After two years of credit card and personal loan growth, despite serious delinquency rates that remained near pre-COVID levels, TransUnion predicts the consumer credit market will experience pronounced changes in 2023. TransUnion’s 2023 Consumer Credit Forecast projects delinquency rates for credit card and personal loans to rise to levels not seen since 2010. At the same time, demand for most lending products will remain high relative to pre-pandemic levels with the number of consumers securing auto and home equity loans increasing on an annual basis.

After two years of credit card and personal loan growth, despite serious delinquency rates that remained near pre-COVID levels, TransUnion predicts the consumer credit market will experience pronounced changes in 2023. TransUnion’s 2023 Consumer Credit Forecast projects delinquency rates for credit card and personal loans to rise to levels not seen since 2010. At the same time, demand for most lending products will remain high relative to pre-pandemic levels with the number of consumers securing auto and home equity loans increasing on an annual basis.

Despite a challenging macroeconomic environment, TransUnion’s new Consumer Pulse study found that more than half (52%) of Americans are optimistic about their financial future during the next 12 months. The youngest generations – Millennials (64%) and Gen Z (61%) – are most optimistic. The optimism levels are occurring against a backdrop wherein 82% of consumers believe the U.S. is currently in or will be in a recession before the end of 2023.

Rapidly increasing interest rates and stubbornly high inflation combined with recession fears represent the latest in a series of significant challenges consumers have faced in recent years. It’s not surprising then to see pronounced increases in delinquency rates for credit card and personal loans, two of the more popular credit products. Yet, many consumers – from a credit perspective – are in a better position than they were just a few years ago, equipped with credit they can use in case of more macroeconomic challenges. We expect demand for credit to continue to be high with lenders positioned well to meet it. While unemployment is likely to rise next year, it should remain relatively low, a key element for a healthy consumer credit market.

Tag Archives: consumer bankruptcy

The 2023 Used Car Market

Marketers anticipate a period of adjustment in 2023 for used car sales. Affordability due to higher interest rates and inventory challenges point to an anticipated slight decrease in sales.

Marketers anticipate a period of adjustment in 2023 for used car sales. Affordability due to higher interest rates and inventory challenges point to an anticipated slight decrease in sales.

Marketers forecast 18.9 million in retail used car sales for 2023 and 35.6 million for overall used sales.

Used car sales were down in 2022, with the rolling 30-day retails sales 9% behind 2021. The average listing price also saw a 4% decrease to $27,077.

By end of 2022, the used market saw a double-digit drop in vehicles priced between $25,000 and $30,000 and a near 10% drop in vehicles between $20,000 and $25,000. There has been a steady growth in wholesale inventory over the past six months.

However, as prices retreat for used vehicles from record highs, affordability remains an issue, with high interest rates, 12%-13%. Rates are expected to climb, as the Federal Reserve tries to bring down inflation. The Fed in the past year has raised rates 425 basis points — the highest annual adjustment on record. The rising rates have dramatically impacted the subprime market. But the higher interest rates and costs have caused demand to slide throughout the industry.

The industry is trading a supply problem for a demand problem. With higher expenses comes lower demand.

Interest rates are not expected to decrease though hikes are expected to slow during the 3rd and 4th quarter.

Certified preowned vehicles (CPP) are expected to remain in short supply. Vehicles usually available for the CPO market were entering the rental car market at a higher rate throughout 2021 and 2022. CPO sales are expected to be around 2.2 million this year.

RESOURCE: National Independent Auto Dealers Association

Indicators Show Mixed Activity in Housing Markets

National housing market indicators available as of January showed activity in housing markets was mixed. Trends in some of the top indicators for this month include:

National housing market indicators available as of January showed activity in housing markets was mixed. Trends in some of the top indicators for this month include:

