Check out our short video that gives The Year in Review! Click here

Tag Archives: Subprime

Subprime Lending Is Back

Great article from Forbes on Subprime Lending. Check it out…

Don’t look now but banks are once again issuing lines of credit to customers with bad credit histories. Read more here

BEBdata Preps for NADA in Orlando

The NADA is the Automotive Industry Event of the Year!

It is the world’s largest international gathering for franchised new-vehicle dealers. This convention offers dealers a rare chance to meet face-to-face with executives of major auto manufacturers and features hundreds of exhibitors showcasing the latest equipment, services and technologies and over 40 workshops with the industry’s best trainers. We’ll be there, will you!? Contact us today! Check out our video promoting the event by clicking onto the link below:

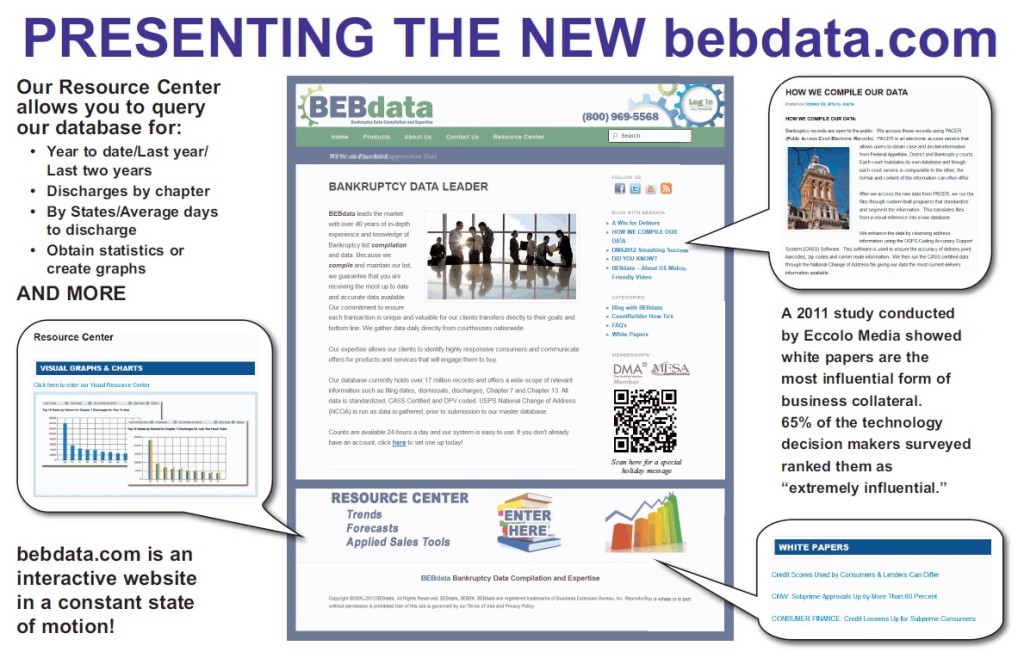

The new bebdata.com

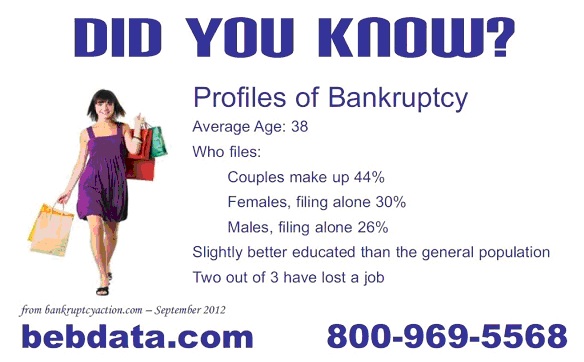

Profiles of Banktruptcy

CFPB Study Finds Credit Scores Can Differ

One Out of Five Consumers Likely to Receive Meaningfully Different Score Than Creditor

One Out of Five Consumers Likely to Receive Meaningfully Different Score Than Creditor

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) released a study comparing credit scores sold to creditors and those sold to consumers. The study found that about one out of five consumers would likely receive a meaningfully different score than would a lender.

“This study highlights the complexities consumers face in the credit scoring market,” said CFPB Director Richard Cordray. “When consumers buy a credit score, they should be aware that a lender may be using a very different score in making a credit decision.”

The complete Analysis of Differences between Consumer and Creditor-Purchased Credit Scores is available at http://files.consumerfinance.gov/f/201209_Analysis_Differences_Consumer_Credit.pdf

Read more here

New Suppression Tool

BEBdata’s new BK Data Suppression Tool

BEBdata is proud to offer a quick, easy and cost effective online BK Data Hygiene tool!

BEBdata is proud to offer a quick, easy and cost effective online BK Data Hygiene tool!

Our BK Data Suppression allows you to identify and eliminate unwanted records, making your campaigns more cost efficient and effective. Upload up to 150,000 records at a time and flag unwanted names within minutes. Call us for more information today!

Credit loosens up for subprime consumers

Excerpts from an article run for WSJ.com

Good news for those with less-than-stellar credit scores below 660: Banks are finally opening the lending spigots to you, too. But banks don’t seem to be returning to the heyday unbridled lending to consumers who couldn’t afford the debt they were taking on. It’s not as easy get. Lenders are making smarter decisions with more strict criteria in opening credit to these consumers than in the past.

Good news for those with less-than-stellar credit scores below 660: Banks are finally opening the lending spigots to you, too. But banks don’t seem to be returning to the heyday unbridled lending to consumers who couldn’t afford the debt they were taking on. It’s not as easy get. Lenders are making smarter decisions with more strict criteria in opening credit to these consumers than in the past.

It will cost you more, too. Good credit always begets good interest rates. Bad or mediocre credit scores will up your interest rates as much as 5 to 10 percentage points, according to some researchers. It seems they are pricing those accounts much higher out of the gate. That’s also tied to the 3-year-old credit card legislation that prohibits card issuers from raising rates for the first year in which the account was open and then doing it only on new purchases.

Subprime Approvals up by 60%

Subprime approvals for both new and used vehicle sales are 62.5% higher than they were one year ago because dealers are finding it easier to place subprime used vehicle paper.

Breaking down its sales predictions, industry expert, CNW thinks franchised dealers will turn 1.33 million used models this month, marketing a 11.7% gain.

Thanks to inventories and supply becoming more stable and improvements in inventory make-up, the firm contends independent dealers are looking at a significant year-over-year used sales gain in September. Expectations are for independent lots moving 1.28 million units, which would translate to into a 9.7% jump from a year ago.