The means test determines how much disposable income a person has to pay their creditors. If this number is zero, then there is a good chance you could qualify for chapter 7 bankruptcy. If the number is higher, then you would likely to file chapter 13. In chapter 13 bankruptcy you would then seek to make your available disposable income lower by taking allowed deductions, similar to doing your taxes, on the means test. These deductions are often calculated from your paystubs and include things like your federal taxes, Medicare, social security etc. Therefore, if these amounts are less in the future, then you won’t get as much of a deduction on the means test.

The good news is that a consumer will have more disposable income in which to possibly avoid filing bankruptcy, although for most people, it probably will not make a significant difference. For lower income earners who are already below the median income, the impact from a bankruptcy standpoint will most likely be negligible.

Category Archives: Blog with BEBdata

Zettabytes

12-Year BK Span

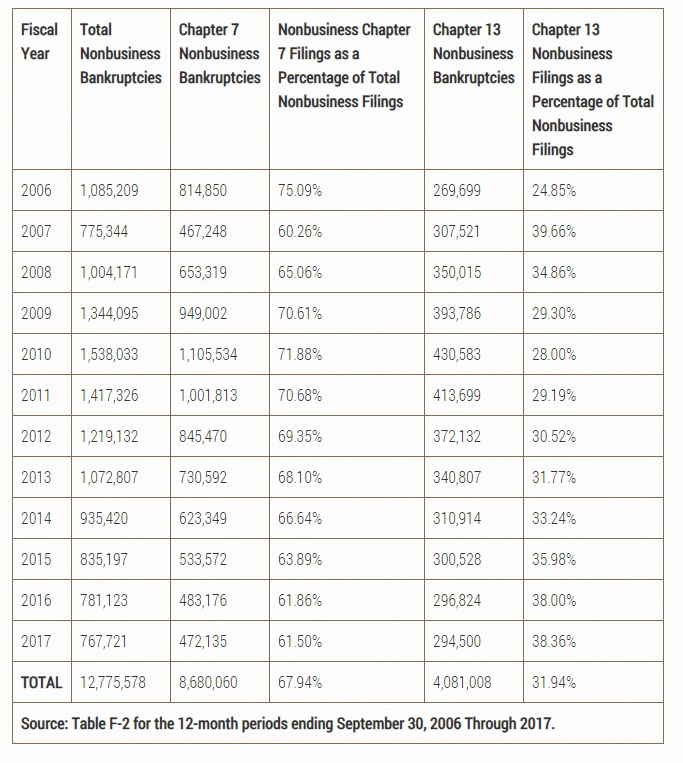

In the 12-year span from October 1, 2005 to September 30, 2017, about 12.8 million consumer bankruptcy petitions were filed in the federal courts. Of those, 8.7 million–68 percent–were filed under Chapter 7, and 4.1 million– 32 percent–were filed under Chapter 13. Nonbusiness filings (i.e., filings involving mainly consumer debt) constituted 97 percent of all Chapter 7 bankruptcies and 99 percent of all Chapter 13 bankruptcies.

In the 12-year span from October 1, 2005 to September 30, 2017, about 12.8 million consumer bankruptcy petitions were filed in the federal courts. Of those, 8.7 million–68 percent–were filed under Chapter 7, and 4.1 million– 32 percent–were filed under Chapter 13. Nonbusiness filings (i.e., filings involving mainly consumer debt) constituted 97 percent of all Chapter 7 bankruptcies and 99 percent of all Chapter 13 bankruptcies.

Happy Thanksgiving

Postal Rate Hike Approved

It’s official. The Postage Rate Hike has been approved and will take effect on January 27, 2019.

Prices were approved raising rates approximately 2.5% across the board. Shipping Service price increases vary by product. For example, Priority Mail Express will increase 3.9 percent and Priority Mail will increase 5.9 percent. Although Mailing Services price increases are based on the Consumer Price Index (CPI), Shipping Service prices are primarily adjusted according to market conditions.

The new prices include a 5-cent increase in the price of a First-Class Mail Forever stamp, from 50 cents to 55 cents. Click below to review Price Comparisons by Type of Service.

FIRST CLASS COMPARISON – Postal Rate Comparison First Class 2018-2019

MARKETING MAIL COMPARISON – Postal Rate Comparison Marketing Mail 2018-2019

NON PROFIT MAIL COMPARISON – Postal Rate Comparison NP 2018-2019

2019 POSTAL RATE GUIDE – BEB Postal Rate Guide

Local Searches

Here are some basics to ensure your business is discoverable on searches with local intent:

- Claim your Google My Business Page

- Ensure your NAP details (Name, address, telephone) are the same across different listings and match the ones on your website.