- Purchases of new homes increased in December for a third

consecutive month. New single-family home sales rose 2.3 percent

to 616,000 units (SAAR) in December from a pace of 602,000 in

November but were 26.6 percent lower year-over-year (y/y). Note

that monthly data on new home sales tend to be volatile. For all of

2022, new home sales reached 644,000, down 16.5 percent from

771,000 in 2021 and their slowest pace since 2018. (Sources: HUD

and Census Bureau) - Existing home sales fell for the eleventh consecutive month to their

slowest pace since November 2010. The National Association of

REALTORS® (NAR) reported that December sales of existing homes

(including single-family homes, townhomes, condominiums, and

cooperatives) slipped 1.5 percent to 4.02 million units (SAAR) from a

pace of 4.08 million in November and were 34 percent lower y/y. For

all of 2022, existing home sales dropped 17.8 percent to 5.03 million

units from 6.12 million in 2021 and the slowest pace since 2014.

Because existing home sales are based on a closing, December sales

reflect contract signings in October and November. Mortgage rates

have trended down since September, and month-to-month (m/m)

house prices have remained the same or declined in the past several

months—all of which should help to improve demand. Inventories

of existing homes are still lean, however. - New construction of single-family homes rose to their highest level

since August. Single-family housing starts increased 11.3 percent to

909,000 units (SAAR) in December from a revised pace of 817,000

units in November but were 25 percent lower y/y. Multifamily

housing starts (5+ units in a structure), at 463,000 units (SAAR),

fell 18.9 percent m/m and were 16.3 percent lower y/y. Note that

m/m changes in multifamily starts are often volatile. Residential

construction employment was up 3.2 percent y/y; residential

construction costs were down 1.2 percent in December but up 6.9

percent y/y. For all of 2022, total construction of new homes reached

1.553 million units, 3.0 percent lower than in 2021 (1.601 million

units and the strongest pace since 2006). New construction of singlefamily homes fell 10.6 percent, while starts on multifamily homes

rose 14.5 percent in 2022. (Sources: HUD, Census Bureau and BLS) - Annual house price appreciation continued to decelerate in

November, with annual gains ranging from 6.8 to 8.2 percent.

The Federal Housing Finance Agency (FHFA) seasonally adjusted

purchase-only house price index for November estimated that home

values were down 0.1 percent m/m and rose 8.2 percent y/y, down

from an annual gain of 9.8 percent in October. The non-seasonally

adjusted CoreLogic Case-Shiller® 20-City Home Price Index, posted

a 0.8 percent m/m decline in home values in November and a

6.8 percent y/y increase, down from an 8.6-percent annual gain in

October. Mortgage financing has become more expensive as the

Federal Reserve raises interest rates, a process that began in April.

The annual growth rate of house prices peaked in the spring of 2022

and may well continue to decelerate. The home price data for both

indices are based on real estate sales contracts signed in September

and October with subsequent closings during November. (Both price

indices are released with a 2-month lag.) - The inventory of homes for sale remained the same for new homes

but fell for existing homes. The listed inventory of new homes for

sale, at 461,000 units at the end of December, was unchanged m/m

but was 18.5 percent higher y/y. That inventory would support 9.0

months of sales at the current sales pace, down from 9.2 months in

November due to an increase in sales. Available existing homes for

sale, at 970,000 units in December, declined 13.4 percent m/m but

were 10.2 percent higher y/y. That inventory represents a 2.9-month

supply, down from 3.3 months in November. The long-term average

for months’ supply of homes on the market is 6.0 months. - The U.S. homeownership rate fell slightly in the fourth quarter.

The national homeownership rate decreased to 65.9 percent in the

fourth quarter of 2022 from 66.0 percent the previous quarter but

was up from 65.5 percent a year ago. The historic norm since 1965

is 65.2 percent. (Source: Census Bureau) - Forbearance on mortgage loans remained the same. The MBA

Forbearance Survey shows the share of homeowners with mortgages

in forbearance was 0.70 percent (351,000 households) in December,

the same as in the previous month, but down from 1.41 percent

(705,000 households) one year ago. The forbearance rate was only

0.25 percent of all home loans in the beginning of March 2020,

before the economic effects of the COVID pandemic began to be felt. - Housing insecurity due to the pandemic remains elevated but

has improved. HUD analysis of the Census Household Pulse Survey

(Week 53: January 4-16, 2022) shows that approximately 11.4

percent, or 5.25 million, renter households were behind on rental

payments, an improvement over 15.1 percent, or 6.96 million,

households one year ago. An estimated 4.6 percent, or 2.13 million,

renter households feared eviction was imminent in the next

two months, down from 7.1 percent or 3.17 million a year ago.

