Click below for a downloadable January 2023 postal rate guide.

The first of two 2023 postal rate increases take effect on Sunday, January 22nd. Price adjustments vary depending on the product, and a few rates remain unchanged. Postmaster General Louis DeJoy said that increases would be necessary to keep up with rising costs.

Click below to download a First-Class Mail Postal Rate Comparison chart.

The first of two 2023 postal rate increases take effect on Sunday, January 22nd. Price adjustments vary depending on the product, and a few rates remain unchanged. Postmaster General Louis DeJoy said that increases would be necessary to keep up with rising costs.

Click below to download a Marketing Mail Postal Rate Comparison chart.

A local dealership has been using our Lead Program for over 20-years.

A local dealership has been using our Lead Program for over 20-years.

Our Bankruptcy Leads help them sell an average of 15 additional cars a month.

They spent less than $60K (including postage) and generated over $360,000 in profit last year using our Bankruptcy Program.

We just completed a test program with another local dealership. We mailed 1,526 letters to people recently discharged out of bankruptcy. That generated 11 calls from 8 prospect which resulted in 3 cars purchased. That’s a 37.5% close rate! Cost per closed deal, including postage was only $522.

Our Special Finance Lead Program Works!

U.S. Postal Service Announces Proposed Temporary Rate Adjustments for 2021 Peak Holiday Season

U.S. Postal Service Announces Proposed Temporary Rate Adjustments for 2021 Peak Holiday Season

WASHINGTON – The United States Postal Service filed notice the Postal Regulatory Commission (PRC) regarding a temporary price adjustment for key package products for the 2021 peak holiday season. This temporary rate adjustment , which was approved by the Board of Governors Aug. 5, will affect prices on commercial and retail domestic competitive parcels – Priority Mail Express (PME), Priority Mail (PM), First-Class Package Service (FCPS), Parcel Select, USPS Retail Ground, and Parcel Return Service. International products would be unaffected. Pending final approval by the PRC, the temporary rates will go into effect on Oct. 3, 2021, and remain in place until Dec. 26, 2021.

The planned price changes include:

Priority Mail, Priority Mail Express, Parcel Select Ground and USPS Retail Ground:

• $0.75 increase for PM and PME Flat Rate Boxes and Envelopes.

• $0.25 increase for Zones 1-4, 0-10 lbs.

• $0.75 increase for Zones 5-9, 0-10 lbs.

• $1.50 increase for Zones 1-4, 11-20 lbs.

• $3.00 increase for Zones 5-9, 11-20lbs.

• $2.50 increase for Zones 1-4, 21-70 lbs.

• $5.00 increase for Zones 5-9, 21-70 lbs.

A full list of commercial and retail pricing can be found on the Postal Service’s Postal Explorer website https://pe.usps.com/text/dmm300/Notice123.htm

On July 28, 2021, the Postal Regulatory Commission (PRC) approved increasing the size limit for a Presorted First-Class Mail (FCM) Postcard. The new 9″ by 6″ maximum size card has a slightly different minimum thickness of .009″ compared to the previous maximum size dimensions of 6″ by 4.25″ with a minimum thickness of .007″. (The minimum .007″ thickness still applies to cards less than 6″X9″).

Previous dimension restrictions made it easy for First-Class Postcards to “get lost” in the mailbox as larger pieces pulled away attention, and marketers didn’t have the needed space to sell products or services. The Postal Service argued that the proposed change would make the First-Class Postcards more valuable by creating new opportunities for marketers and nonprofits to take advantage of technologies such as QR codes and variable personalization making them even more effective.

Being able to send larger cards using First-Class Postcards rates will also give mailers faster delivery service circumventing the recent reduction of delivery standards recently implemented.

See the size comparison below:

In the past, dealerships haven’t considered using their customer data as a source for advertising. That data was primarily used for sales follow-up calls or service inquiries.

In the past, dealerships haven’t considered using their customer data as a source for advertising. That data was primarily used for sales follow-up calls or service inquiries.

That’s because third-party cookies (small pieces of text sent to your browser that remembers information about websites you visit on the internet) are becoming extinct. Privacy regulations and laws are driving digital giants to stop the use of them. Apple’s latest update allows users to opt out of ad tracking, Firefox and Safari have already stopped storing cookies, and Google will phase them out of Chrome by 2023.

The loss of cookies will make it more difficult to target people who previously visited dealership’s websites making digital ads less personalized.

The good news is that dealerships have a treasure of data of their own. Customers’ emails, addresses, phone numbers, details of their automobiles and more. This data is collected through CRM systems and dealership websites. It’s known as first-party data.

Social media companies can continue to track their user activity within their own platforms which helps to build an audience and allow for retargeting through advertising directly through the platform such as Facebook or Instagram. Social media is facing extreme challenges with the newly introduced privacy options as Apple user opt out of ad tracking, social platforms lose their ability to identify their user locations.

With the recent change in size regulation for First-Class postcards (from 6 X 4.25 to 6 X 9), dealers are beginning to revisit direct mail.

Data compilers can help to “fill in” missing data from dealers first-party data through a reverse append. You provide us with your data, name/address/city/state/zip and we can append phone numbers, email addresses, and run the data through cleansing software that will update records based on the National Change of Address Database, standardize the address information, and check the addresses for accuracy.

