During the start of COVID-19 stay-at-home orders, banks and credit unions began to tighten lending standards, while carmakers increased incentives for prime borrowers.

As traditional institutions such as banks and credit unions, became more selective about who they would loan money to, individuals with lower credit scores used finance companies or buy-here-pay-here car lots for used cars.

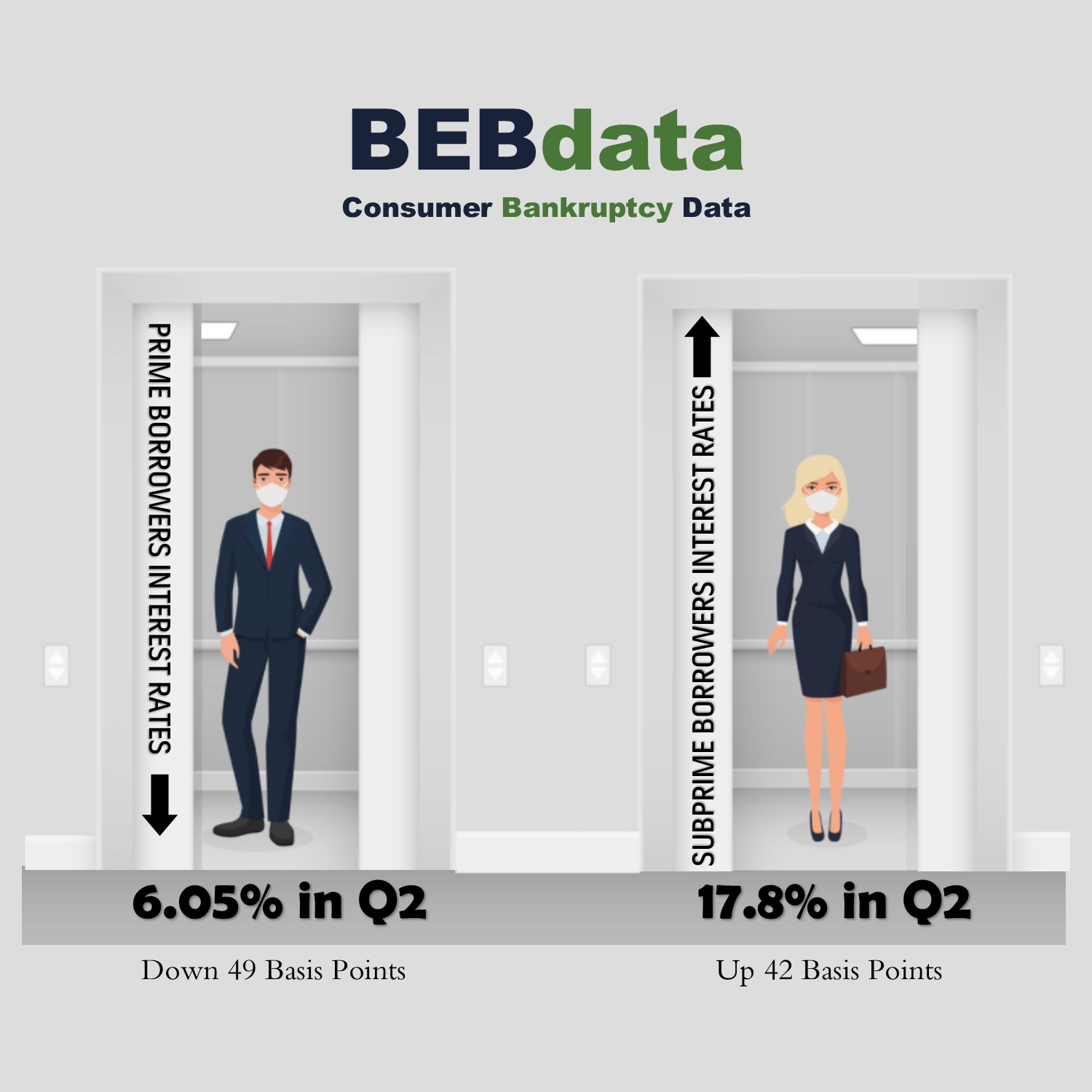

Prime borrowers with FICO scores of 661 to 779, paid an average interest rate of 6.05% in the second quarter on used cars. That’s down 49 basis points from a year earlier. Subprime borrowers, individuals with FICO scores 500 to 600, paid 17.78%, up 42 basis points from a year earlier.

As a result, bank and credit union market shares for used cars dropped sharply during the spring.