We will be running on May 4, 2019 to benefit the Blanton-Davis Ovarian Cancer Research Program at MD Anderson to honor the memory of our Rama Moore. Won’t you consider making a donation today? Go to runforrama.com.

Category Archives: Blog with BEBdata

1.5 Trillion in Student Loan Debt

Student Loans & Bankruptcy

Did you know that one of the most googled student loan questions is; “Can you discharge your student loans in bankruptcy?”

In 2005, Congress passed, and President George W. Bush signed, the Bankruptcy Abuse Prevention and Consumer Protection Act, which exempted federal and private students loans from discharge.

Prior to 1976, you could discharge your student loans in bankruptcy.

Then, student loans were dischargeable if they had been in repayment for five years. Subsequently, that period was extended to seven years. In 1998, Congress removed dischargeablility except if a debtor could show that paying back the student loans would create an undue hardship. In 2005, Congress extended this protection to private student loans.

In order to have a student loan discharged through bankruptcy, an Adversary Proceeding (a lawsuit within bankruptcy court) must be filed, where a debtor claims that paying the student loan would create an undue hardship for the debtor.

Government Shut Down & BK Courts

On December 22, 2018, the federal funding for certain agencies lapsed, and the United States government entered into a partial shutdown. The U.S. Department of Justice (DOJ), including the United States Trustee Program (USTP), was one of the agencies that shut down. United States Trustees (“UST”) representing the USTP appear and litigate in a multitude of bankruptcy proceedings. USTs also actively participate in out-of-court settlement discussions, plan negotiations, and the like. Pursuant to the partial shutdown, regular operations at the USTP ended, with only “excepted employees” continuing work on limited matters.

USTP excepted employees comprise a total of 35 percent of its employees. Excepted employees work without pay during the shutdown but will receive back pay after the government reopens. Remaining USTP employees who are not excepted are furloughed and will only receive compensation if Congress passes a bill allowing for it.

The contingency plan sets forth changes in the duties of DOJ employees. The contingency plan directs that civil litigation be halted except where the safety of human life or protection of property are at stake. Much of the civil litigation in which the USTP is a party does not involve such issues. The contingency plan further notes that DOJ attorneys should request stays in civil cases and reduce civil litigation staffing only to that necessary to protect human life and property. Several UST and DOJ attorneys involved in bankruptcy litigation have filed motions seeking stays of proceedings and extension of deadlines until the government reopens.

As the USTP continues to operate with its skeletal staff, certain bankruptcy processes will likely encounter delays. Although federal courts have rearranged funds to remain operational through January 18, should the shutdown extend beyond that date, bankruptcy matters such as plan confirmations and other court hearings will encounter similar delays.

Proceedings involving Chapter 7 and 13 trustees, including out-of-court discussions or negotiations, are unlikely to be delayed as these parties receive payments outside of government assistance.