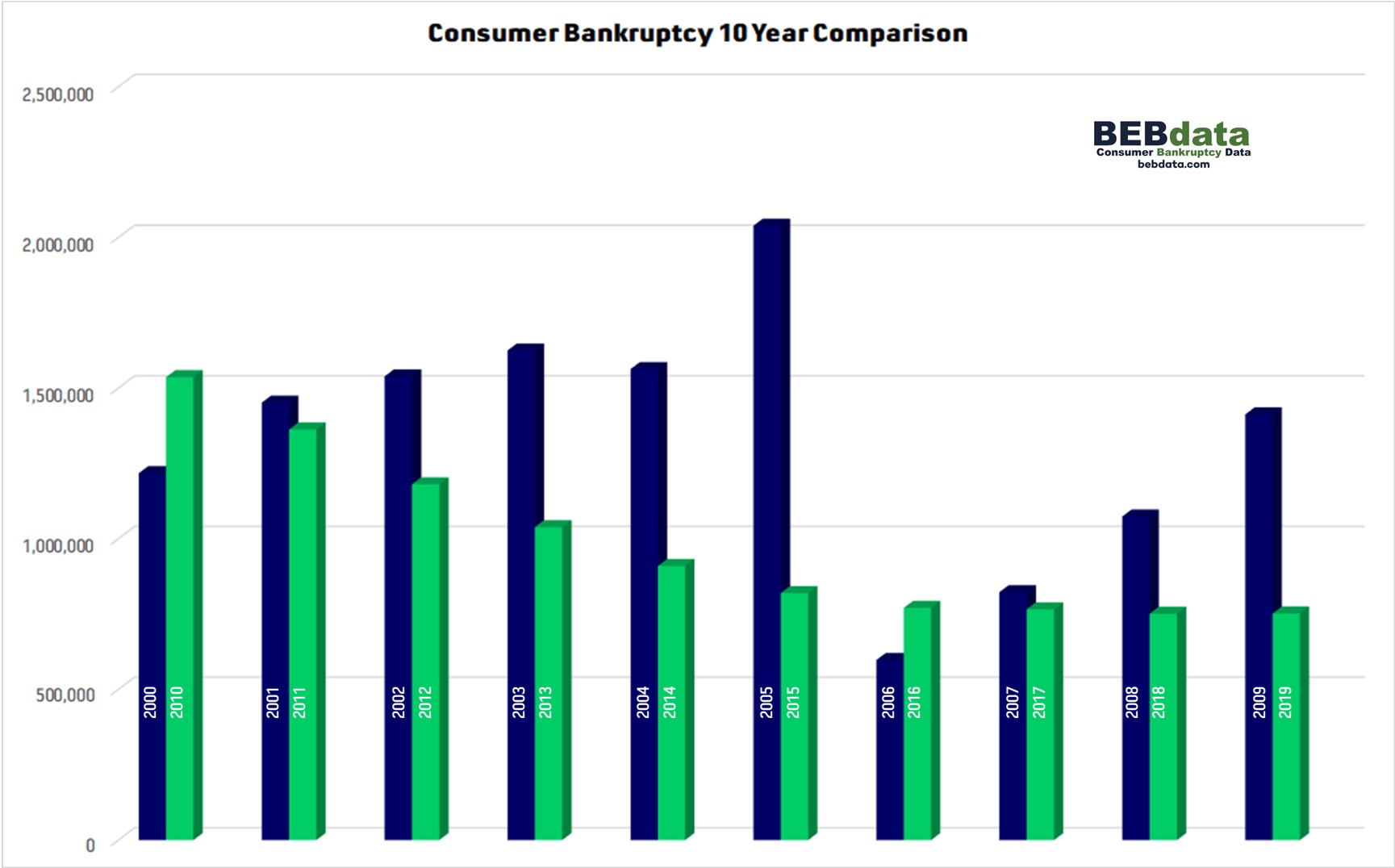

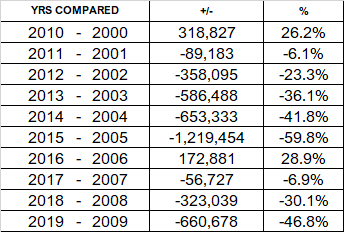

In 2000, 1.2 million people filed for bankruptcy compared to 1.5 million in 2010. That was a 26.2% increase. The chart above shows comparisons, by year, for a decade. 2001 – 2005 compared to 2011 – 2015 showed significant decreases, up to 59.8% between 2005 and 2015. 2006 compared to 2016 showed a 28.9% increase in filing, then the reduced number of filings trend resumed.

In 2000, 1.2 million people filed for bankruptcy compared to 1.5 million in 2010. That was a 26.2% increase. The chart above shows comparisons, by year, for a decade. 2001 – 2005 compared to 2011 – 2015 showed significant decreases, up to 59.8% between 2005 and 2015. 2006 compared to 2016 showed a 28.9% increase in filing, then the reduced number of filings trend resumed.

On July 19th the PRC (The Postal Rate Commission) ruled that the Postal Service’s unprecedented price adjustment request for Market Dominant products was consistent with applicable laws and approved the increase to take effect August 29, 2021.

Click on the items below to see rate comparison charts or download a handy BEBdata Postal Rate Guide:

NONPROFIT POSTAL RATE COMPARISON

MARKETING MAIL COMPARISON CHART

Consumers snapped up new autos at pre-pandemic rates in the first quarter of 2021 by more than 8%.

The gain was powered by higher demand in anticipation of a return to offices and everyday travel as vaccination rates exceeded one-quarter of the population. Also, fear of lower supplies of cars because of chip shortages has left consumers scrambling for any car that they can get, which means accepting less-than-optimal colors, features and even swapping to a different model entirely if needed.

The projected sales acceleration is part of a trend that began soon after factories reopened last summer and has persisted in the months since then. This year’s gains come from retail buyers, whose purchases soared 20% compared with a year ago — a period that largely predated the onset of shelter-in-place orders. Retail deliveries are forecast to have reached 3.16 million vehicles in the quarter, the second-highest total ever.