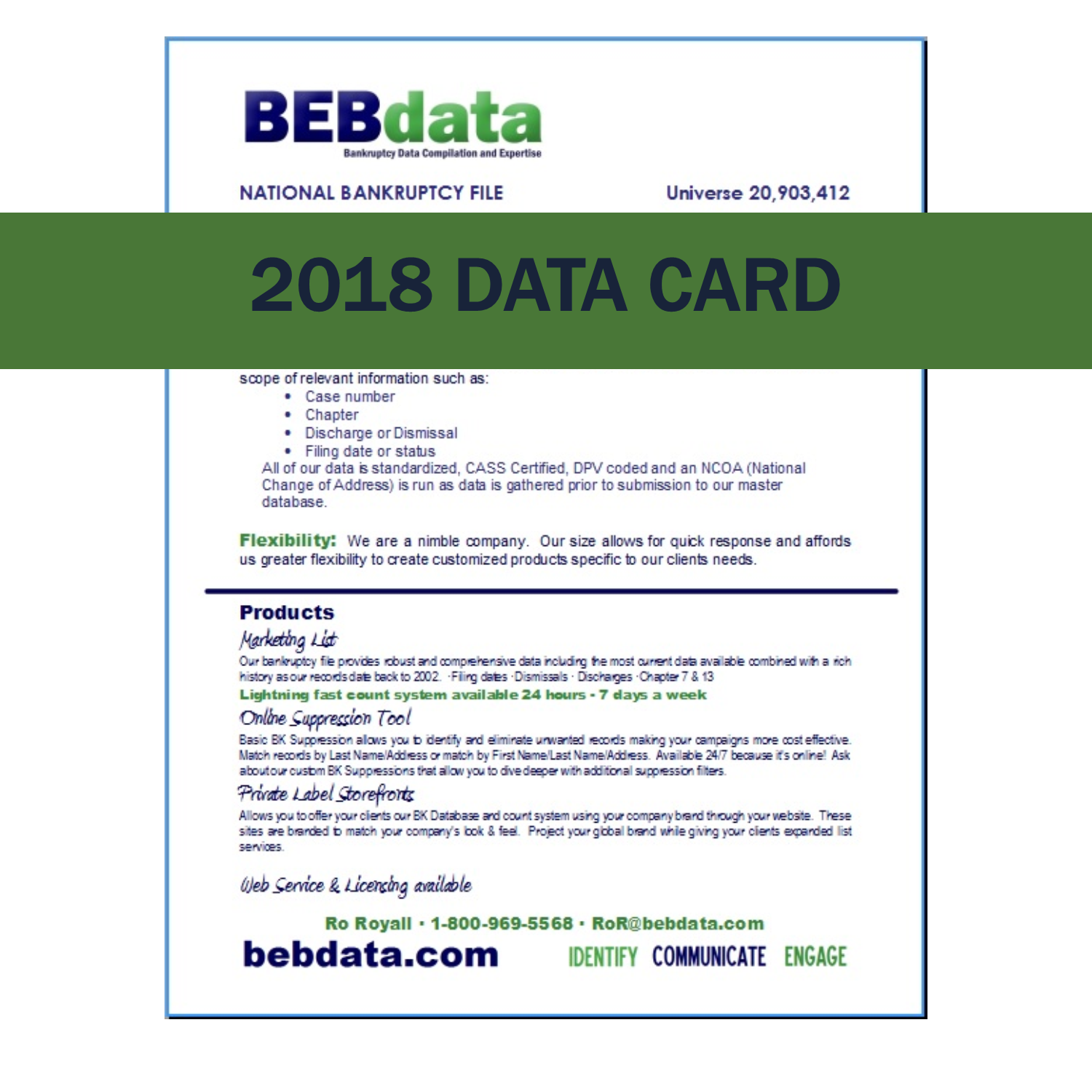

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and data. Bankruptcy is our specialty and we are experts. We have been compiling our database for over 10 years and our knowledge of the industry, coupled with our in-depth understanding of the data, ensures our clients’ they are getting exactly what they want. See our online data card here.

