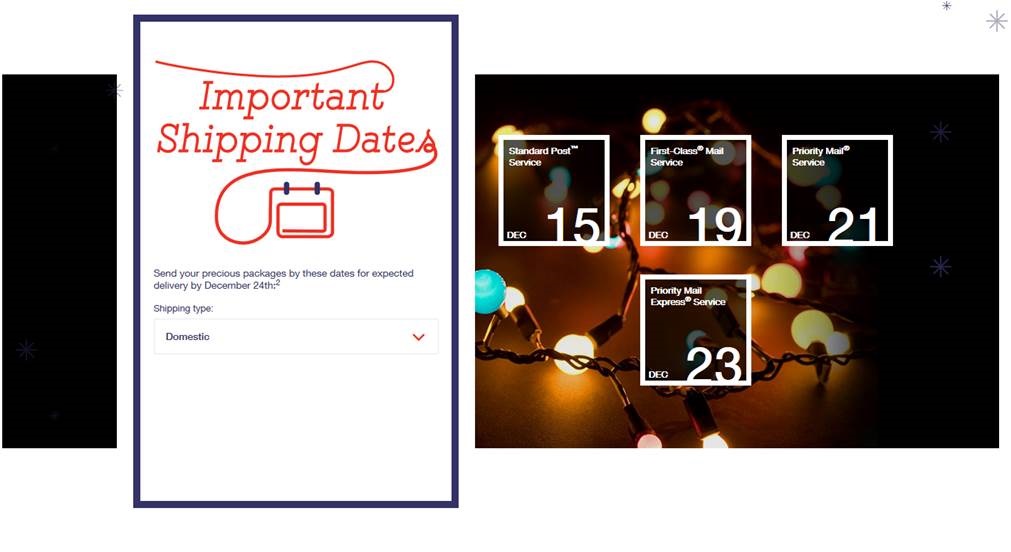

Use this easy reference graphic when shipping for the holidays.

Use this easy reference graphic when shipping for the holidays.

Author Archives: BEBdata

December 2015 QR Code

Have you scanned your December QR Code from BEB-Business Extension Bureau’s 2015 calendar?

We have a special message for you!

You can also click here to see it!

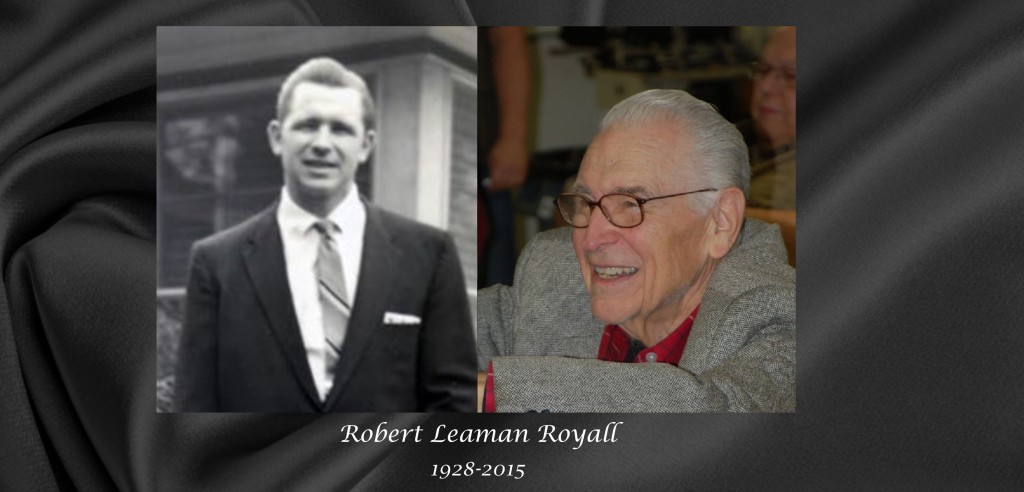

Passing of a Pioneer

It is with great sadness that we share that Robert “Bob” Royall, founder and president emeritus of BEB-Business Extension Bureau, passed away at age 87 on Thursday, November 26, 2015.

It is with great sadness that we share that Robert “Bob” Royall, founder and president emeritus of BEB-Business Extension Bureau, passed away at age 87 on Thursday, November 26, 2015.

“The entire BEB family is deeply saddened by the loss of a pioneer in direct mail marketing,”  said Ron Royall, his son and CEO. “Dad’s vision and passion for his business and staff were unwavering over the 66 years Business Extension Bureau has been operating. His legacy will live on, even as we mourn.”

said Ron Royall, his son and CEO. “Dad’s vision and passion for his business and staff were unwavering over the 66 years Business Extension Bureau has been operating. His legacy will live on, even as we mourn.”

