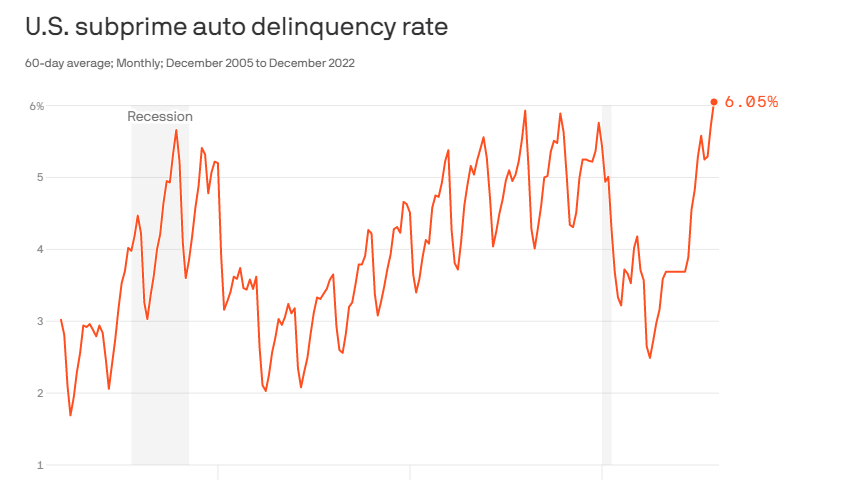

Consumers with low credit scores are falling behind on their car payments a record rate.

Consumers with low credit scores are falling behind on their car payments a record rate.

Even with the strength of the current job market, cash-tight US households are suffering from two years of cost-of-living increases and the end of pandemic-related benefits.

Subprime payments for auto loans that were at least 60 days late rose to more than 6% in December.

According to data from S&P Global, December’s delinquency rate is a record, passing prior peaks just before the pandemic.

Contributing factors include the surge in the cost of living as the Consumer Price Index has jumped more than 14% over the past two years. Also, COVID federal aid to household such as expanded unemployment benefits are no longer.

We also see trends indicating that households are increasing their credit card usage, even though interest rates are hitting record highs.

Resource: Article written by Matt Phillips, author of Axios Markets

Data: S&P Global; Chart: Axios Visuals