Have you scanned this month’s QR Code from your BEB-Business Extension Bureau calendar?

We have a special message for you!

You can also click here to see it!

Have you scanned this month’s QR Code from your BEB-Business Extension Bureau calendar?

We have a special message for you!

You can also click here to see it!

PLEASE NOTE: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications.

PLEASE NOTE: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications.

BEBdata leads the market with over 40 years of in-depth experience and knowledge of Bankruptcy list compilation and bankruptcy data. Because we compile and maintain our Bankruptcy list, we guarantee that you are receiving the most up to date and accurate bankruptcy data available.

BEBdata

4802 Travis Street

Houston, TX 77002

(800) 969-5568

Fueled by a record high level of borrowing for car purchases, Americans probably bought about 1.4 million motor vehicles this month, pushing sales up more than 10 percent from July 2013. By most forecasts this will be the best July on record since 2006, more than a year before the start of the Great Recession that sent the auto industry into a crisis.

Fueled by a record high level of borrowing for car purchases, Americans probably bought about 1.4 million motor vehicles this month, pushing sales up more than 10 percent from July 2013. By most forecasts this will be the best July on record since 2006, more than a year before the start of the Great Recession that sent the auto industry into a crisis.

Read more from this International Business Times article by pressing here.

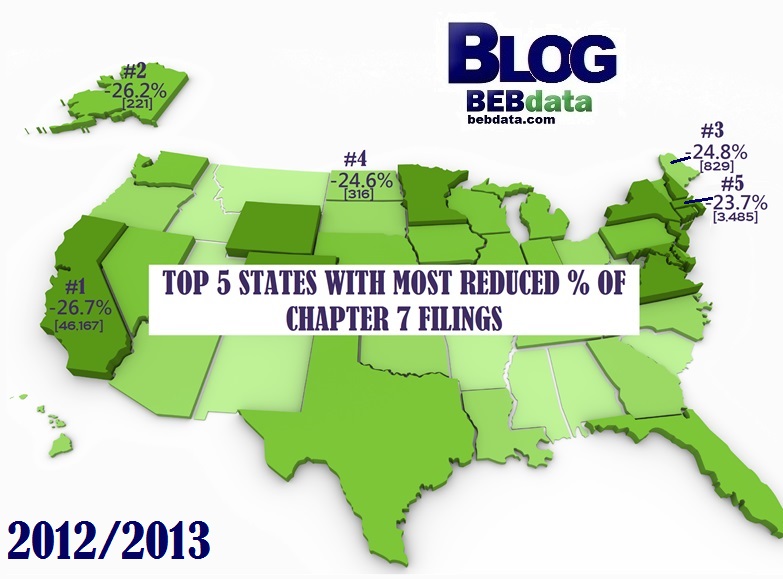

In the first half of 2014, there were 310,210 Chapter 7 Discharges. This reflects a 35% decline in Chapter 7 Discharges compared to the first half of 2012 which totaled 477,367.

PLEASE NOTE: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications.

Today, people are able to buy new cars even with a credit score lower than 500. A year ago that would have been very difficult to pull off. Dealerships all over the country are offering deals for high credit risk buyers as long as they have a good job, current utility bills that are in good standing, and some money for a down payment.

Today, people are able to buy new cars even with a credit score lower than 500. A year ago that would have been very difficult to pull off. Dealerships all over the country are offering deals for high credit risk buyers as long as they have a good job, current utility bills that are in good standing, and some money for a down payment.

The market for subprime borrowing is hot and this time the car business is leading the way. The central bank’s stimulus is making it easier for people with spotty credit to buy cars as investors purchase riskier bonds linked to auto loans. Below are some interesting facts surrounding subprime lending:

*Synopsis of an article published by The Toledo Blade at http://www.toledoblade.com/Automotive/2013/11/12/Subprime-borrowing-gains-traction-in-the-auto-industry.html

BEBdata would like to wish you and yours a safe and happy holiday!

Click here for our fun tribute video – Happy Birthday America!

Have you scanned this month’s QR Code from your BEB-Business Extension Bureau calendar?

We have a special message for you!

You can also click here to see it!

Have you scanned this month’s QR Code from your interactive calendar?!

We have a special message for you!

You can also click here to see it!