Matt Diehl of OneMain recently published a blog regarding “Six Money Topics Every Couple Should Discuss”. Topics include:

Matt Diehl of OneMain recently published a blog regarding “Six Money Topics Every Couple Should Discuss”. Topics include:

- Joint or separate bank accounts

- Paying Bills

- Debt

- Budgeting

- Children

- Retirement

Sarah Chaney of The Wall Street Journal just published a fascinating article on how bankruptcy courts (since March) are allowing borrows to cancel private student loans with a new legal argument that relies on vague wording about the definition of a student loan.

Sarah Chaney of The Wall Street Journal just published a fascinating article on how bankruptcy courts (since March) are allowing borrows to cancel private student loans with a new legal argument that relies on vague wording about the definition of a student loan.

Check out the entire article by clicking here.

Our Bankruptcy file provides robust and comprehensive data including the most current data available combined with rich history as our records date back to 2002. We compile our database, which is over 20 million records today and contains a wide array of information such as filing dates, dismissals, discharges, Chapter 7 and Chapter 13.

Have you scanned your November QR Code inside your BEB Calendar? There is a super funny video (a turkey singing) to help you celebrate the November holidays! Check it out here.

Have you scanned your November QR Code inside your BEB Calendar? There is a super funny video (a turkey singing) to help you celebrate the November holidays! Check it out here.

The high court has granted a petition for a writ of certiorari brought by Midland Funding LLC, which faces penalties under federal debt collections law for attempting to collect payment on debt from someone who had sought bankruptcy protection. Read the entire Wall Street Journal Article here.

—————————————————————-

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation, bankruptcy data, bankruptcy statistics and bankruptcy marketing.

The proposed January postal rate hike has been released. The anticipated changes, by percentage and class are as follows:

The proposed January postal rate hike has been released. The anticipated changes, by percentage and class are as follows:

First Class Mail = .78%

Standard Mail = .895%

Periodicals = .832%

Some highlights to review:

For detailed rate comparison charts, click onto a category below:

Rates were submitted to the PRC (Postal Regulatory Commission) for review. We will continue to post the current changes as they happen. If you have questions or need additional information, please don’t hesitate to contact us.

Rates were submitted to the PRC (Postal Regulatory Commission) for review. We will continue to post the current changes as they happen. If you have questions or need additional information, please don’t hesitate to contact us.

800-969-5568

Is there a link between science and creativity? Can that link impact marketing and human emotion? Making successful data-driven connections is both an art as well as a science. Part craft and part instinct, &THEN explores the relationship of where art, science and humanity collide. Hundreds of speakers from major brands, leading agencies, and innovative services will tell you how to find that sweet spot of what you know about a customer and what you think your customer wants all while asking your audience to keep your message top of mind. &THEN’s speakers will explore the science of creativity and how marketers can benefit from exploring data-based creative solutions. Learn new things. Be inspired. Get motivated. Read more here

Is there a link between science and creativity? Can that link impact marketing and human emotion? Making successful data-driven connections is both an art as well as a science. Part craft and part instinct, &THEN explores the relationship of where art, science and humanity collide. Hundreds of speakers from major brands, leading agencies, and innovative services will tell you how to find that sweet spot of what you know about a customer and what you think your customer wants all while asking your audience to keep your message top of mind. &THEN’s speakers will explore the science of creativity and how marketers can benefit from exploring data-based creative solutions. Learn new things. Be inspired. Get motivated. Read more here

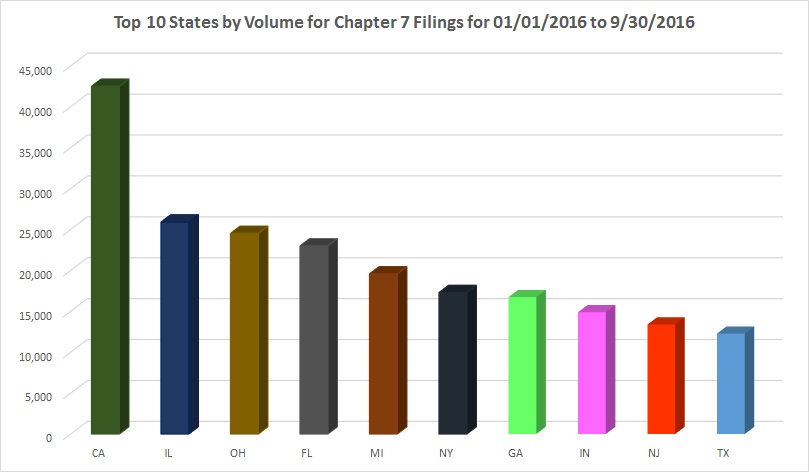

Top 10 States by Volume for Chapter 7 Filings for 01/01/2016 to 9/30/2016. Create your own graphs or download raw data by using our National Bankruptcy Data provided by BEBdata Resource Center.