Under Treasury’s Emergency Rental Assistance (ERA) program, an

estimated 2.84 million renters have applied for and received rental

assistance. Approximately 5.57 percent, or 4.59 million, homeowner

households were behind on their mortgage payments in January, an

improvement over 6.66 percent, or 5.50 million in January of 2021.

An estimated 1.12 percent, or 890,000 homeowners, feared

foreclosure was imminent in the next two months. - The 30-year fixed-rate mortgage (FRM) continued to ease, reaching

its lowest level since September. The 30-year FRM reached an

average weekly low in January of 6.13 percent the week ending

January 26, 2023, down from the weekly low in December of 6.27

percent and the lowest average weekly rate since last September

(6.02 percent). The highest average weekly rate during that time

frame was 7.08 percent in October and November. The mortgage

rate was 3.55 percent one year ago. (Source: Freddie Mac)

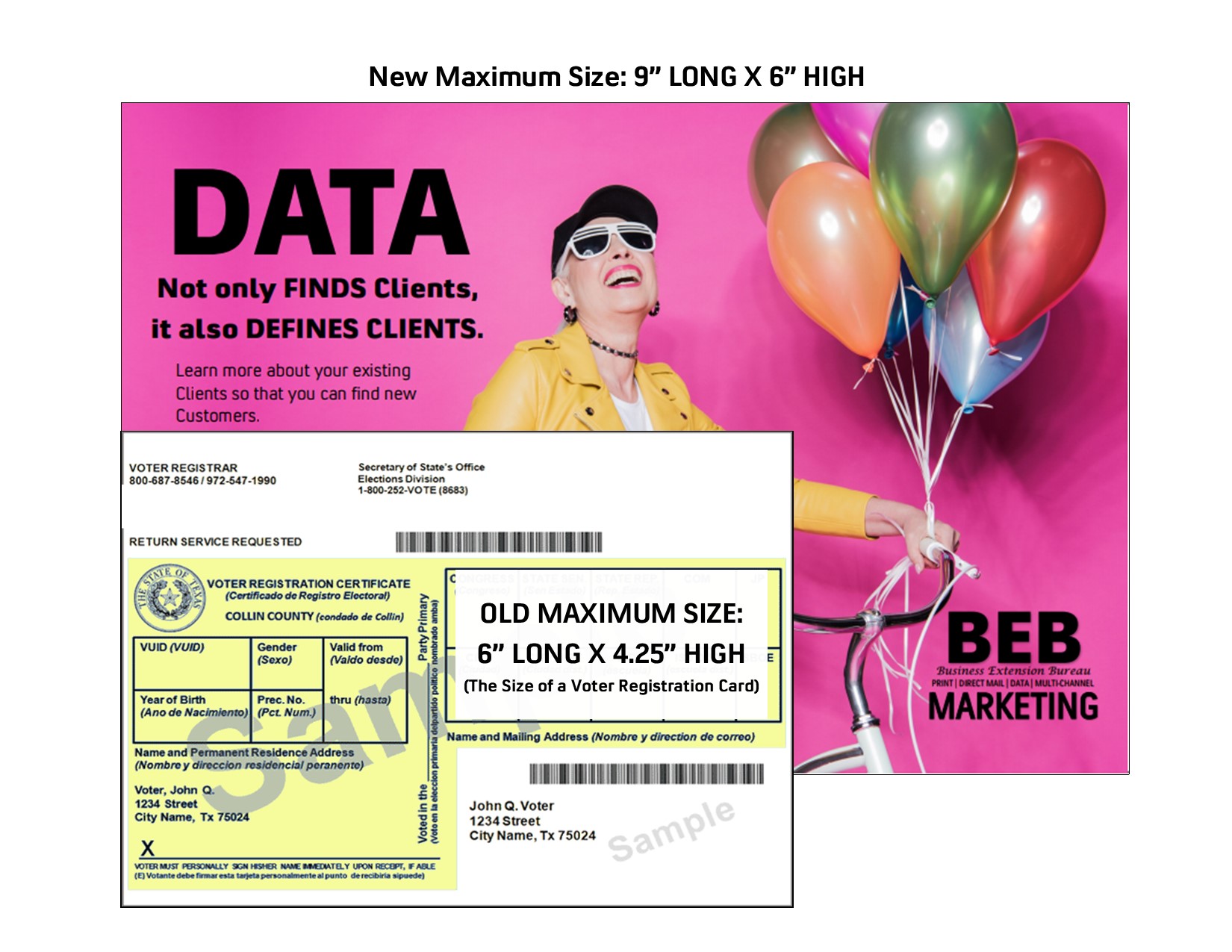

First Class Postcards Just Got Bigger

On July 28, 2021, the Postal Regulatory Commission (PRC) approved increasing the size limit for a Presorted First-Class Mail (FCM) Postcard. The new 9″ by 6″ maximum size card has a slightly different minimum thickness of .009″ compared to the previous maximum size dimensions of 6″ by 4.25″ with a minimum thickness of .007″. (The minimum .007″ thickness still applies to cards less than 6″X9″).

Previous dimension restrictions made it easy for First-Class Postcards to “get lost” in the mailbox as larger pieces pulled away attention, and marketers didn’t have the needed space to sell products or services. The Postal Service argued that the proposed change would make the First-Class Postcards more valuable by creating new opportunities for marketers and nonprofits to take advantage of technologies such as QR codes and variable personalization making them even more effective.

Being able to send larger cards using First-Class Postcards rates will also give mailers faster delivery service circumventing the recent reduction of delivery standards recently implemented.

See the size comparison below:

