We’re excited about heading to NADA at the end of the month! Are YOU going to be there?!

We’re excited about heading to NADA at the end of the month! Are YOU going to be there?!

Tag Archives: BEBdata

Faces to the Names – Year in Review

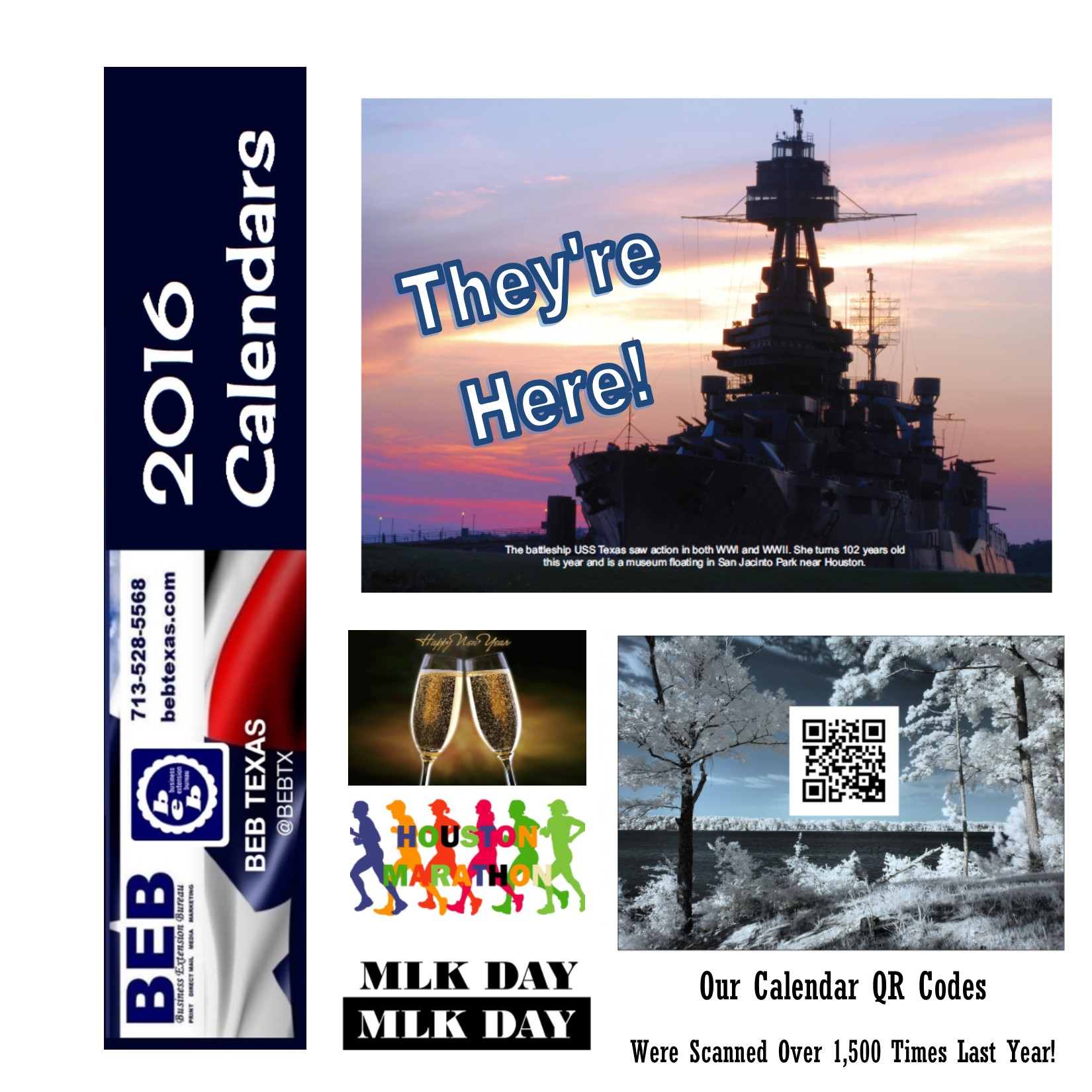

2016 Calendars Are Here!

Our award winning, interactive calendars are ready! If you haven’t already received one, and would like one (or more), click here and we’ll send you yours right away!

Our award winning, interactive calendars are ready! If you haven’t already received one, and would like one (or more), click here and we’ll send you yours right away!

The BEB Calendars have a QR Code for each month. Scan it, and you’ll receive a special message from us throughout the year! Last year, our calendars were scanned over 1,500 times. Join in the fun today. Check out the January QR Code message here.

Happy New Year!

Happy Holidays 2015

#TeamBEB at the Jingle Bell Run

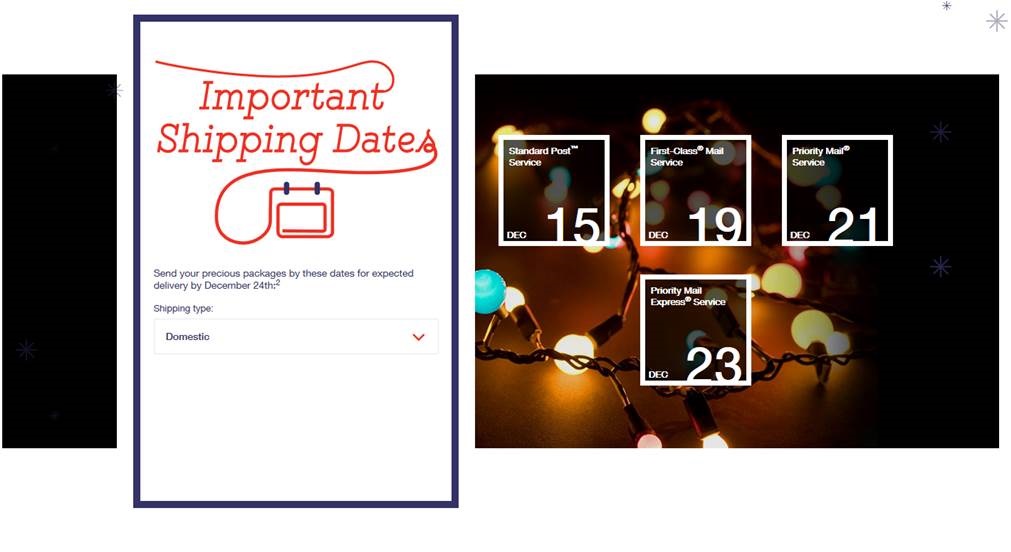

Important Holiday Shipping Dates

December 2015 QR Code

Have you scanned your December QR Code from BEB-Business Extension Bureau’s 2015 calendar?

We have a special message for you!

You can also click here to see it!

Subprime lenders’ profits slip

Auto finance companies that lend to the riskiest customers remained profitable last year. But their average results dropped 20 percent from the prior year, according to the National Automotive Finance Association’s 2015 Non-Prime Automotive Financing survey.

Two-thirds of the institutions polled reported that their results declined.

Even so, the value of U.S. portfolios of subprime loans on new and used vehicles grew for the fourth consecutive year, the association said. Read more…

Credit Card Delinquency Remains Low

CHICAGO, IL, Aug 25, 2015 – More credit cards are being offered to subprime consumers, but delinquency rates remain low, according to the latest TransUnion, Industry Insights Report. The credit card delinquency rate (the ratio of borrowers 90 days or more delinquent on their general purpose credit cards) remained steady at 1.19% in Q2 2015. The delinquency rate was relatively unchanged read more