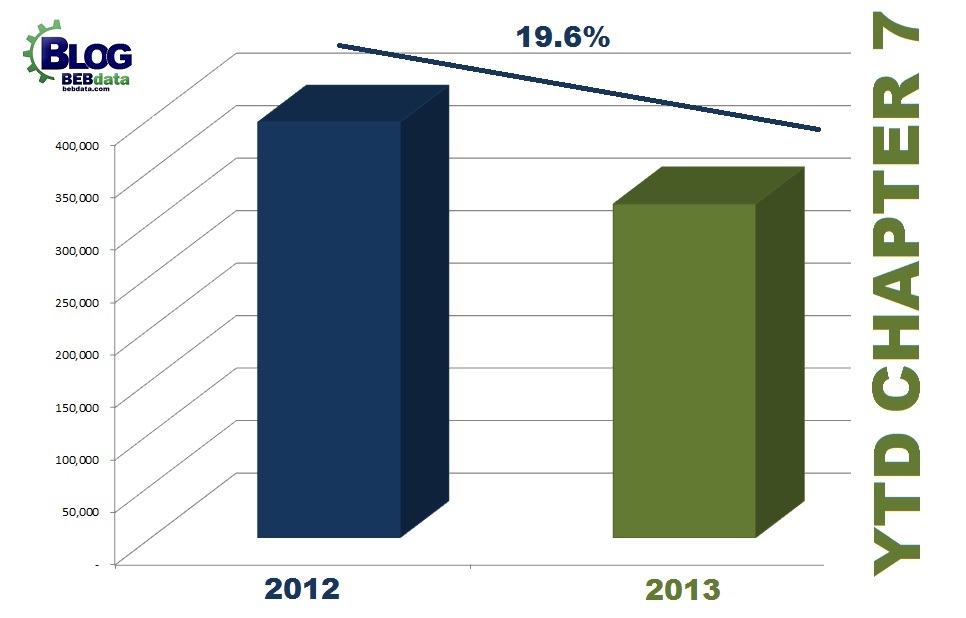

Chapter 7 filings have gone down by 7.5% during the first 28-weeks of 2013 compared to the same timeframe in 2012 from 418,323 to 387,095. The drop between 2012 & 2011 shows an 11.8% decrease in filings for a total downward trend of 18% over the past two years.

Gather your own statistics with our comprehensive and easy to use Resource Center by clicking here.