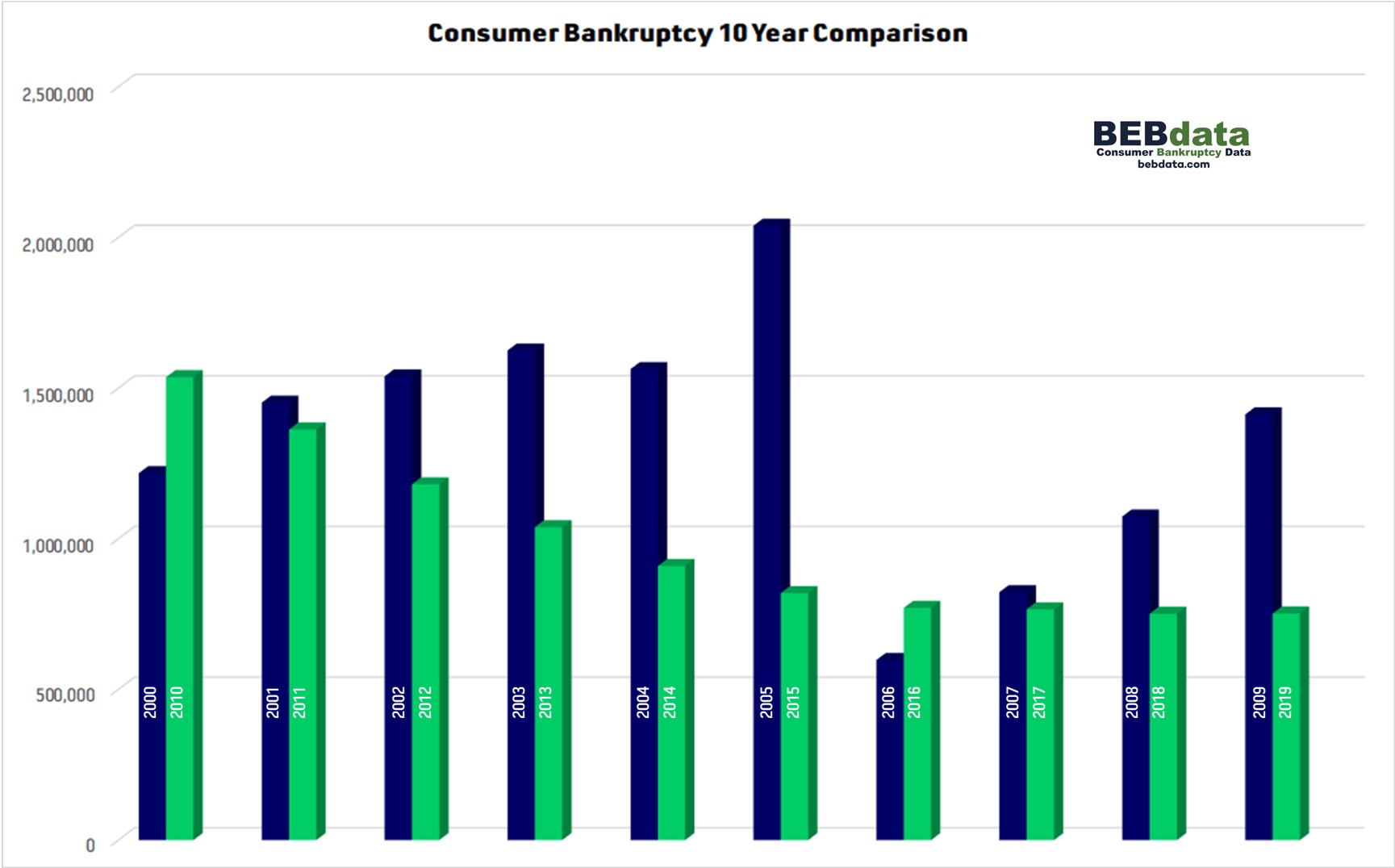

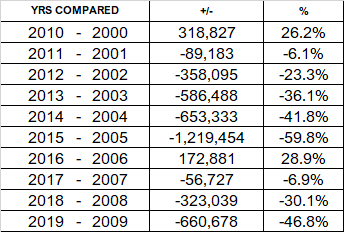

Consumer Bankruptcy 10 yr Comparisons

In 2000, 1.2 million people filed for bankruptcy compared to 1.5 million in 2010. That was a 26.2% increase. The chart above shows comparisons, by year, for a decade. 2001 – 2005 compared to 2011 – 2015 showed significant decreases, up to 59.8% between 2005 and 2015. 2006 compared to 2016 showed a 28.9% increase in filing, then the reduced number of filings trend resumed.

In 2000, 1.2 million people filed for bankruptcy compared to 1.5 million in 2010. That was a 26.2% increase. The chart above shows comparisons, by year, for a decade. 2001 – 2005 compared to 2011 – 2015 showed significant decreases, up to 59.8% between 2005 and 2015. 2006 compared to 2016 showed a 28.9% increase in filing, then the reduced number of filings trend resumed.

Consumer Bankruptcy Filings Slow & Steady Climb

People often associate bankruptcy with unemployment. Bankruptcy is tied to debt levels, not unemployment rates. Bankruptcy does not add money to a bank account or find an individual a job. Bankruptcy is all about debt and unless people have debt, they won’t file for bankruptcy.

Recently, the Federal Reserve Bank of New York reported that, despite unemployment rates increasing to levels not seen since the Great Depression, household debt levels are going down. Q2 credit card balances fell by the largest amount since data began being collected and the number of new credit accounts being opened also fell by a record amount. Also, consumer spending saw a sharp decline due to the pandemic stay-at-home order and ongoing social distancing requirements.

Some industry researchers believe that Chapter 13 filings, which are often submitted by individuals with stable incomes and good prospects for eventually repaying creditors, will likely decrease in favor of Chapter 7 filings that don’t call for borrowers to repay debts in the coming year.

Unlike some predictions of a tidal wave of filings, others believe that consumer bankruptcy filings don’t happen immediately following a life event such as loss of a job. Research shows that most people struggle between 2 – 5 years prior to filing for bankruptcy. As a result, the COVID-19 driven rise in consumer bankruptcy cases likely won’t be seen for months or years to come. If the economy doesn’t recover and unemployment persists, bankruptcy filings will begin to see a slow and steady increase throughout 2021

2025 CAFE Standards

- By 2025, passenger cars and light-duty trucks in the U.S. must meet Corporate Average Fuel Economy (CAFE) fleet standards of 54.5 miles per gallon (MPG).

