Manufacturers continue to plow forward to meet the 2025 CAFE (Corporate Average Fuel Economy) standards. Ramping up electric car sales is on the forefront. Be prepared to see lots more Electric Vehicles starting in 2020, for example:

Manufacturers continue to plow forward to meet the 2025 CAFE (Corporate Average Fuel Economy) standards. Ramping up electric car sales is on the forefront. Be prepared to see lots more Electric Vehicles starting in 2020, for example:

The trend in construction of new vehicles using lighter weight substrates continues. According to an article by MPower, much of the focus is placed on aluminum but many automakers are turning to carbon fiber not only for exterior components but also complete inner body structures. Some of Volvo’s hybrids inner structure are primarily carbon fiber. This reduces weight and enhances rigidity. Carbon fiber is also in the Silverado/Sierra trucks where GM is using carbon fiber in the construction of new bed assemblies. Industry analysts predict a compound annual growth rate of the automotive carbon fiber market between 7.9 percent and 10.6 percent for the coming five years.

The trend in construction of new vehicles using lighter weight substrates continues. According to an article by MPower, much of the focus is placed on aluminum but many automakers are turning to carbon fiber not only for exterior components but also complete inner body structures. Some of Volvo’s hybrids inner structure are primarily carbon fiber. This reduces weight and enhances rigidity. Carbon fiber is also in the Silverado/Sierra trucks where GM is using carbon fiber in the construction of new bed assemblies. Industry analysts predict a compound annual growth rate of the automotive carbon fiber market between 7.9 percent and 10.6 percent for the coming five years.

This year, the auto industry will grow 2.0% to $1.299 trillion, the slowest growth rate since at least 2011. Growth will flatten through 2022, according to eMarketer’s latest US retail forecast.

This year, the auto industry will grow 2.0% to $1.299 trillion, the slowest growth rate since at least 2011. Growth will flatten through 2022, according to eMarketer’s latest US retail forecast.

Based on an article by eMarketer, that says that US light vehicle sales have been off to a slow start this year. Cindy Liu, forecasting analyist said that will contribute to the slowdown in the overall US retail market. Auto buyers remain hesitant to purchase new vehicles amid uncertainty surrounding the economy and rising interest rates.

The auto industry represents 23.7% of all US retail sales, making it the largest retail sector. As a result, it has a large impact on the aggregate. eMarketer says that total retail sales in the US will grow 3.0% in 2019 to $5.475 trillion. Because the auto industry represents nearly one-quarter of total US retail, any growth or contraction will have an outsized effect.

According to a new LendEDU study, 32% of consumers filing for Chapter 7 bankruptcy carry student loan debt. Of that group, student loan debt comprised 49% of their total debt on average.

According to a new LendEDU study, 32% of consumers filing for Chapter 7 bankruptcy carry student loan debt. Of that group, student loan debt comprised 49% of their total debt on average.

As of 2019, student loan debt is at an all-time high with a national total of $1.5 trillion. According to Student Loan Hero, the average student-loan debt per graduating student in 2018 who took out loans was $29,800.

The LendEDU data shows the effects of the growing burden of student loan debt. Coupled with a high cost of living and the fallout of the recession, student loans make it harder for millennials to save and put them financially behind — to the point where they may need to declare bankruptcy to be able to pay them off.

Is the trend of declining bankruptcy filings coming to an end? There are some key indicators that suggest it.

Is the trend of declining bankruptcy filings coming to an end? There are some key indicators that suggest it.

A 2019 report from the American Bankruptcy Institute (ABI) indicates that consumer bankruptcy filings are on track to increase notably for the first time in years. The ABI shows that total U.S. bankruptcy filings increased 3% in July from the previous July; consumer bankruptcy filings increased at the same 3 percent rate year-to-year, with 61,025 consumer filings in July 2019, up from 59,110 in July 2018. Consumer bankruptcies also rose about 5 percent month to month from June to July 2019 (from 58,003 to 61,025).

The New York Post noted that if the trend continues, the overall total of [personal and business] bankruptcies is on pace to hit 796,000 which far exceeds last year’s totals.

Data from the ABI suggests that household debt is roughly $14 trillion, which is $1 trillion more than the 2008 Great Recession peak. Credit card debt is $1 trillion and also exceeds the 2008 peak, which could make households more likely to turn to bankruptcy as a means of relief moving forward.