Bob was hired by San Francisco-based BEB in 1952 to run the sales department in Houston. He was 23 years old and fresh out of business school at the University of North Texas. In 1959, he bought the business with partner James Tardy.

As majority stockholder, Bob served as chief executive officer of Business Extension Bureau, and most recently, its president emeritus.

As the company continued to grow and evolve, two of Bob’s three sons, Ron Royall and Ro Royall, assumed leadership roles in the organization. Ron is now president and CEO and Ro serves as executive vice president.

As the company continued to grow and evolve, two of Bob’s three sons, Ron Royall and Ro Royall, assumed leadership roles in the organization. Ron is now president and CEO and Ro serves as executive vice president.

Bob was also one of the founders of MASA-SW (the leading industry trade association known as Epicomm-SW today), serving on the board of directors and as president in 1972.

Bob was also active with the Printing Industries of the Gulf Coast, the Houston Rotary Club and many other industry and community outreach organizations. He also received the prestigious Helsley Award for Lifetime Achievement within the direct marketing industry in 2001.

Always passionate about his love for the industry, we often referred to BEB as Bob’s fourth son. Bob continued to come to the office every day after assuming the role of president emeritus in 2004 and remained actively involved in the expansion of products and services.

son. Bob continued to come to the office every day after assuming the role of president emeritus in 2004 and remained actively involved in the expansion of products and services.

Bob’s legacy will shine on and contribute to the continued growth of Business Extension Bureau in the future. The entire organization mourns the loss of this great leader and wonderful human being.

Bob is survived by his wife of 57 years, Ann; sons Rob, Ron, and Ro; daughter-in-law Sharon Royall and four grandchildren.

Visitation is from Noon-2:00pm to be followed by burial on Sunday, December 6, 2015 at George Lewis Funeral Home located at 1010 Bering Drive, Houston, TX 77057.

A memorial service will be held at 11:00am on Monday, December 7, 2015 at Berachah Church 2815 Sage Rd, Houston, TX 77056.

In lieu of flowers, the family suggests donations to R.B. Thieme, Jr. Bible Ministries and/or the American Heart Association.

TEAM BEB RUNS in Hou Jingle Bell Run

For the first time, Business Extension Bureau has enrolled a team to participate in the 2015 Houston Jingle Bell Run benefiting the YMCA of Greater Houston on December 13, 2015. Join us in cheering us on for the 5K Family Fun Run. We’ll post more details soon!

For the first time, Business Extension Bureau has enrolled a team to participate in the 2015 Houston Jingle Bell Run benefiting the YMCA of Greater Houston on December 13, 2015. Join us in cheering us on for the 5K Family Fun Run. We’ll post more details soon!

https://www.ymcahouston.org/jingle-bell-run/registration/

November 2015 QR Code

Have you scanned your November QR Code from BEB-Business Extension Bureau’s 2015 calendar?

We have a special message for you!

You can also click here to see it!

October 2015 QR Code

Have you scanned your October QR Code from BEB-Business Extension Bureau’s 2015 calendar?

We have a special message for you!

You can also click here to see it!

You can also click here to see it!

Subprime lenders’ profits slip

Auto finance companies that lend to the riskiest customers remained profitable last year. But their average results dropped 20 percent from the prior year, according to the National Automotive Finance Association’s 2015 Non-Prime Automotive Financing survey.

Two-thirds of the institutions polled reported that their results declined.

Even so, the value of U.S. portfolios of subprime loans on new and used vehicles grew for the fourth consecutive year, the association said. Read more…

Credit Card Delinquency Remains Low

CHICAGO, IL, Aug 25, 2015 – More credit cards are being offered to subprime consumers, but delinquency rates remain low, according to the latest TransUnion, Industry Insights Report. The credit card delinquency rate (the ratio of borrowers 90 days or more delinquent on their general purpose credit cards) remained steady at 1.19% in Q2 2015. The delinquency rate was relatively unchanged read more

Americans who recently took out federal student loans aren’t paying down their debt.

Recent Federal Student Loans Look A Lot Like Subprime Mortgages

Written by:

Shahien Nasiripour

Chief Financial and Regulatory Correspondent, The Huffington Post

Federal student loans made in recent years resemble the toxic subprime mortgage loans that helped cause the Great Recession, new data show.

Federal student loans made in recent years resemble the toxic subprime mortgage loans that helped cause the Great Recession, new data show.

Rather than paying down their balances after leaving school, borrowers with recent federal student loans are experiencing an increase in debt as they fail to make enough payments to offset the accumulating interest on their loans. Read more…

September 2015 QR Code

Have you scanned your September QR Code from BEB-Business Extension Bureau’s 2015 calendar?

We have a special message for you!

You can also click here to see it!