- Between 2017 and 2025, vehicle manufacturers are required to achieve annual efficiency gains of 5% and 3.5% respectively.

- In a report from the Environmental Protection Agency (EPA), technological innovation remains the primary driver behind vehicle improvements in fuel economy.

The Fast Slow Auto Market

This year, the auto industry will grow 2.0% to $1.299 trillion, the slowest growth rate since at least 2011. Growth will flatten through 2022, according to eMarketer’s latest US retail forecast.

This year, the auto industry will grow 2.0% to $1.299 trillion, the slowest growth rate since at least 2011. Growth will flatten through 2022, according to eMarketer’s latest US retail forecast.

Based on an article by eMarketer, that says that US light vehicle sales have been off to a slow start this year. Cindy Liu, forecasting analyist said that will contribute to the slowdown in the overall US retail market. Auto buyers remain hesitant to purchase new vehicles amid uncertainty surrounding the economy and rising interest rates.

The auto industry represents 23.7% of all US retail sales, making it the largest retail sector. As a result, it has a large impact on the aggregate. eMarketer says that total retail sales in the US will grow 3.0% in 2019 to $5.475 trillion. Because the auto industry represents nearly one-quarter of total US retail, any growth or contraction will have an outsized effect.

32% of Chapter 7 bankruptcies carry student debt

According to a new LendEDU study, 32% of consumers filing for Chapter 7 bankruptcy carry student loan debt. Of that group, student loan debt comprised 49% of their total debt on average.

According to a new LendEDU study, 32% of consumers filing for Chapter 7 bankruptcy carry student loan debt. Of that group, student loan debt comprised 49% of their total debt on average.

As of 2019, student loan debt is at an all-time high with a national total of $1.5 trillion. According to Student Loan Hero, the average student-loan debt per graduating student in 2018 who took out loans was $29,800.

The LendEDU data shows the effects of the growing burden of student loan debt. Coupled with a high cost of living and the fallout of the recession, student loans make it harder for millennials to save and put them financially behind — to the point where they may need to declare bankruptcy to be able to pay them off.

Government Shut Down & BK Courts

On December 22, 2018, the federal funding for certain agencies lapsed, and the United States government entered into a partial shutdown. The U.S. Department of Justice (DOJ), including the United States Trustee Program (USTP), was one of the agencies that shut down. United States Trustees (“UST”) representing the USTP appear and litigate in a multitude of bankruptcy proceedings. USTs also actively participate in out-of-court settlement discussions, plan negotiations, and the like. Pursuant to the partial shutdown, regular operations at the USTP ended, with only “excepted employees” continuing work on limited matters.

USTP excepted employees comprise a total of 35 percent of its employees. Excepted employees work without pay during the shutdown but will receive back pay after the government reopens. Remaining USTP employees who are not excepted are furloughed and will only receive compensation if Congress passes a bill allowing for it.

The contingency plan sets forth changes in the duties of DOJ employees. The contingency plan directs that civil litigation be halted except where the safety of human life or protection of property are at stake. Much of the civil litigation in which the USTP is a party does not involve such issues. The contingency plan further notes that DOJ attorneys should request stays in civil cases and reduce civil litigation staffing only to that necessary to protect human life and property. Several UST and DOJ attorneys involved in bankruptcy litigation have filed motions seeking stays of proceedings and extension of deadlines until the government reopens.

As the USTP continues to operate with its skeletal staff, certain bankruptcy processes will likely encounter delays. Although federal courts have rearranged funds to remain operational through January 18, should the shutdown extend beyond that date, bankruptcy matters such as plan confirmations and other court hearings will encounter similar delays.

Proceedings involving Chapter 7 and 13 trustees, including out-of-court discussions or negotiations, are unlikely to be delayed as these parties receive payments outside of government assistance.