According to Make Lemonade, there are more than 44 million borrowers who collectively owe $1.5 trillion in student loan debt in the U.S. Student loans are now the second highest consumer debt category – behind mortgages, but ahead of credit card debt.

Tag Archives: BEBdata

Student Loans & Bankruptcy

Did you know that one of the most googled student loan questions is; “Can you discharge your student loans in bankruptcy?”

In 2005, Congress passed, and President George W. Bush signed, the Bankruptcy Abuse Prevention and Consumer Protection Act, which exempted federal and private students loans from discharge.

Prior to 1976, you could discharge your student loans in bankruptcy.

Then, student loans were dischargeable if they had been in repayment for five years. Subsequently, that period was extended to seven years. In 1998, Congress removed dischargeablility except if a debtor could show that paying back the student loans would create an undue hardship. In 2005, Congress extended this protection to private student loans.

In order to have a student loan discharged through bankruptcy, an Adversary Proceeding (a lawsuit within bankruptcy court) must be filed, where a debtor claims that paying the student loan would create an undue hardship for the debtor.

Government Shut Down & BK Courts

On December 22, 2018, the federal funding for certain agencies lapsed, and the United States government entered into a partial shutdown. The U.S. Department of Justice (DOJ), including the United States Trustee Program (USTP), was one of the agencies that shut down. United States Trustees (“UST”) representing the USTP appear and litigate in a multitude of bankruptcy proceedings. USTs also actively participate in out-of-court settlement discussions, plan negotiations, and the like. Pursuant to the partial shutdown, regular operations at the USTP ended, with only “excepted employees” continuing work on limited matters.

USTP excepted employees comprise a total of 35 percent of its employees. Excepted employees work without pay during the shutdown but will receive back pay after the government reopens. Remaining USTP employees who are not excepted are furloughed and will only receive compensation if Congress passes a bill allowing for it.

The contingency plan sets forth changes in the duties of DOJ employees. The contingency plan directs that civil litigation be halted except where the safety of human life or protection of property are at stake. Much of the civil litigation in which the USTP is a party does not involve such issues. The contingency plan further notes that DOJ attorneys should request stays in civil cases and reduce civil litigation staffing only to that necessary to protect human life and property. Several UST and DOJ attorneys involved in bankruptcy litigation have filed motions seeking stays of proceedings and extension of deadlines until the government reopens.

As the USTP continues to operate with its skeletal staff, certain bankruptcy processes will likely encounter delays. Although federal courts have rearranged funds to remain operational through January 18, should the shutdown extend beyond that date, bankruptcy matters such as plan confirmations and other court hearings will encounter similar delays.

Proceedings involving Chapter 7 and 13 trustees, including out-of-court discussions or negotiations, are unlikely to be delayed as these parties receive payments outside of government assistance.