- Build local citations for your business

- Earn reviews

For more information on local search and best practices, check out this checklist by Moz.

Car Buyers -Mobile vs Desktop

According to new statistics provided by Facebook, 48% of mobile first auto buyers are Millennials. 43% of desktop first auto buyers are Baby Boomers.

Mobile first buyers have some additional interesting stats:

- 44% plan to purchase an automobile in less than 90-days

- 50% shop during the day

- 24% request quotes online

- 76% know the exact car they want to buy before walking into the dealership

Mobile buyers are growing in numbers every day. Savvy brands have developed brand apps allowing buyers to customize their shopping, leveraging smartphone features like 360-degree views. Last year, Chevrolet launched the immersive app for the Camaro that garnered 62,000 downloads in just a couple of months.

Happy Halloween

2nd QTR Numbers

2018 second quarter showed signs of improvement for auto loan delinquencies.

30-day delinquencies dropped to 2.11% of outstanding balances from 2.2% in the prior-year period, while the 60-day delinquency rate dropped to 0.64% of outstanding balances from 0.67% over the same time period. However, the industry saw average finance amounts and monthly payments reach new highs during the period.

Delinquencies are one of the most telling metrics. The downward trend is an encouraging sign. However, lenders will keep a close eye on car buyers’ payment performance.

The average new-vehicle finance amount jumped more than $700 from the prior-year period to $30,958 and used-vehicles average jumped $520 from the prior-year period to $19,708. Also, the average monthly payment for a new-vehicle purchase increased $20 over the same period to a record $525 and the average payment for used increased by $13 to a record $378. 72 months remains the most common loan term for both new and used financing,

Outstanding loan balances have increased from $1.027 trillion in the prior-year period to a record $1.149 trillion, consumers appear unfazed by the rise in loan amounts and monthly payments. However, the average interest rate for new and used increased 56 and 38 basis points to 5.76% and 9.40%, respectively.

Car buyers are increasingly looking to credit unions to secure auto financing; the segment saw double-digit growth in new-vehicle financing (12.9%) and strong growth overall (4.9%). Credit unions closed the quarter with a 21.3% share of the market in the second quarter. The only other lender type to experience growth was the captive finance segment, which grew 1.2 percent during the same time period.

Market share for banks dropped to 31.6% from 32.3% in the second quarter of 2017.

High-risk tiers felt the impact of more restrictive credit standards, with the percentage of both subprime and deep subprime falling below 19% of loan balances. On its own, deep subprime hit an all-time low of 3.54%, compared with 3.98% in the prior-year quarter. The pullback from the high-risk tiers caused average credit scores for new and used financing to rise from 714 and 652 in the year-ago period to 715 and 655, respectively.

**from an August 30th Blog of Autodealer.

Google Store Visit Conversion Reporting

Google Ads (formerly known as Google AdWords) is now reporting Store Visits as a new Conversion Metric for a small group of US dealers.

Google Ads (formerly known as Google AdWords) is now reporting Store Visits as a new Conversion Metric for a small group of US dealers.

A store visit is defined as someone who has physically been in a dealership after clicking on a paid search ad or being shown a viewable impression of a display ad within the past 30 days. An ad impression is considered viewable when at least 50% of the ad is on screen for at least one (1) second. Currently about 300 dealerships are able to track Store Visits. The quantity of dealers is expected to increase over time. In approximately 12 months, about half of all dealers in the U.S. are expected to be tracking Store Visits.

Store Visit data is based on anonymous, aggregated statistics. Google Ads creates a count of visitors by using current and past data on the number of people who click or view your ads and later visit the dealership. Visit data can’t be tied to individual ad clicks, viewable impressions or people. Industry best practices are used to ensure the privacy of individual users. Google states that they are accurate >99% of the time.

To be able to measure store visit conversions you need the following:

• Receive thousands of ad clicks and viewable impressions.

• Have a Google My Business account linked to your Google Ads account.

• Create each of your store locations in your Google My Business account.

• Have at least 90% of your linked locations verified in Google My Business.

• Ensure location extensions are active in your account.

• Have sufficient store visits data on the backend to attribute to ad click or viewable impressions traffic and pass our user privacy thresholds.

Read more about this at https://www.l2tmedia.com/2018/08/new-google-store-visit-conversion-metric-in-google-ads/