The Postal Accountability and Enhancement Act (PAEA) dictated that the Postal Regulatory Commission (PRC) conduct a study of the past decade to determine if the current system for regulating rates and classes for Market Dominant Postal Products was achieving its objectives.

The Postal Accountability and Enhancement Act (PAEA) dictated that the Postal Regulatory Commission (PRC) conduct a study of the past decade to determine if the current system for regulating rates and classes for Market Dominant Postal Products was achieving its objectives.

Those results were published on December 1, 2017 and the PRC concluded that the current system achieved some of its goals, but overall the system has failed.

The PRC issued a Notice of Proposed Rulemaking that would give the USPS the authority to raise rates by at least 2% above the CPI for each market dominant rate class for five years. It also allows for an additional 1% increase if they hit service and productivity standards, and will be required to raise prices for “underwater products” (Periodicals and Nonprofit mailings for example) by a minimum of an additional 2% above the price change authority to move prices toward full-cost coverage over time. This could drive rate increases for standard letters (officially known as Marketing Mail Letters) up by 27% and flats by more than 40% over the next five-years.

These proposed changes to the current postage rate ceilings are inflated and threaten the vitality and efficiencies of the postal service and our industry as a whole.

The PRC is an independent agency that has exercised regulatory oversight over the Postal Service since its creation by the Postal Reorganization Act of 1970. It is composed of five Commissioners, each of whom is appointed by the President and subject to confirmation by the US Senate, for a term of six years. To ensure bipartisanship, not more than 3 of the Commissioners can belong to the same political party.

The PRC is tasked with ensuring transparency and accountability of the USPS and fostering a vital and efficient universal mail system. They act as an independent regulator for engaging postal stakeholders to promote a robust mail system through objective regulatory analyses and decisions. Normally, the PRC does not have the final say when it comes to postage rate increases. That is for the USPS Board of Governors. However, this is not a rate case. This is a 10-year review of the system which the PRC reigns supreme.

The argument that the USPS has accumulated losses of $59.1 billion include the $54.8 billion needed to prefund their already financially healthy retiree health plan; even though no other entity is required to do the same.

The current regulations force the USPS to reduce costs and raise efficiencies which is needed now more than ever as many economists expect inflation to increase.

Thursday, March 1, 2018 marks the end of a 90-day comment period. There is another 30-day (one month) period allowed for replies to comments before a ruling can be implemented.

We are very active with industry associations and sit on several industry boards. Together we are fighting to prevent this travesty from happening. The industry will continue to stand united and push the USPS to focus on rate increases specifically tied to cost efficiencies only. We will keep you abreast of the situation as it unfolds.

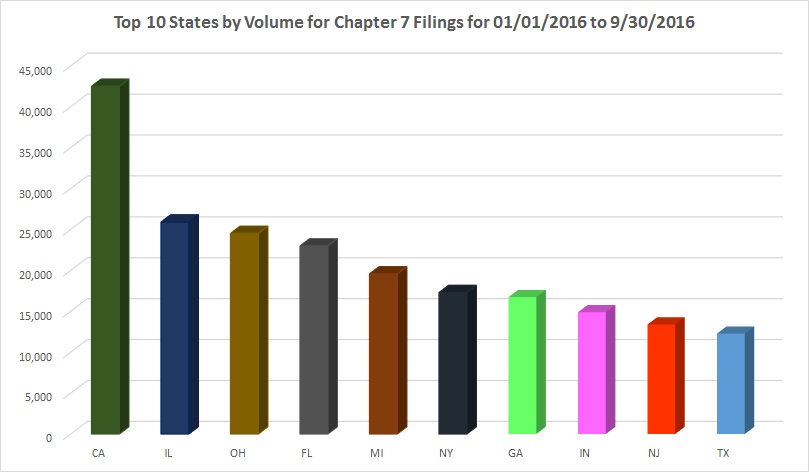

Top 10 States by Volume for Chapter 7 Filings for 01/01/2016 to 9/30/2016. Create your own graphs or download raw data by using our National Bankruptcy Data provided by BEBdata Resource Center.

Top 10 States by Volume for Chapter 7 Filings for 01/01/2016 to 9/30/2016. Create your own graphs or download raw data by using our National Bankruptcy Data provided by BEBdata Resource Center.