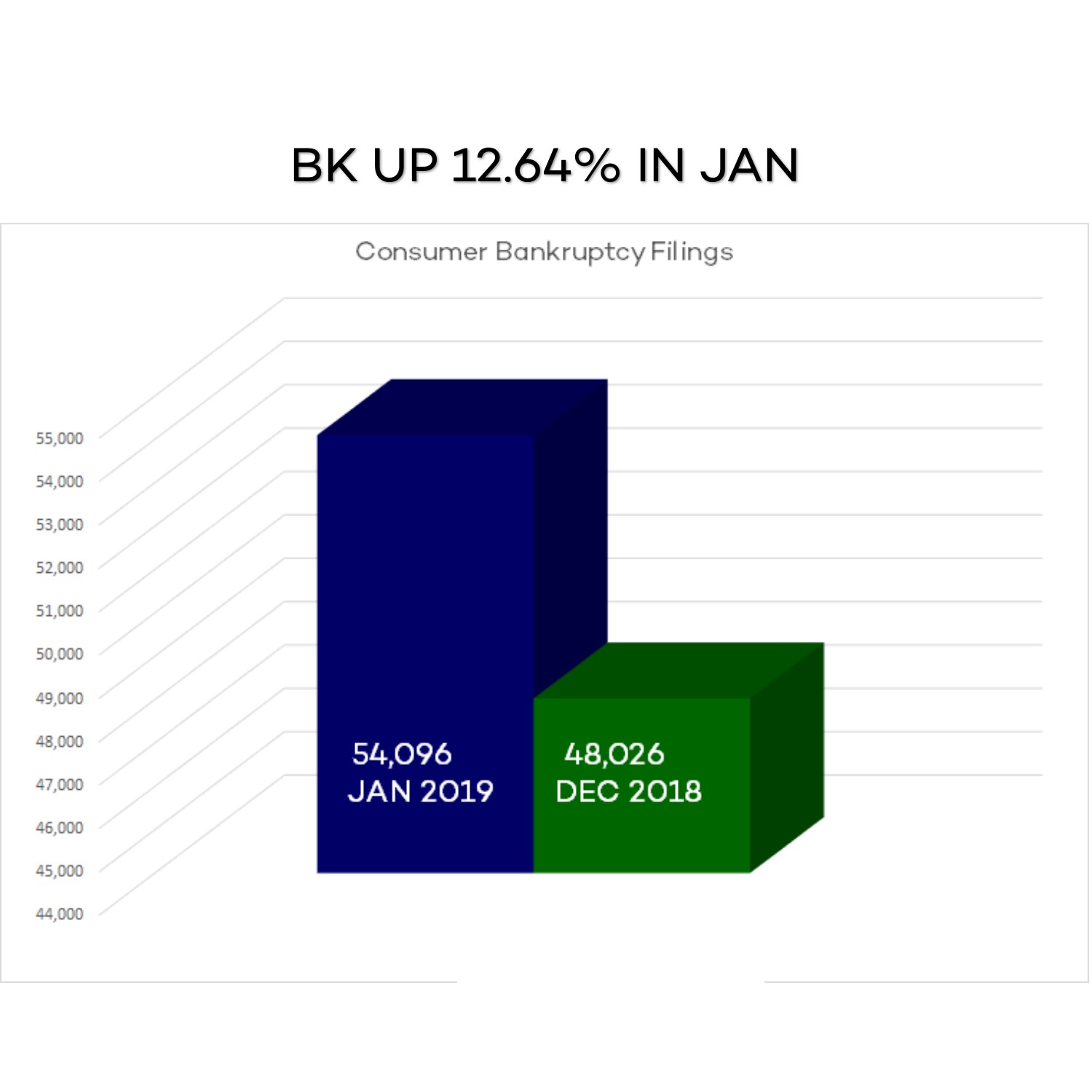

BK Up 12% in January

Medical Problems & Consumer Bankruptcy

Medical problems contributed to 66.5% of all bankruptcies, a figure that is virtually unchanged since before the passage of the Affordable Care Act (ACA), according to a study published yesterday as an editorial in the American Journal of Public Health. The findings indicate that 530,000 families suffer bankruptcies each year that are linked to illness or medical bills.

The study, carried out by a team of two doctors, two lawyers, and a sociologist from the Consumer Bankruptcy Project (CBP), surveyed a random sample of 910 Americans who filed for personal bankruptcy between 2013 and 2016, and abstracted the court records of their bankruptcy filings. The study, which is one component of the CBP’s ongoing bankruptcy research, provides the only national data on medical contributors to bankruptcy since the 2010 passage of the ACA. Bankruptcy debtors reported that medical bills contributed to 58.5% of bankruptcies, while illness-related income loss contributed to 44.3%; many debtors cited both Read more here.

Alternative Loans Performing Well

Two-thirds of consumers active in the alternative loan market fall in the subprime risk category, the riskiest of all credit tiers. Data from a new TransUnion study found that many of these consumers perform well when opening traditional credit products such as credit cards, auto and personal loans. Read more here.

Two-thirds of consumers active in the alternative loan market fall in the subprime risk category, the riskiest of all credit tiers. Data from a new TransUnion study found that many of these consumers perform well when opening traditional credit products such as credit cards, auto and personal loans. Read more here.

Dodd-Frank Update

Last week The House voted to give final congressional approval to a major rewrite of banking rules that would revoke key elements of Dodd-Frank Act but still leaving most of it tact.

