellers to quickly locate or advertise products and services to and from other businesses.