Around 530,000 bankruptcy cases are filed every year due to inability to pay medical expenses.

Around 530,000 bankruptcy cases are filed every year due to inability to pay medical expenses.

54% of Americans with medical debt, have no other debt.

On January 7th, Senator Elizabeth Warren unveiled a plan to reform the consumer bankruptcy system. The plan provides for one chapter that everyone files, combined with a menu of options to respond to each individual’s particular needs. It also undoes some of the amendments that came with the 2005 bankruptcy law, including the means test. The bankruptcy means test determines who can file for debt forgiveness through Chapter 7 bankruptcy. It considers income, expenses and family size to determine whether one has enough disposable income to repay debts. In doing so, it sets new rules for the discharge of student loan debt, modification of home mortgages, and keeping cars.

The plan also tackles bad behavior that some big banks and corporations currently engage in once people file, like trying to collect already discharged debt and requires additional data collection including debtors’ age, gender, and race.

During the start of COVID-19 stay-at-home orders, banks and credit unions began to tighten lending standards, while carmakers increased incentives for prime borrowers.

As traditional institutions such as banks and credit unions, became more selective about who they would loan money to, individuals with lower credit scores used finance companies or buy-here-pay-here car lots for used cars.

Prime borrowers with FICO scores of 661 to 779, paid an average interest rate of 6.05% in the second quarter on used cars. That’s down 49 basis points from a year earlier. Subprime borrowers, individuals with FICO scores 500 to 600, paid 17.78%, up 42 basis points from a year earlier.

As a result, bank and credit union market shares for used cars dropped sharply during the spring.

On average, used car prices rose year over year by 2.4% from 2016 through 2019. Then the came the Corona Virus. U.S. factories shut down less than a week after COVID-19 was declared a pandemic on March 11, and slowly began reopening in June. As supplies of new cars fell, buyers were pushed into the used car market.

Based on Kelley Blue Book and CarMax numbers, the average cost of a used car today is $22,000. That’s up 17% from 2016. The growing crowd of used car buyers drove up prices.

As manufacturing plants continue to open and replete the inventory of new cars, this trend should begin to retract. But one thing we have learned in the year of 2020 – nothing is normal or as expected.

People often associate bankruptcy with unemployment. Bankruptcy is tied to debt levels, not unemployment rates. Bankruptcy does not add money to a bank account or find an individual a job. Bankruptcy is all about debt and unless people have debt, they won’t file for bankruptcy.

Recently, the Federal Reserve Bank of New York reported that, despite unemployment rates increasing to levels not seen since the Great Depression, household debt levels are going down. Q2 credit card balances fell by the largest amount since data began being collected and the number of new credit accounts being opened also fell by a record amount. Also, consumer spending saw a sharp decline due to the pandemic stay-at-home order and ongoing social distancing requirements.

Some industry researchers believe that Chapter 13 filings, which are often submitted by individuals with stable incomes and good prospects for eventually repaying creditors, will likely decrease in favor of Chapter 7 filings that don’t call for borrowers to repay debts in the coming year.

Unlike some predictions of a tidal wave of filings, others believe that consumer bankruptcy filings don’t happen immediately following a life event such as loss of a job. Research shows that most people struggle between 2 – 5 years prior to filing for bankruptcy. As a result, the COVID-19 driven rise in consumer bankruptcy cases likely won’t be seen for months or years to come. If the economy doesn’t recover and unemployment persists, bankruptcy filings will begin to see a slow and steady increase throughout 2021

