Tag Archives: Blog

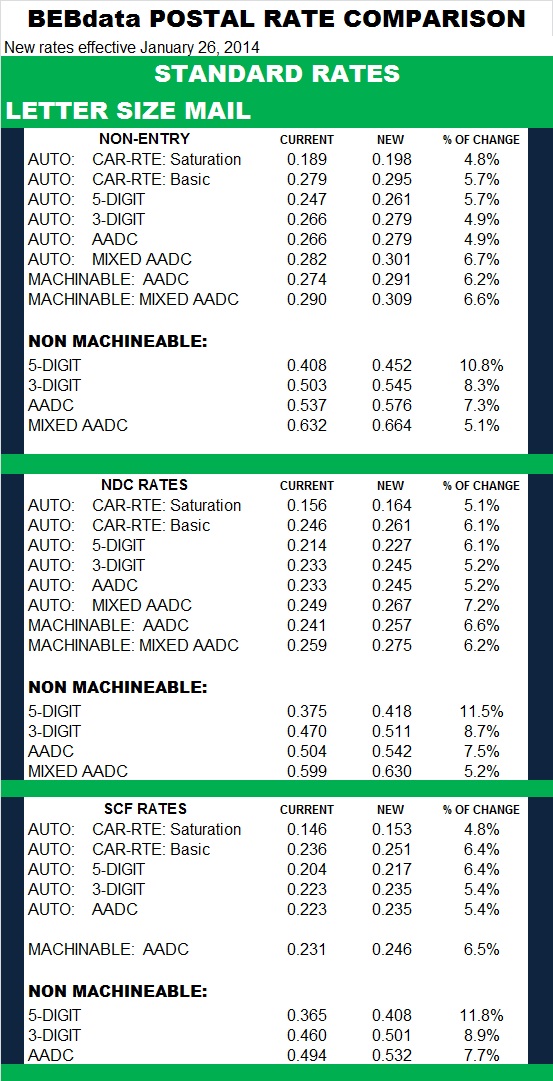

Standard Letter Rates

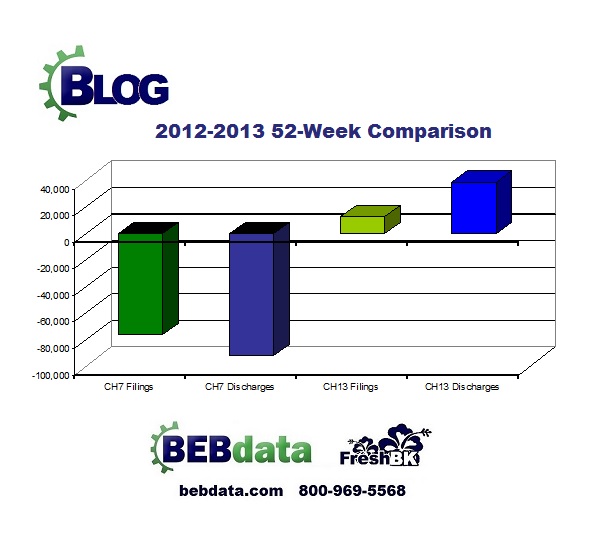

2013 – 2012 Bankruptcy Trends

Comparing 2012 to 2013 BK Filings & Discharges, our data shows that Chapter 7 Filings were down by 10.2% with almost 76,000 fewer filings in 2013. Chapter 7 discharges dropped by over 90,000 representing an 11.5% decrease from 2012.

Comparing 2012 to 2013 BK Filings & Discharges, our data shows that Chapter 7 Filings were down by 10.2% with almost 76,000 fewer filings in 2013. Chapter 7 discharges dropped by over 90,000 representing an 11.5% decrease from 2012.

Chapter 13 filings increased by over 13,000 to show an almost 5% increase (4.6%) while Chapter 13 discharges increased by 36.8% with 39,000 more in 2013.

Please note: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications

JAN 2014 Calendar QR Code

Don’t forget to scan the QR Code from the month of January in your BEBdata Interactive Calendar. Or you can click here to see where it goes too!

Don’t forget to scan the QR Code from the month of January in your BEBdata Interactive Calendar. Or you can click here to see where it goes too!

Happy New Year 2014

From all of us, to all of you, Happy New Year.

Happy Holidays 2013

DEC 2013 Calendar QR Code

Don’t forget to scan this month’s Calendar QR Code for a special message from BEBdata! Or you can click here to see where it takes you.

Don’t forget to scan this month’s Calendar QR Code for a special message from BEBdata! Or you can click here to see where it takes you.

Happy Thanksgiving

Subprime Borrowing is HOT in the Car Biz

Today, people are able to buy new cars even with a credit score lower than 500. A year ago that would have been very difficult to pull off. Dealerships all over the country are offering deals for high credit risk buyers as long as they have a good job, current utility bills that are in good standing, and some money for a down payment.

Today, people are able to buy new cars even with a credit score lower than 500. A year ago that would have been very difficult to pull off. Dealerships all over the country are offering deals for high credit risk buyers as long as they have a good job, current utility bills that are in good standing, and some money for a down payment.

The market for subprime borrowing is hot and this time the car business is leading the way. The central bank’s stimulus is making it easier for people with spotty credit to buy cars as investors purchase riskier bonds linked to auto loans. Below are some interesting facts surrounding subprime lending:

- Subprime car buyers account for more than 27% of loans for new vehicles, compared to 25% last year and 18% in 2009.

- Issuance of bonds linked to subprime auto loans soared to $17.2 billion this year, more than double the amount sold during the same period in 2010.

- Some experts believe that vehicle loans are safer because the underlying asset can be more accurately valued, it’s easier to repossess, and people who need a car to get to work make that payment a priority.

- 58% of loans taken out to purchase Chrysler’s Dodge brand vehicles in October were with loans above the industry average of 4.2% annual percentage rate, according to Edmunds, a researcher that tracks vehicle sales.

- Buyers with imperfect credit account for 27% of loans for new vehicles.

READ MORE BY CLICKING HERE

2014 NADA Conference

We are jazzed to attend the National Auto Dealers Association Conference in New Orleans! Will you be there?