Check out our short video that gives The Year in Review! Click here

Tag Archives: bankruptcy data

Happy New Year – 2013

Happy Holidays

Subprime Lending Is Back

Great article from Forbes on Subprime Lending. Check it out…

Don’t look now but banks are once again issuing lines of credit to customers with bad credit histories. Read more here

BEBdata Preps for NADA in Orlando

The NADA is the Automotive Industry Event of the Year!

It is the world’s largest international gathering for franchised new-vehicle dealers. This convention offers dealers a rare chance to meet face-to-face with executives of major auto manufacturers and features hundreds of exhibitors showcasing the latest equipment, services and technologies and over 40 workshops with the industry’s best trainers. We’ll be there, will you!? Contact us today! Check out our video promoting the event by clicking onto the link below:

BEBdata On YouTube

Check out our YouTube Channel by clicking here!

Check out our YouTube Channel by clicking here!

We’ll post videos on the latest in Bankruptcy information, how to use our Resource Center, review upcoming conferences and share happenings involving staff and clients.

Happy Thanksgiving

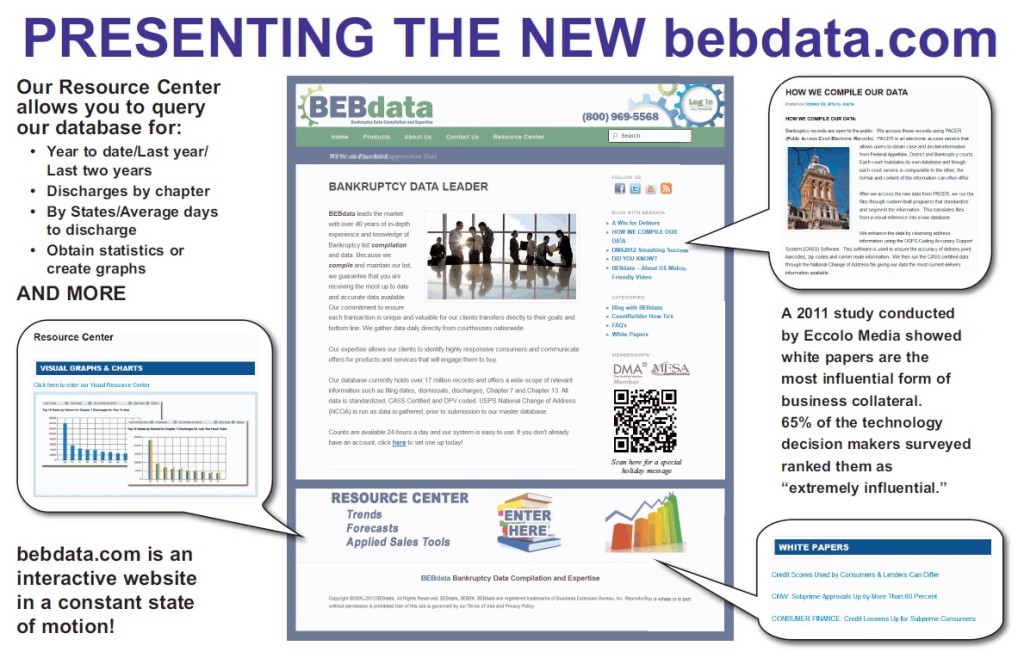

The new bebdata.com

Social Security Income and Banktruptcy

In October, the U.S. Court of Appeals, Tenth Circuit upheld the district court when it concluded that social security income should not be included in the calculation of projected disposable income for people filing for Chapter 13 bankruptcy.

In October, the U.S. Court of Appeals, Tenth Circuit upheld the district court when it concluded that social security income should not be included in the calculation of projected disposable income for people filing for Chapter 13 bankruptcy.

It was noted that “projected disposable income” is defined as “current monthly income” minus the amount needed for the debtor’s support in section 1325(b).

This gives people who are receiving social security the option to file for bankruptcy if they need to, without having to include the social security in their projected disposable income.

The second argument was over whether this exclusion would be in ‘bad faith’ or ‘good faith.’

The court stated, “When a Chapter 13 debtor calculates his repayment plan payments exactly as the Bankruptcy Code and Social Security Act allow him to, and thereby excludes SSI, that exclusion cannot constitute a lack of good faith.”

Several other circuits have the same issue pending and this decision may play an influential role.

Written by: Mary Ann Pekara of Total Bankruptcy

How We Compile Our Data

Bankruptcy records are open to the public. We access those records using PACER (Public Access Court Electronic Records). PACER is an electronic access service that allows users to obtain case and docket information from Federal Appellate, District and Bankruptcy courts. Each court maintains its own database and though each court service is comparable to the other; the format and content of the information can often differ.

BK Data – The BEBdata System

After we access th e raw data from PACER, we run the files through custom built programs that standardize and segment the information. This translates files from a visual reference into a raw database.

e raw data from PACER, we run the files through custom built programs that standardize and segment the information. This translates files from a visual reference into a raw database.

We enhance the data by cleansing address information using the USPS Coding Accuracy Support System (CASS) Software. This software is used to ensure the accuracy of delivery point barcodes, zip codes and carrier route information. We then run the CASS certified data through the National Change of Address file giving our data the most current delivery information available.

The final step in the process to create a marketing worthy database entails distributing the records within our custom built database system. Our system allows us to segment and categorize each section of information within each record allowing for query, analysis or fragmenting data.

The data is available in a variety of vertical markets and is under no circumstances used to determine creditworthiness. When used for credit solicitation marketing, our BK Data may only be used for Invitation To Apply (ITA) purposes only.