Be sure to scan the QR Code in your BEBdata Calendar for a fun message! Or, click here to see where it takes you!

Be sure to scan the QR Code in your BEBdata Calendar for a fun message! Or, click here to see where it takes you!

Tag Archives: Blog

Happy Labor Day

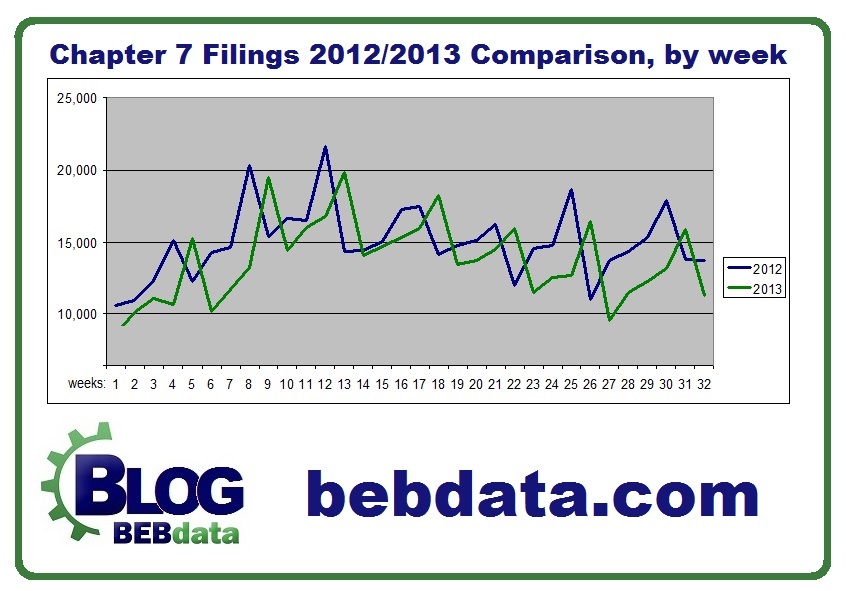

Chapter 7 Filings Ebb & Flow

Though overall down by 8.2% for the year compared to last year; the Chapter 7 filings ebb and flow by week are very similiar from 2012 to 2013. You can run your own statistics by using our robust Resource Center. Click here to check it out!

Please note: Our data is based on one per household, excludes multiple filings and has been cleansed to postal specificiations.

Blog With Us!

Bankruptcy and Under 25’s

Errors on Credit Reports Cost Consumers

A recent FTC Bureau of Economics study says that 5% of US Consumers have errors on their credit reports that can hike the cost of credit. Interesting article from NBC here.

A recent FTC Bureau of Economics study says that 5% of US Consumers have errors on their credit reports that can hike the cost of credit. Interesting article from NBC here.

USPS Announces 5-Day Delivery

Other countries such as Canada, Sweden and Australia have reduced their Saturday services with a positive impact.

The bold move raised immediate legal questions in Washington as some lawmakers claim that Congressional approval is required. Earlier attempts to change the current law have been met with objections and delays from Congress driving the USPS to make the change on their own.

Washington’s mandate, imposed solely on the USPS, to pay over $5 billion a year for health benefits to future retirees remains a central point of contention and a driving factor to make radical change.

The decision to end Saturday delivery may be ultimately blocked by an act of Congress however, the announcement moves postal overhaul legislation to the forefront. We’ll keep you posted on the latest as it happens.

BEBdata Calendar QR Code – February 2013

Be sure to scan the QR Code located on your BEBdata Interactive Calendar to see where it takes you! Or you can click here too.

Be sure to scan the QR Code located on your BEBdata Interactive Calendar to see where it takes you! Or you can click here too.

Subprime Lending In Stimulation Mode

Credit card and vehicle financing subprime lending is in a stimulation mode. A recent study showed 25% of risk managers at banks and other financial institutions surveyed expect subprime lending to expand in the next six-months. About 50% of those predict a rise will surface in auto loans which indicates that the market may be loosening.

Credit card and vehicle financing subprime lending is in a stimulation mode. A recent study showed 25% of risk managers at banks and other financial institutions surveyed expect subprime lending to expand in the next six-months. About 50% of those predict a rise will surface in auto loans which indicates that the market may be loosening.

@bebdata at 400 Organic Followers