Delinquencies for subprime buys crept up to 5.50% in the fist quarter of 2013 from 5.09% a year earlier. Great article from SubPrime Auto Finance News.

Tag Archives: BK Statistics

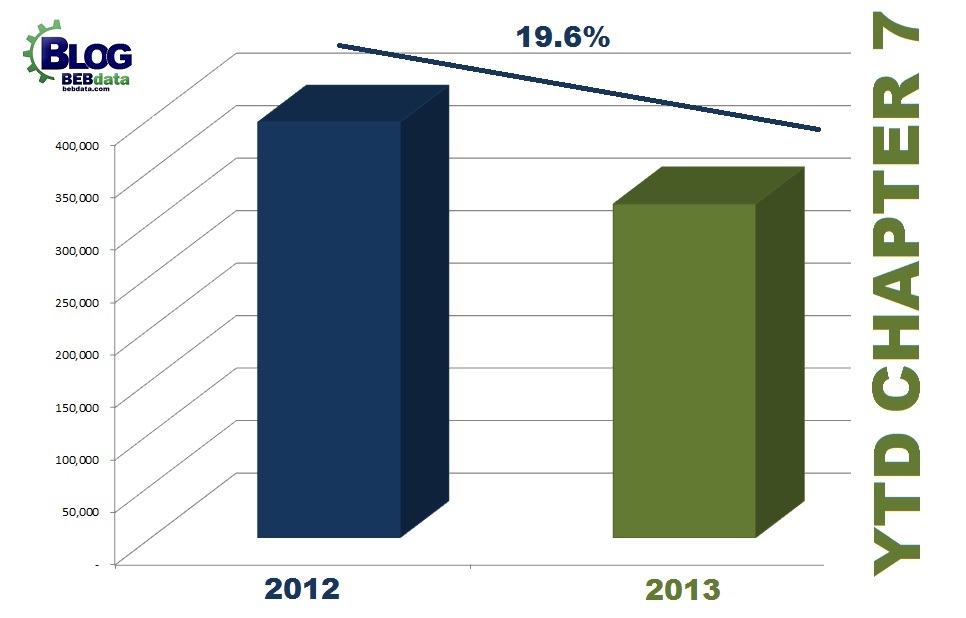

Chapter 7 Discharges Down YTD

Year to date Chapter 7 Discharges* are down 19.6% in 2013 compared to the same time frame in 2012. The largest drop based on percentage took place in Alaska, with 42.5% decrease. Still, the largest number of Chapter 7 Discharges are found in California. Though down 28% from last year, 50,284 were processed so far this year (through May) compared to the second highest activity in Florida with 23,675 discharges.

*(January – May)

*(January – May)

Note: Our data is based on one per household and has been cleaned to postal specifications.

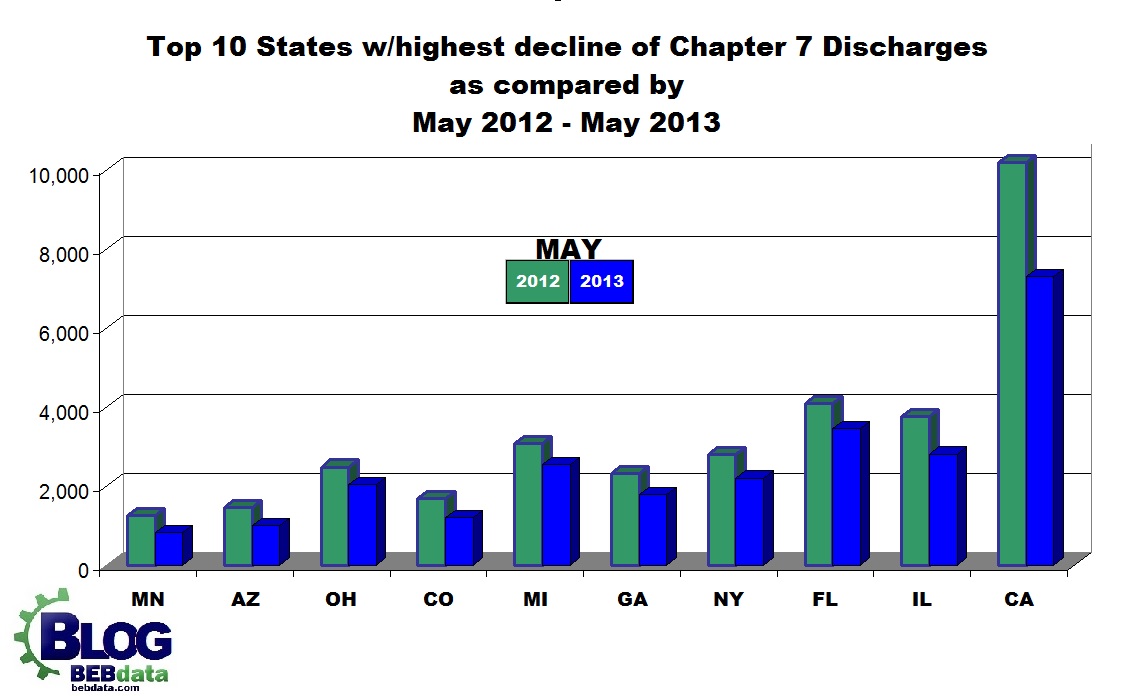

Highest Chapter 7 Decline for May in CA

There was a 21.3% decline in Chapter 7 discharges nationwide in the month of May 2013 compared to May of 2012.

