Subprime lending is booming once again in the US – not for home loans, but for cars.

Tag Archives: BK data

Happy First Day of Spring

Happy St Patrick’s Day

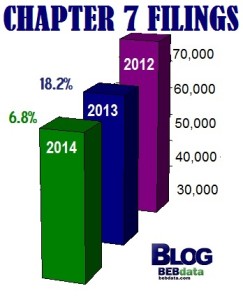

Decreased Ch 7 Filings Trend Slowing

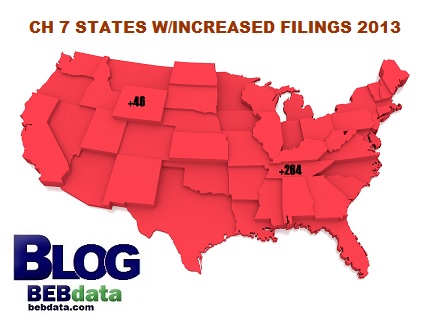

Chapter 7 Filings increased slightly (1.4%) in February compared to January 2014. The number of Chapter 7 filings from February 2013 showed a significant decrease of over 11,000 (-18.2%) from February filings the year before. February 2014 numbers show the downward trend slowing as some 46,000 filings were processed last month compared to the 50,000 processed in February of 2013 representing a reduction of only 6.8%.

PLEASE NOTE: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications.

Over 1/2 US Consumers w/Subprime Credit

CFED (Corporation for Enterprise Development) released their 2014 Score Card Deep Five Report, a comprehensive evaluation of the relative financial security of the American public.

Results from the Score Card reflect that 56.3% of all US consumers do not qualify for credit at “prime” rates. With an average annual pay of only $40,309, consumers in the state of Mississippi account for the highest percentage of consumers with subprime credit at 69.1%.

Consumer Spending Rebounds In Feb

Consumers spent an average of $87 per day last month, up from $78 in January, according to Gallup. This represents the highest daily discretionary spending average for the month of February since 2008.

Average daily spending for February 2014 was the strongest for the month of February since 2008, according to Gallup’s daily tracking estimates. Daily spending last month averaged $87, an increase from $78 per day in January. February daily spending averaged $106 in 2008 then declined until the amount reported last year was $83.

Read more from this ACA International article here.

Mar 2014 QR Code

Be sure to scan the QR Code from your interactive calendar to see how Guinness Beer would like for the world to celebrate St Patrick’s day! You can also click here to see.

Be sure to scan the QR Code from your interactive calendar to see how Guinness Beer would like for the world to celebrate St Patrick’s day! You can also click here to see.

Rising consumer debt linked to lackluster retail

Consumer debt, and not just wicked winter weather, is having a chilling effect on retail sales. Consumer debt rose by $241 billion in the fourth quarter of 2013, the largest period increase seen since the fall of 2007, according to a recent study by the Federal Reserve Bank of New York.

Consumer debt, and not just wicked winter weather, is having a chilling effect on retail sales. Consumer debt rose by $241 billion in the fourth quarter of 2013, the largest period increase seen since the fall of 2007, according to a recent study by the Federal Reserve Bank of New York.

At the same time consumers were taking on more debt, retailers from Abercrombie and Fitch to Wal-Mart reported lackluster sales largely blamed on inclement weather and deflationary margins. Read more from this City Wire article from Kim Souza here.

Practice What We Preach

Recently, we reviewed our company marketing statistics and trends from 2013. We found some exciting highlights that include:

Recently, we reviewed our company marketing statistics and trends from 2013. We found some exciting highlights that include:

- Reduced our e-mail bounces by 12.6%

- Increased our e-mail opens by 10.1%

- Organically increased our Twitter followers by 150%

- Increased our Google Adwords impressions by 16.6%

- Increased Google Adwords clicks by 40.6%

- Increased our position by 40.5%