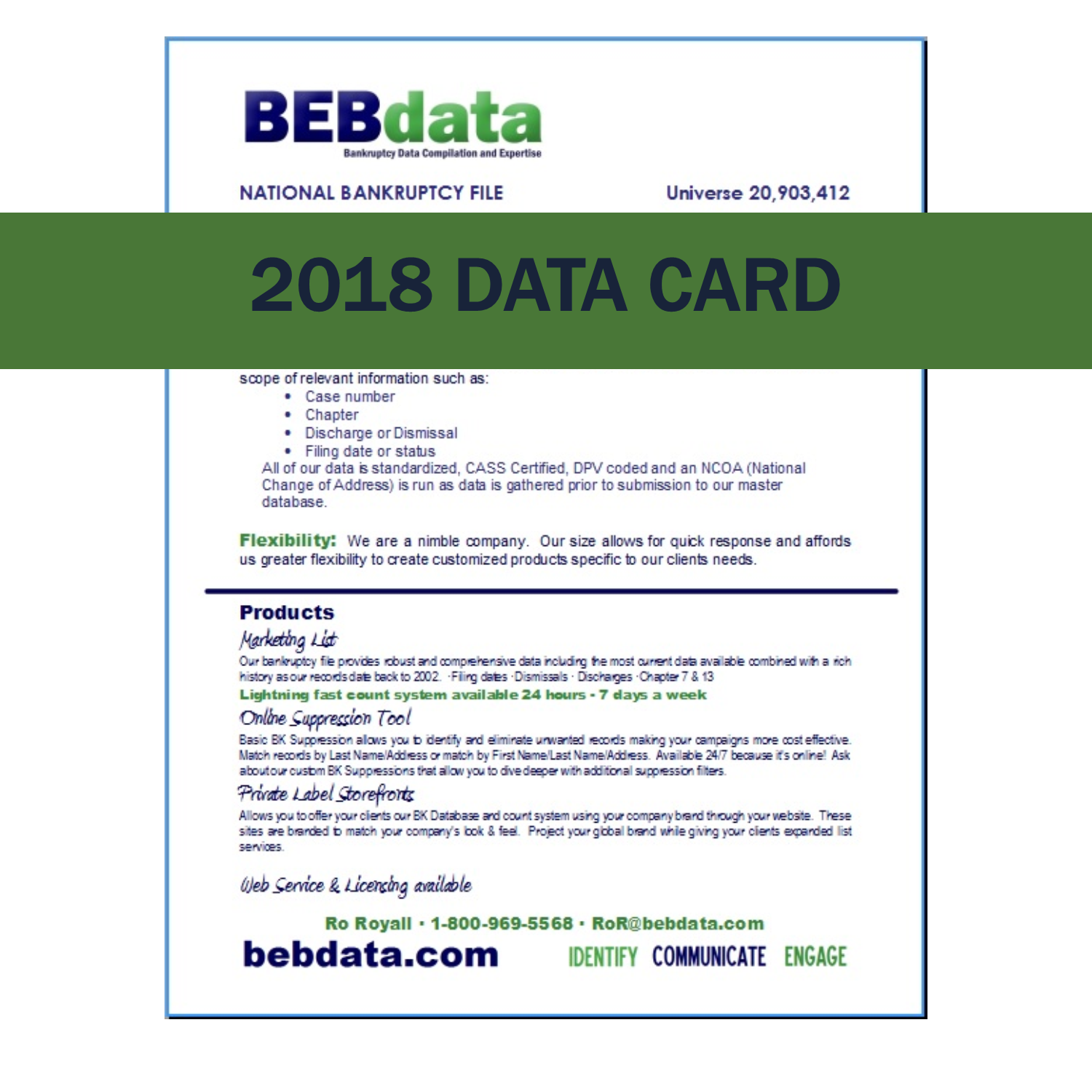

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and data. Bankruptcy is our specialty and we are experts. We have been compiling our database for over 10 years and our knowledge of the industry, coupled with our in-depth understanding of the data, ensures our clients’ they are getting exactly what they want. See our online data card here.

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and data. Bankruptcy is our specialty and we are experts. We have been compiling our database for over 10 years and our knowledge of the industry, coupled with our in-depth understanding of the data, ensures our clients’ they are getting exactly what they want. See our online data card here.