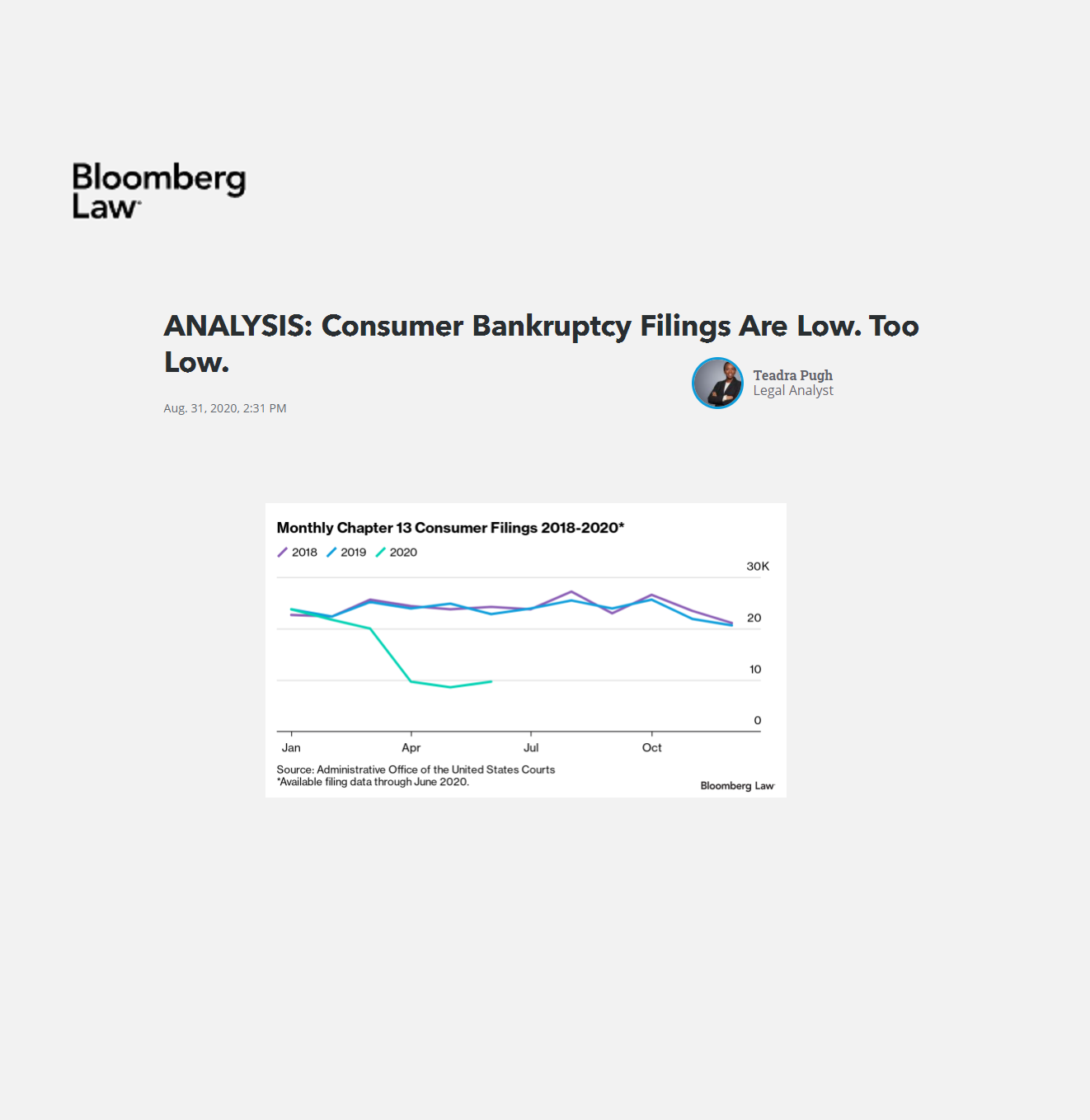

So far, a surge of personal bankruptcies has been avoided during 2020 and to date, bankruptcy filings are trailing last year’s numbers.

Even though the federal stimulus payments and other government programs most likely have a lot to do with 2020’s decline in consumer bankruptcies, it could also be attributed to people borrowing less. However, consumer bankruptcies are likely to rise if unemployment and income loss continue.

Some industry experts forecast a “tidal wave” of filings starting in the fourth quarter of 2020 and gaining momentum after the first of 2021.

Mortgage forbearance nearing its end could also be the start of a significant bankruptcy filing surge. You remember that part of the CARES Act allowed homeowners with federally backed mortgages to stop making payments for periods of six months, with a possible extension of six additional months. Starting as soon as October 1, affected homeowners will not only have to resume payment, but banks could demand immediate make up of all missed payments.

Depending on how lenders work with those who exercised the deferral, a wave of Chapter 13 bankruptcies could begin. Chapter 13 allows debtors to set up a repayment plan usually allowing three to five years to catch up on payments.

Bankruptcy booms have happened in the past but it’s unlikely that even Covid-19 could produce anything like the historical peak of filings in 2005. In October of 2005, a new law, the Bankruptcy Abuse Prevention and Consumer Protection Act, went into effect. Because it was seen as less favorable to borrowers, people rushed to court before the law’s effective date resulting in a short-term surge of filings. Soon after, filings dropped (significantly) and stayed low until the housing bubble began to collapse in 2007. The next peak was seen in 2010 as foreclosures skyrocketed.

In any case, looking for trends in this unprecedented time may be futile, as nothing is normal during the “new norm”. We will continue to keep you abreast of current trends as they unfold and share industry analysis and forecasts through our weekly blog.

Read, “Analysis: Consumer Bankruptcy Filings Are Low. Too Low” here.

This is an excellent update on Consumer Bankruptcy filings by Teadra Pugh for Bloomberg Law.

A recent UBS report says that housing prices in areas where the economies depend on leisure and hospitality will be under greater pressure than other areas. The report mentions Las Vegas, Miami and Orlando, which were some of the more disastrous markets during the subprime crisis.

A recent UBS report says that housing prices in areas where the economies depend on leisure and hospitality will be under greater pressure than other areas. The report mentions Las Vegas, Miami and Orlando, which were some of the more disastrous markets during the subprime crisis.

Home prices were hot at the start of 2020. As we muster through the pandemic, gains in values will likely slow. However, prices are not expected to fall nationally. There is a severe shortage of homes for sale which is unlike the subprime mortgage crisis. Home values fell as much as 50% in some markets 10-years back. Now, the supply-demand imbalance favors stronger prices.

Although numbers are still rising compared to 2019, (in the first two weeks of March, new listings were up 5% annually on average), slower gains are indicative to the current market, (the second week of April, new listing were down 47%). There has also been a slowdown in asking prices. In early March, median list prices were, on-average, up by 4.4%. The first half of April reported the slowest growth in seven years with an increase of just under 1%.