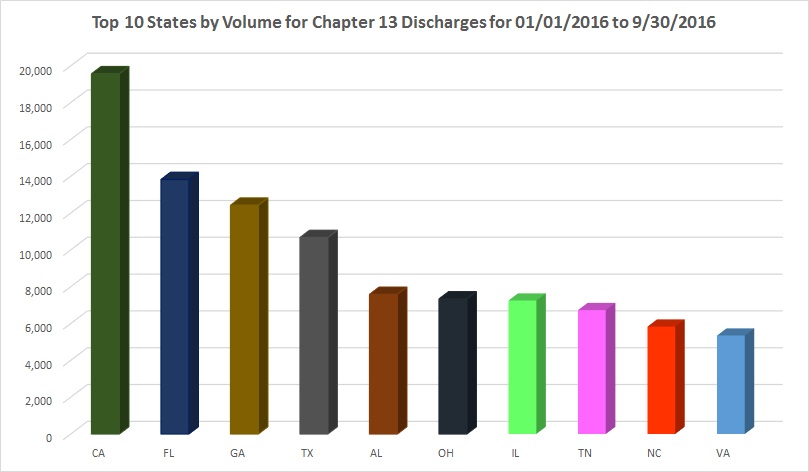

Top 10 Chapter 13 Discharges – Chapter 13 National Database by BEBdata

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Have you scanned your October QR Code from BEB-Business Extension Bureau’s 2016 calendar yet?

We have a fun message for you!

You can also click here to see it!

Ever since the day BEB Data came into existence, we had only one objective in our minds. Our single goal was to bring the service that no one else could deliver with the experience and expertise that no one else yet possessed so that we see the day when we may become the leader of the market and, while doing so, build the trust with our customers so that each step we take is a step forward, never having to look or go back. With that being said, we can be at ease when we say that BEB Data has been leading this market with well over 40 years on experience on our hands. So if you’re someone who is looking to hire the best in the business when it comes to bankruptcy data compilation and expertise, BEB Data is the place to be. With hiring us as the organization to provide you the latest and up to date bankruptcy data, rest assured that you have placed the responsibility in the hands of people that know their job and know how to get it done in the most professional way possible.

Here at BEB Data, we possess the latest material of bankruptcy list compilation and bankruptcy. By signing up for your very own account with us, we make sure that you get what you ask for i.e. the most up to date, reliable and accurate bankruptcy data that is available in the market. It may be noted that reliability should be of much concern when data of such caliber is the topic at hand. One should not leave room for even the slightest of a mistake. It may not be the case, but a simple error may just even cost you a lot of dollars. And trust us when we say this that it is not a good sight. Here at BEB Data, bankruptcy data is gathered on a daily basis from different courthouses placed nationwide. A lot of care and hard work goes into this process, just so we can get the most accurate information for our customers. Customer satisfaction is our top most priority, and that is something BEB Data will never compromise upon. So, if you’re someone who is looking for bankruptcy data, we are here to provide you with all the relevant information you need including filling dates, dismissals, discharges and much more.

BEB Data is a group of individuals who are highly skilled and experience in what we do and bring a skill set of expertise to the table like non other. All our services are waiting to be availed by you to make your life easier. So why wait when you can register yourselves at BEB data today to get the most accurate bankruptcy data available.