Top 10 States by Volume for Chapter 7 Filings for 01/01/2016 to 9/30/2016. Create your own graphs or download raw data by using our National Bankruptcy Data provided by BEBdata Resource Center.

When it comes to accuracy and up to date information on bankruptcy data, BEB Data is the leader in the market and brings to you the most accurate, reliable and up to date information from our very own bankruptcy database. Here at BEB Data, we are a group of highly skilled and trained individuals who occupy a skill set of great caliber and experience that guarantees to bring you the services you are looking for in the most professional manner you can think of. All our services are waiting to be availed by you. And for you, the process is just as easy as creating your very own account at BEB Data.

If you’re looking for the most accurate and reliable bankruptcy data, you have to look no further as BEB Data is the place to be. With our very own bankruptcy database, we are here for our customers to avail our services. Here at BEB Data, our bankruptcy database, as of right now, holds more than 20 million bankruptcy records. And this number seems to be growing each and every day. It may be noted here 20 million is a huge number and having to maintain a bankruptcy database with such a high number of records is as hard of a job on its own. But rest assured, as our team of highly skilled individuals know how to get things done and promise to deliver a maximum uptime and a minimum downtime for our bankruptcy database. BEB Data holds the bankruptcy database with all the relevant information you need whether it be filing dates, dismissals, discharges or any other relevant information as required by our customers. And how do we approve of this data as being the most accurate bankruptcy data available? Not only is all the data in our bankruptcy database standardized, but also CASS certified and DPV coded. And that is not all. As BEB Data gathers all the information, USPS National Change of Address (NCOA) is performed before having this data inserted into our bankruptcy database. Surely, this is a long process. But all of this has been made possible by BEB Data, just so you can get your hands on the most accurate and reliable bankruptcy data there is. We have said this before, and we will say it again. Rest assured as we are more than just talk. By hiring us, you are hiring a group of individuals who specialize in delivering you with the most reliable bankruptcy data available.

If you have not already signed up for your very own account at BEB Data, it is never too late to begin doing so right now. Our accounts are available 24/7 round the clock. And our system is as simple and easy to use as it can get. Sign up for your very own account and avail the finest services offered by BEB Data.

Anticipated Mail Delivery Delays Due To Hurricane Matthew Along the Southeastern and Mid-Atlantic Coast

Anticipated Mail Delivery Delays Due To Hurricane Matthew Along the Southeastern and Mid-Atlantic Coast

Post Office Closures/Relocations/

The U.S. Postal Service is monitoring the progress of Hurricane Matthew. With its current track, the hurricane is poised to have significant impacts along the Florida coast and northward into Georgia, South Carolina, and North Carolina. In preparation, the USPS has begun to take the necessary steps to prepare for the storm.

At this time, the Governor of South Carolina has issued an evacuation order for the counties around Charleston, SC, effective 3:00 PM. today. Specific offices impacted will be shared shortly. Also, the Governor of Florida has asked for voluntary evacuations in coastal, barrier islands, and low lying areas along the east coast.

As the impacts to postal operations are identified, updated information will be posted to the USPS Alerts website accessed through the RIBBS webpage, http://ribbs.usps.gov/ and https://about.usps.com/news/service-alerts/.

——————

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and bankruptcy data. Because we compile and maintain our Bankruptcy list, we guarantee that you are receiving the most up to date and accurate bankruptcy data available.

BEBdata

4802 Travis Street

Houston, TX 77002

(800) 969-5568

http://bebdata.com

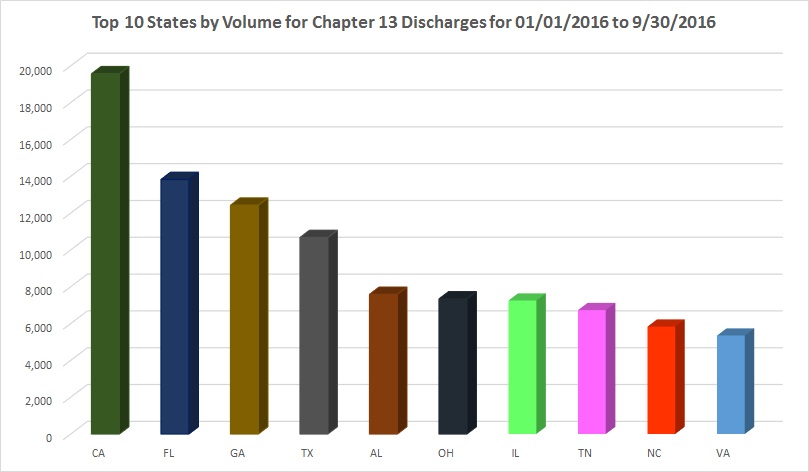

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.

Top 10 states by volume for Chapter 13 Discharges from January 1, 2016 through September 30, 2016. Create your own charts and graphs by using our BEBdata Resource Center.