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and data. Bankruptcy is our specialty and we are experts. We have been compiling our database for over 10 years and our knowledge of the industry, coupled with our in-depth understanding of the data, ensures our clients’ they are getting exactly what they want. See our online data card here.

Category Archives: Blog with BEBdata

Millennials Credit Scores

Chances are, If you’re a millennial your credit score is “subprime” — enough to make lenders think twice about doing business with you.

Chances are, If you’re a millennial your credit score is “subprime” — enough to make lenders think twice about doing business with you.

TransUnion reported that 43% of borrowers ages 18 to 36 have a credit score of 600 or below on the 300-to-850 VantageScore scale. Generation X (ages 37-51) is at 33%, Baby Boomers (52-70) at 20%, and the silent generation (70+) rounds out at 9%.

The Year in Review

We hope you enjoy this quick glimpse into the people at BEB & BEBdata!

We hope you enjoy this quick glimpse into the people at BEB & BEBdata!

L-R: Lilly (Accounting); Ann Swanson (Swanson Graphics), Kathy (Sales), Diane (Client Services), Joy Z (VP), and Angel (Client Services) at the PIGC Graphic Excellence Awards; Nina (Accounting); Walter (Postal); Shannon (Operations) & Kristin (Data Processing); Ron, Scott Fancher (Suncoast Resources) & Pat Amante (Tasman Sign &Graphics); Rama (Client Services); Ron’s (CEO) winning chili cook-off team from the Epicomm-SW Conference; Lupe, Olga (Operations) & family at The Texans game; Melvin, the Marketing Chimp; Olivia (Operations); Kathy & Terry Hall; Bill (Print) & Chris Washam; Angel & Diane; Rachel (Operations); Jasmine, Helen, Patty, Noreen, Liz & Laura (Operations); Sharon, Ro (EVP), Randall, and Roy Royall & Larry Corbin.

Dealership turnover squeezing profits

NADA study spotlights struggles in recruitment and retention

The struggle among dealerships to attract and retain female employees mirrors a broader problem: the industry’s inability to keep new hires.

That inability, shown dramatically in the National Automobile Dealers Association’s 2016 Dealership Workforce Study, hurts profits, says an author of the study. Read more here…

BEBdata Auto Lead Lists

BEBdata partners with the nation’s most robust data companies for our automotive leads lists. The databases hold over 150 million records of car, truck & SUV owners throughout the United States. Buy your next auto file from BEBdata. We specialize in bankruptcy data, bankruptcy leads, and more. We are data experts and can help you to identify, communicate and engage your prospects to become customers.

January 2017 QR Code

Have you scanned the January 2017 QR Code from BEB-Business Extension Bureau’s new calendar yet? We have a fun message for you! Or Click Here Now.

If you don’t have a calendar and would like one, please feel free to contact us at 713.528.5568 and we’ll send one right out!

You can also click here to see it!

Happy New Year

Happy Holidays

Housing Credit Index Update

Loans originated in Q3 2016 are among the highest-quality home loans originated since the year 2001, according to the latest CoreLogic Housing Credit Index (HCI) Report.

Loans originated in Q3 2016 are among the highest-quality home loans originated since the year 2001, according to the latest CoreLogic Housing Credit Index (HCI) Report.

Higher index values indicate a higher level of credit risk for new originations and lower index values indicate less credit risk present. Compared with other loans made since mid-2009, the starting point of the current economic expansion, Q3 2016 loans are among the loans originated with the lowest credit risk based on six important credit-risk attributes.

The average credit score for homebuyers increased 5 points between the third quarter of 2015 and the third quarter of 2016, rising from 734 to 739.

The average DTI for homebuyers fell slightly comparing the third quarters of 2015 and 2016, falling from 35.7 percent to 35.4 percent.

The LTV for homebuyers decreased nearly 1 percentage point between the third quarter of 2015 and the third quarter of 2016, declining from 86.8 percent to 85.8 percent.

Read more at http://www.calculatedriskblog.com/2016/12/corelogic-mortgage-loans-originated-in.html#OdLMYqp9fDiE2bjC.99

December 2016 QR Code

Have you scanned your final QR Code from BEB-Business Extension Bureau’s 2016 calendar yet?

We have a fun message for you!

You can also click here to see it!