Tag Archives: consumer bankruptcy data

Millennials Credit Scores

Chances are, If you’re a millennial your credit score is “subprime” — enough to make lenders think twice about doing business with you.

Chances are, If you’re a millennial your credit score is “subprime” — enough to make lenders think twice about doing business with you.

TransUnion reported that 43% of borrowers ages 18 to 36 have a credit score of 600 or below on the 300-to-850 VantageScore scale. Generation X (ages 37-51) is at 33%, Baby Boomers (52-70) at 20%, and the silent generation (70+) rounds out at 9%.

Bankruptcy and Student Loans

Sarah Chaney of The Wall Street Journal just published a fascinating article on how bankruptcy courts (since March) are allowing borrows to cancel private student loans with a new legal argument that relies on vague wording about the definition of a student loan.

Sarah Chaney of The Wall Street Journal just published a fascinating article on how bankruptcy courts (since March) are allowing borrows to cancel private student loans with a new legal argument that relies on vague wording about the definition of a student loan.

Check out the entire article by clicking here.

Looking for Bankruptcy Data?

Our Bankruptcy file provides robust and comprehensive data including the most current data available combined with rich history as our records date back to 2002. We compile our database, which is over 20 million records today and contains a wide array of information such as filing dates, dismissals, discharges, Chapter 7 and Chapter 13.

The size of the U.S. subprime population is getting smaller

From Subprime Auto Financial News

From Subprime Auto Financial News

Dealers still see subprime availability as big players adjust By Nick Zulovich, Senior Editor

CLEVELAND and FORT WORTH, Texas -The size of the U.S. subprime population is getting smaller — at least that’s what FICO says. And large finance companies such as General Motors Financial again acknowledged that the segment of its portfolio composed of subprime paper will continue to diminish, too.

However, dealerships that participated in KeyBanc Capital Markets’ monthly survey indicated that they’re still able to obtain financing for their vehicle buyers, even if they fall into the subprime credit tier. Read More…

Need to track auto buyers?

Buy your next auto file from BEBdata. Great for targeting vehicle owners that need service work, warranties, or need to upgrade to newer vehicles. Our lists are accurate and have a large select group to chose from such as Make, Model & Year to name only a few. e specialize in bankruptcy data, bankruptcy leads, and more. We are data experts and can help you to identify, communicate and engage your prospects to become customers.

Student Loans & Bankruptcy

Here’s an interesting article from CREDIT.COM regarding Student Loans and Bankruptcy written by Constance Brinkley-Badgett.

Here’s an interesting article from CREDIT.COM regarding Student Loans and Bankruptcy written by Constance Brinkley-Badgett.

The belief that student loans are never dischargeable in bankruptcy is, simply put, not true. Student loans can be discharged in some limited cases. In fact, according to a study published in 2011 by Jason Iuliano, a student at the Woodrow Wilson School of Public and International Affairs at Princeton University, at least 40% of borrowers who include their student loans in their bankruptcy filing end up with some or all Read More…

Americans who recently took out federal student loans aren’t paying down their debt.

Recent Federal Student Loans Look A Lot Like Subprime Mortgages

Written by:

Shahien Nasiripour

Chief Financial and Regulatory Correspondent, The Huffington Post

Federal student loans made in recent years resemble the toxic subprime mortgage loans that helped cause the Great Recession, new data show.

Federal student loans made in recent years resemble the toxic subprime mortgage loans that helped cause the Great Recession, new data show.

Rather than paying down their balances after leaving school, borrowers with recent federal student loans are experiencing an increase in debt as they fail to make enough payments to offset the accumulating interest on their loans. Read more…

Can You Discharge Student Loans?

Credit.com news wrote an interesting blog entitled, “Can You Discharge Private Students Loans in Bankruptcy”.

Credit.com news wrote an interesting blog entitled, “Can You Discharge Private Students Loans in Bankruptcy”.

There’s a big misconception that private student loans can never be discharged in bankruptcy. People have repeated that statement so often they believe it to be a fact. The only problem is it’s not quite true.

Some private student loans are clearly eligible to be wiped away in a consumer bankruptcy. Even in a Chapter 7 bankruptcy, it takes only about 90 days to forgive the debt tax-free.

And while these special rules apply to private student loans that meet some criteria, all private students loans are no longer legally collectible once they have expired under the statute of limitations in your state… read more.