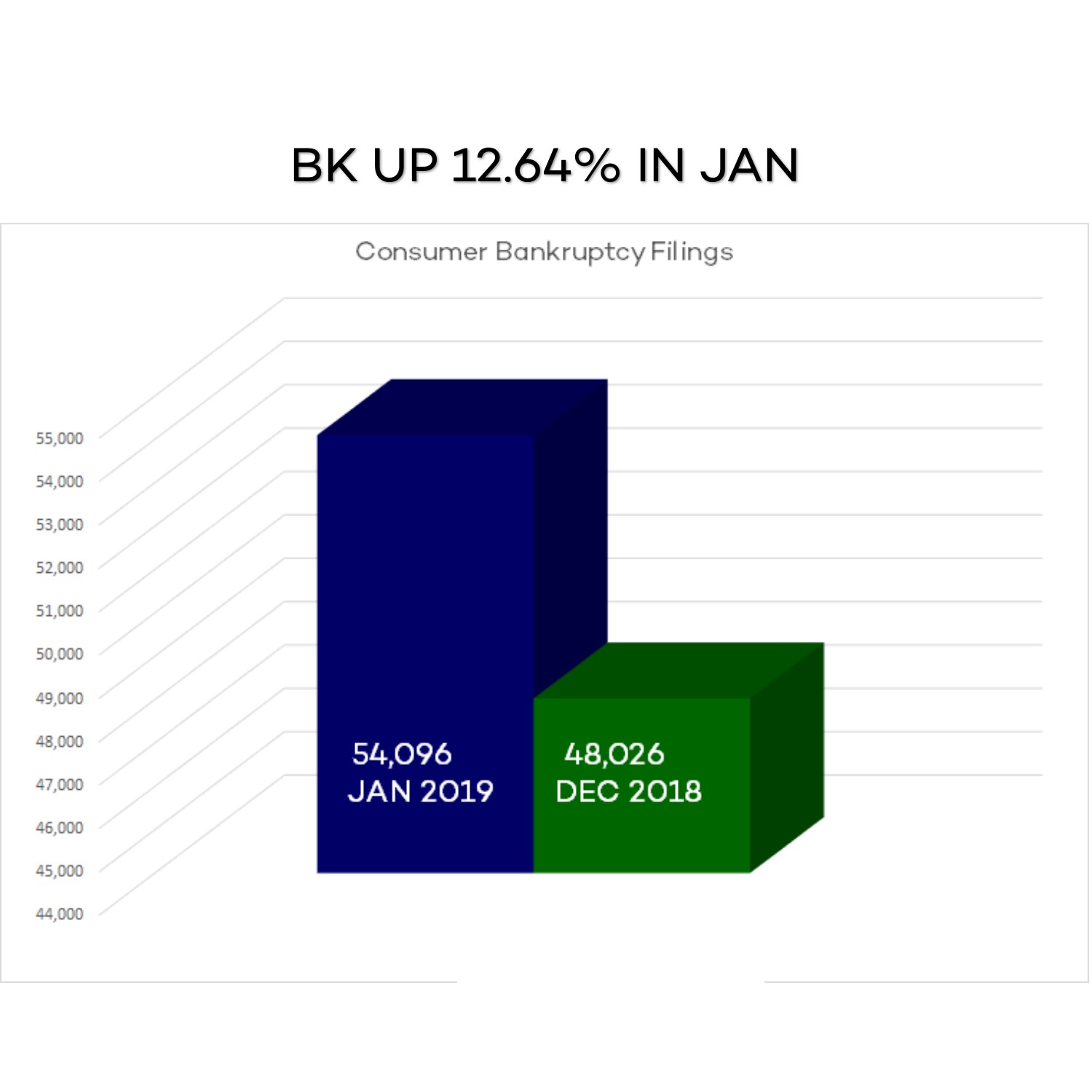

BK Up 12% in January

Medical Problems & Consumer Bankruptcy

Medical problems contributed to 66.5% of all bankruptcies, a figure that is virtually unchanged since before the passage of the Affordable Care Act (ACA), according to a study published yesterday as an editorial in the American Journal of Public Health. The findings indicate that 530,000 families suffer bankruptcies each year that are linked to illness or medical bills.

The study, carried out by a team of two doctors, two lawyers, and a sociologist from the Consumer Bankruptcy Project (CBP), surveyed a random sample of 910 Americans who filed for personal bankruptcy between 2013 and 2016, and abstracted the court records of their bankruptcy filings. The study, which is one component of the CBP’s ongoing bankruptcy research, provides the only national data on medical contributors to bankruptcy since the 2010 passage of the ACA. Bankruptcy debtors reported that medical bills contributed to 58.5% of bankruptcies, while illness-related income loss contributed to 44.3%; many debtors cited both Read more here.

NADA 2019

We are getting excited about attending the upcoming National Auto Dealers Association annual conference in San Francisco!

The NADA Show Expo is the auto industry’s premier marketplace of products, services and technologies. More than 700,000 square feet of exhibits highlight more than 500 manufacturers and suppliers of the hottest products and coolest technologies. See you there!!

Happy New Year

Happy Holidays

Shift to Online Buying

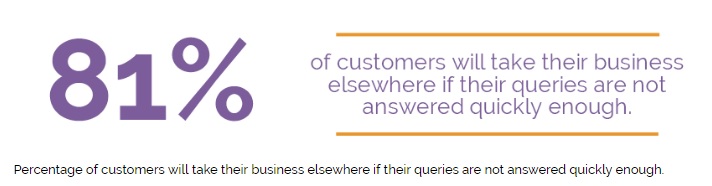

This shift to online buying means that customer expectations have changed, which is why multi-channel marketing is now vital. Nowadays, customers expect a 24-hour real-time response, and 81% of customers will take their business elsewhere if their queries are not answered quickly enough.

Percentage of customers will take their business elsewhere

Percentage of customers will take their business elsewhere if their queries are not answered quickly enough.