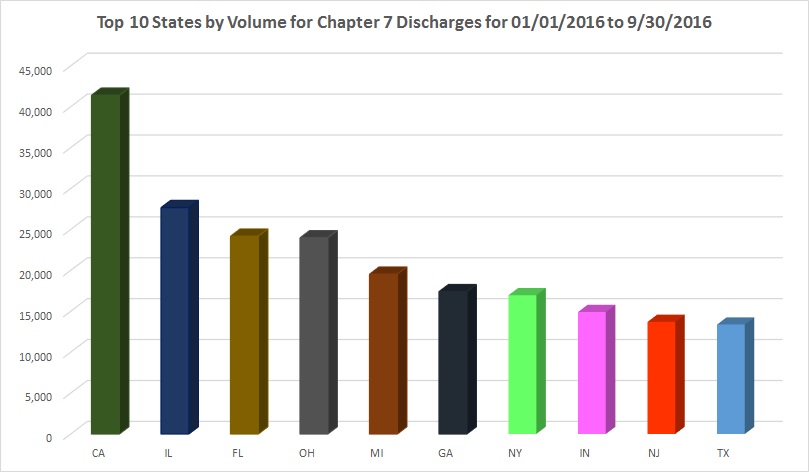

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 7 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

In most instances, the obligation remains to repay student loans despite filing Chapter 7 or Chapter 13 bankruptcy.

In most instances, the obligation remains to repay student loans despite filing Chapter 7 or Chapter 13 bankruptcy.

During a bankruptcy case, the debtor is exempt from collection on the student loan, this is called an Automatic Stay. The automatic stay immediately goes into effect upon the filing of the bankruptcy petition and prevents collectors from taking any action against the debtor to collect.

Interest continues to build, even during a pending bankruptcy. As a result, the ultimate balance for a student loan is higher with additional interest. In some situations, the interest on the loan may be excused. The type of bankruptcy filed combined with other factors determine whether interest is forgiven. Chapter 7 and Chapter 13 bankruptcies treat student loans differently.

In a Chapter 7 bankruptcy, a debtor’s assets are sold, and debts are paid from sales proceeds in accordance with a priority system of seniority. The priority scheme is set in the bankruptcy code and based upon the order of liens, rather than preferences of the debtor. The most senior debts may be the only debts repaid due to the larger number of debts compared to asset sale proceeds. Student loans are often classified as senior debts and are paid in first priority.

In Chapter 13, debtors enter into a reorganization plan and make payments over several years to repay a percentage of total debts. The Chapter 13 plan establishes new terms for the repayment of debts, and lenders must consent to the plan’s terms. While a complete discharge of a student loan is nearly impossible, it is probable that the loan will be restructured through the bankruptcy plan, and the borrower’s payments each month will be lowered to a more affordable sum.

While it would be nice to have Chapter 7 or 13 bankruptcy eliminate outstanding student loan debt, total discharge of that debt seldom occurs. More often, student loans are paid first as senior debts or paid through installments in Chapter 13.

*from a recent blog at attorneys.com

Our Bankruptcy file provides robust and comprehensive data including the most current data available combined with rich history as our records date back to 2002. We compile our database, which is over 20 million records today and contains a wide array of information such as filing dates, dismissals, discharges, Chapter 7 and Chapter 13.

Have you scanned your September QR Code from BEB-Business Extension Bureau’s 2016 calendar yet?

We have a fun message for you!

You can also click here to see it!

Have you scanned your August QR Code from BEB-Business Extension Bureau’s 2016 calendar yet?

We have a fun message for you!

You can also click here to see it!

The Detroit Free Press recently published an article about the increase of auto loan delinquencies in July. Check it out:

More people are defaulting on high-risk auto loans and a credit rating agency predicts the trend could continue through the end of 2016 as prices of used cars are beginning to fall.

The percentage of people who qualified for subprime (FICO score of 600 or lower) auto loans but are 60 days or more behind on payments reached 4.59% in July, a 17% increase from a year earlier, according to Fitch Ratings.

Delinquencies among prime auto loan borrowers also rose, but remain at a manageable 0.4%, or 21% higher than a year ago.

But these loans are packaged into bundles which are sold to investors, much like mortgages were packaged into bundles a decade ago before rising interest rates caused many of them to default, eventually triggering the deepest economic crisis since the Great Depression.

Buy your next auto file from BEBdata. We specialize in bankruptcy data, bankruptcy leads, and more. We are data experts and can help you to identify, communicate and engage your prospects to become customers. Call us today