The President is expected to sign into law the “Economic Growth, Regulatory Relief and Consumer Protection Act,” which won House approval 258-159 as 33 Democrats and 225 Republicans voted for the bill. Officials say that it recalibrates regulation and risk in the financial services sector while promoting economic growth and new jobs.

The Senate Banking Committee Chairman said that the bill “right-sizes” regulations for smaller financial institutions, allowing community banks, credit unions and mortgage lenders to grow.

Key provisions of the legislation include:

- Increasing banks’ asset threshold from $50 billion to $250 billion for extra regulatory scrutiny by the Federal Reserve.

- Streamlining capital requirements and other exemptions from mortgage-lending rules for community banks.

- Amending the Volcker rule for banks with less than $10 billion in assets in an effort to bolster market liquidity and decrease risk to the financial system in economic downturn.

- Repealing the Department of Labor’s fiduciary rule, which aimed to minimize supposedly conflicted investment advice given to retirement savers.

Although Republicans claim the bill is a deregulatory effort, GOP lawmakers weren’t able repeal Dodd-Frank in its entirety. Key provisions remain, including the Consumer Financial Protection Bureau and Washington’s authority to unwind failing large banks.

Car Subscriptions? Yes!

Of the 17 million cars expected to be sold in the U.S. this year, about a third are leased. The rest are purchased. But there’s a new option for drivers coming on strong in 2018 – car subscriptions.

There are several companies offering drivers a monthly fee to access a variety of vehicles they can change up when they want. The fee varies depending on the company, and range from $400 to as much as $3,700 per month! The fee usual includes maintenance, insurance, roadside assistance, pickup and drop-off. And in most cases the subscription can be ended at any time.

Cadillac, Volvo, BMW, and Mercedes are all offering subscriptions today. In an interview with David Liniado of Cox Automotive (part owner of Flexdrive), he said that the market is tiny today (subscriptions between 100K – 150K) but anticipates it growing into the millions within the next 12 months! Read more about this new concept here.

BBB Honors BEBdata

We are so excited receive an Awards for Excellence from the Houston BBB for the fourth year in a row!

We are so excited receive an Awards for Excellence from the Houston BBB for the fourth year in a row!

In 1992, the Better Business Bureau Education Foundation and the University of Houston Bauer College of Business Administration formed a partnership to recognize area businesses for their commitment to quality. Initially called the Spirit of Texas Awards, the Awards for Excellence are modeled after the Malcolm Baldridge National Quality Award. Today, the BBB Awards for Excellence continue to recognize businesses and non-profits in the Greater Houston area for their achievements and commitment to overall excellence and quality in the workplace.

Applications are judged by volunteers with the Silver Fox Advisors, a group of former business owners, entrepreneurs and CEOs dedicated to sharing their knowledge, experience and skills, allowing clients to improve their growth and profitability in a cost-effective manner. All applications were reviewed and scored by a minimum of two different judges. If additional information was needed customer and vendor referrals were surveyed.

We are one of the oldest members of the Houston Better Business Bureau and we very proud and appreciative of this distinguished honor.

Direct Lending

It’s bank lending without the bank. As traditional banks have cut back on business lending a new opportunity for a growing group of asset managers who are making loans to mid-market companies has been created. Investors find Direct Lending an increasingly popular answer to low-yield problems. Companies that are robust enough to dip into the syndicated debt market are choosing direct lending instead, and regulators are asking if the market can sustain such growth without creating a mess.

Here’s how it works. Asset managers raise pools of money from investors interested in debt. The managers hunt for advisers with investment opportunities, or private-equity funds looking to finance acquisitions. The fund does its own research before deploying its money.

Borrowers are typically, mid-market-sized businesses that banks are no longer interested in lending to. Their need for credit and lack of good alternatives means direct lenders can get higher interest rates.

About $13.3 billion was raised globally in the first quarter of 2017, more than half the total for 2016, according to Deloitte. The U.S. is the biggest center for direct lending, with a 61 percent share of the market. As of June 2016, private credit providers had $595 billion in assets under management, according to research firm Preqin.

Read the entire article from Bloomberg here.