We made it! Have a safe and happy New Year.

Author Archives: BEBdata

Happy Holidays

1598.21 billion Passenger Cars

Buying a Car Online

92% of people buying cars today already research online. This year we saw a complete online car buying journey emerge including purchase and delivery. People want online car buying.

92% of people buying cars today already research online. This year we saw a complete online car buying journey emerge including purchase and delivery. People want online car buying.

Prior to the pandemic, only a few dealerships had online capabilities to execute a full online experience. While the purchase journey itself was happening online, the purchase remained offline. Since COVID-19, at-home test drives and vehicle delivery were tied as the number 1 alternative to visiting a car dealership for shoppers.

At a time when social restrictions related to the pandemic are impacting consumer behavior, developing strategies for how to meet consumer demand for online buying and at-home delivery can make a large impact: 18% of auto shoppers would buy a vehicle sooner if they could purchase the vehicle they wanted without going to a dealership.

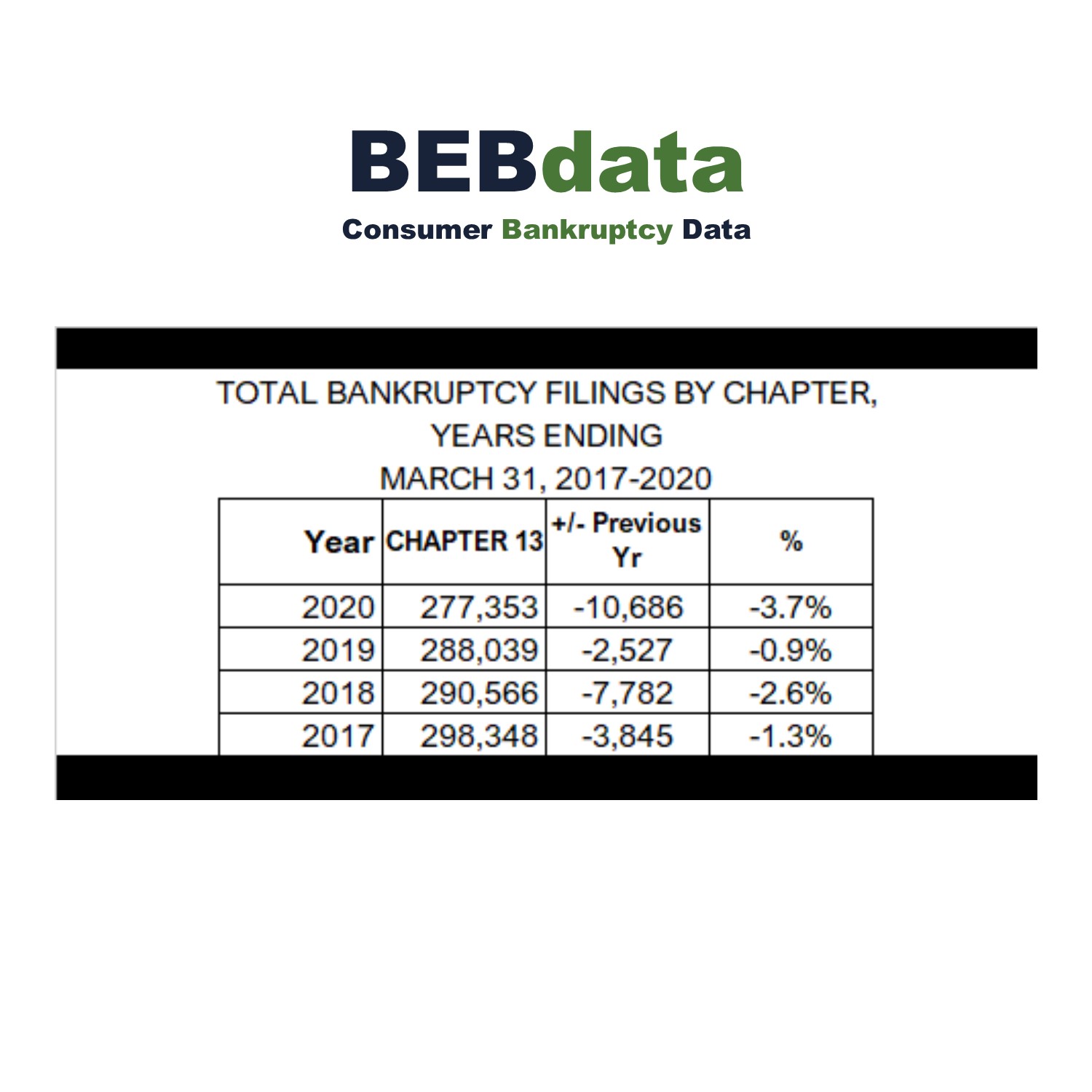

Chapter 13 Comparison

Thanksgiving Wishes

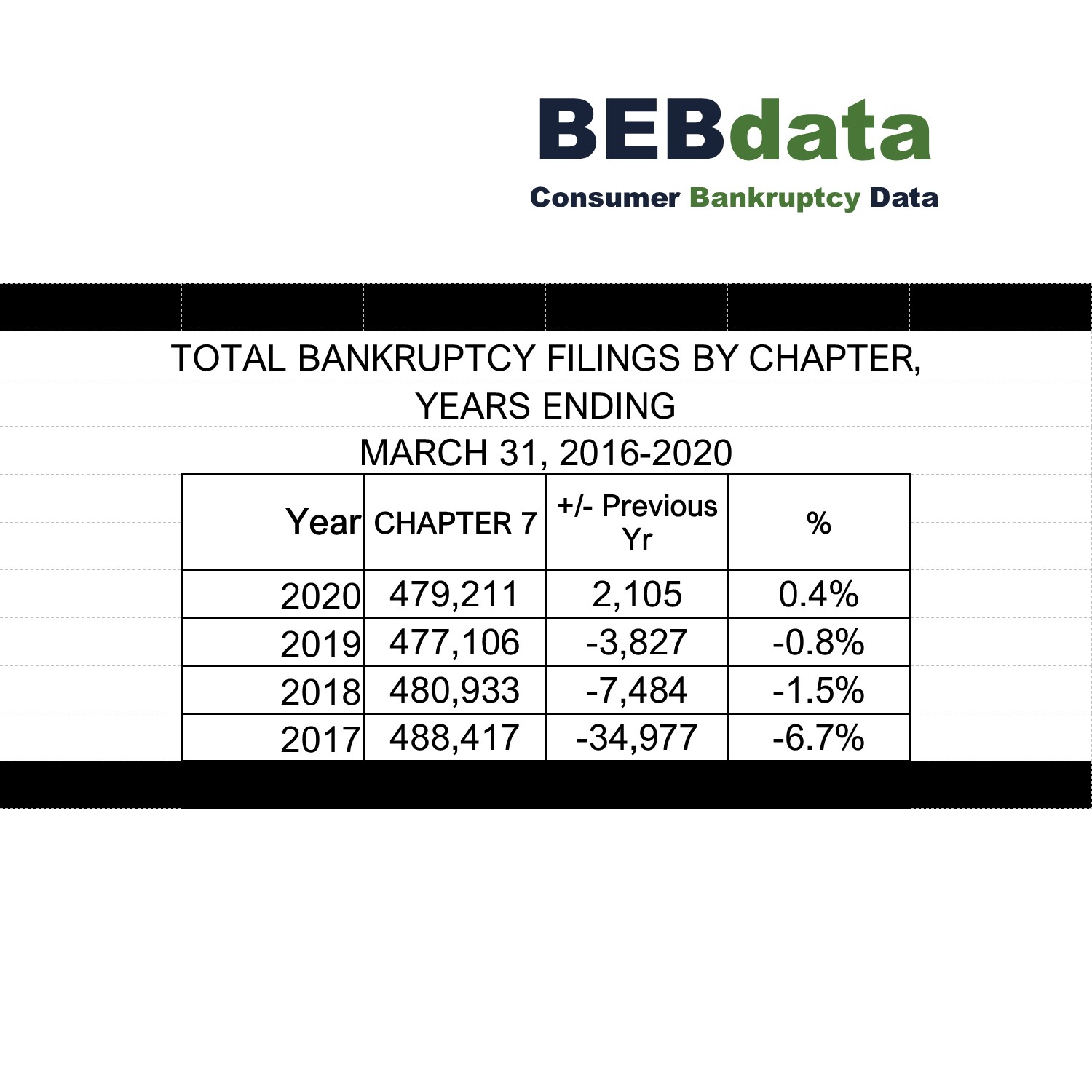

Chapter 7 Comparison

The above chart show total bankruptcy filing by Chapter 7 for years ending March 31st.

The above chart show total bankruptcy filing by Chapter 7 for years ending March 31st.