Category Archives: Blog with BEBdata

December 2017 QR Code

It’s the last QR Code of 2017! But no fear, our 2018 calendars are in the works. In the meantime, scan our last 2017 QR Code for a fun 1-minute video!

You can also check it out here.

HH Debt Climbs to $13T

Happy Thanksgiving

From all of us at BEBdata, we wish you and your family and loved ones a very happy and safe Thanksgiving Holiday.

From all of us at BEBdata, we wish you and your family and loved ones a very happy and safe Thanksgiving Holiday.

Our offices will be closed from Thursday, November 23 and Friday, November 24th in observance of the holiday. We will re-open on Monday, November 27, 2017.

As always, our count or order system will be available 24/hours – 7/days a week.

Thank you for your business and partnership.

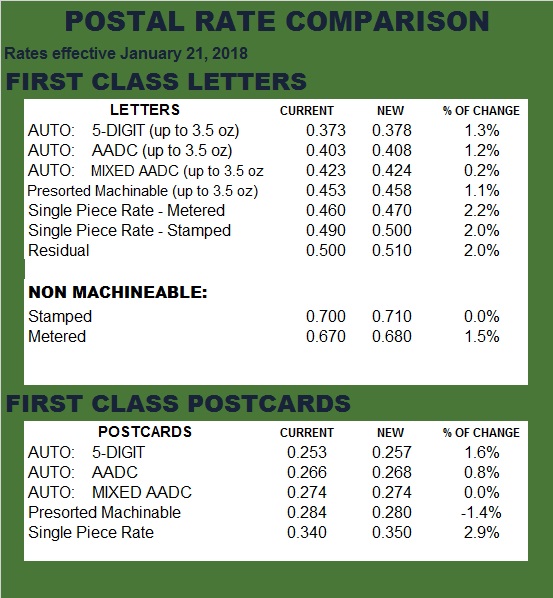

USPS Rate Comparison 2017 – 2018

In an order issued on November 9th, the Postal Regulatory Commission(PRC) approved the Postal Service’s proposed prices for market-dominant products. In its 63-page decision, the PRC found that the proposed rates do not violate the price cap and that the workshare discounts meet statutory requirements; proposed classification changes also were approved.

Earlier the commission also approved USPS price changes for competitive products.

As a result, the price changes announced last month by the USPS will be implemented as planned on January 21, 2018. Below is a price comparison chart for Marketing Mail Rates. For a downloadable PDF of the January Marketing Mail Rates, click here.

To Our Veterans – Thank You

Auto Loans Reach $1.21 Trillion

Business Insider reports that Auto Loans surged to $1.21 Trillion during the 3rd Quarter of 2017.

Business Insider reports that Auto Loans surged to $1.21 Trillion during the 3rd Quarter of 2017.

November 2017 QR Code

Be sure to scan the November QR Code in your BEB Calendar this month!

You can also check it out here!