48 out of 50 states saw a decline, and California shows the largest with a 28.3% descent. Two states had a small increase; Mississippi and Kansas. Our graph shows the top 10 states with the highest decline in Chapter 7 discharges from May 2012 – May 2013.

Note: Our data is based on one per household and has been cleansed to postal specifications.

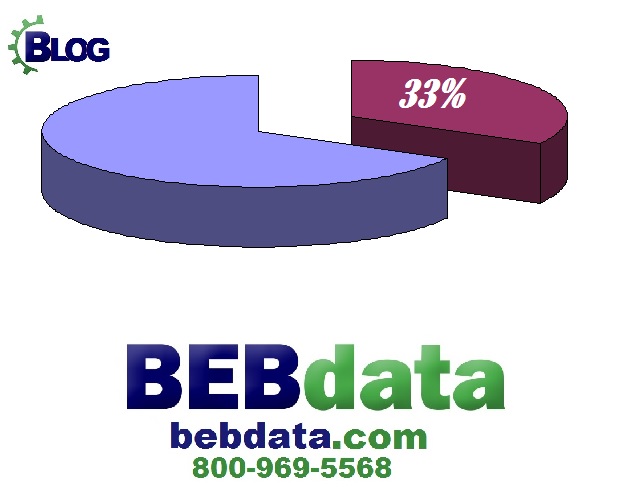

Auto Loans = 33% Subprime

Most Viewed Pages

We were reviewing our website statistics and found that 11.5% of our website hits come from our blog!

We were reviewing our website statistics and found that 11.5% of our website hits come from our blog!

Most read blog (to date) is the Fairness for Struggling Students Act (posted on April 24). Coming in at a close second is the blog on our recent Graphic Excellence Award win, posted on March 15. Rounding out the top three most popular posts is our Ro Royall at the Houston Zoo Partners Summit.

Some other interesting stats include:

- Our top two most visited webpages are the Home Page and Resource Center!

- Of outside links directing people to our website:

* 21.7% come from our sister company’s wesbite bebtexas.com

* 11.7% come from Twitter

* 5% come from LinkedIn

* 2.1 % from the QR codes on our 2013 Calendar landing pages

January

February

March

April

May

Too Big To Fail & Too Big To Jail

Bankruptcy and risk management experts discussed details regarding deficiencies of the Dodd-Frank financial reform law at a House Financial Services Oversight and Investigations Subcommittee hearing on Wednesday.

Bankruptcy and risk management experts discussed details regarding deficiencies of the Dodd-Frank financial reform law at a House Financial Services Oversight and Investigations Subcommittee hearing on Wednesday.

The core provision of the 2010 reform law was to keep the government from paying the bailout bill of major financial institutions when they fail. However, federal government financial regulators still have discretion to subsidize large financial institutions if their failure threatens the economy.

Officials have publicly noted that the government’s ability to prosecute large institutions and their executives for financial crimes is hindered when institutions are treated as “too big to fail”.

Possible corrections discussed including shrinking the biggest institutions and reducing their risk to the financial system. California Democrat Brad Sherman used the phrase “too big to fail and too big to jail”. He said that no institution should be so large that its creditors believe they will be bailed out and its executives believe they are immune from the laws.

A second fix discussed included greatly limiting or all together doing away with regulators’ option of funding and restructuring a failing institution outside of bankruptcy.

Fariness For Struggling Students Act

US Senators Dick Durbin (D-IL), Tom Harkin (D-IA) and Al Franken (D-MN) are reintroducing the Fairness for Struggling Students Act of 2013 in an attempt to address issues surrounded the growing student loan debit crisis. Sources report student loan debt among college students surpasses $1 trillion last year and approximately $150 billion of outstanding student loan debt is in private loans.

The Fairness for Struggling Students Act proposes treating privately issued student loans in bankruptcy the same as other types of private debt. Since 1978, only government issues or guaranteed student loans have been treated as non-dischargeable during bankruptcy in order to safeguard federal investments in higher education. In 2005, the law was changed to give private loans the same privileged bankruptcy treatment as government loans, even though they have vastly different terms and fewer consumer protections.

The differences between private and federal student loans is distinct. Federal loans have fixed interest rates and offer consumer protections, deferment and forbearance in times of economic hardship, as well as manageable repayment options.

The differences between private and federal student loans is distinct. Federal loans have fixed interest rates and offer consumer protections, deferment and forbearance in times of economic hardship, as well as manageable repayment options.

Private student loans often resemble credit cards rather than financial aid with uncapped variable interest rates, large origination fees and few consumer protections. Private loans are ineligible for federal forgiveness, cancellation or repayment programs.

If the Act is passed, private student loans will once again be dischargeable in bankruptcy.

Bankruptcy and Under 25’s

BK & Student Loans

An interesting article on BK and student loans from Steve Rhode’s blog. He says 4 Out of 10 people were able to discharge student loans in bankruptcy — but most never try. Read more here

An interesting article on BK and student loans from Steve Rhode’s blog. He says 4 Out of 10 people were able to discharge student loans in bankruptcy — but most never try. Read more here

Errors on Credit Reports Cost Consumers

A recent FTC Bureau of Economics study says that 5% of US Consumers have errors on their credit reports that can hike the cost of credit. Interesting article from NBC here.

A recent FTC Bureau of Economics study says that 5% of US Consumers have errors on their credit reports that can hike the cost of credit. Interesting article from NBC here.