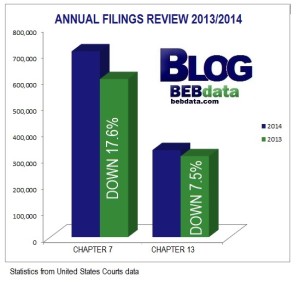

During the 12-month period ending December 31, 2014, 936,795 cases were filed in federal bankruptcy courts, down from the 1,071,932 bankruptcy cases filed in calendar year 2013—a 12.6 percent drop in filings.

During the 12-month period ending December 31, 2014, 936,795 cases were filed in federal bankruptcy courts, down from the 1,071,932 bankruptcy cases filed in calendar year 2013—a 12.6 percent drop in filings.

Tag Archives: Chapter 13 Filings

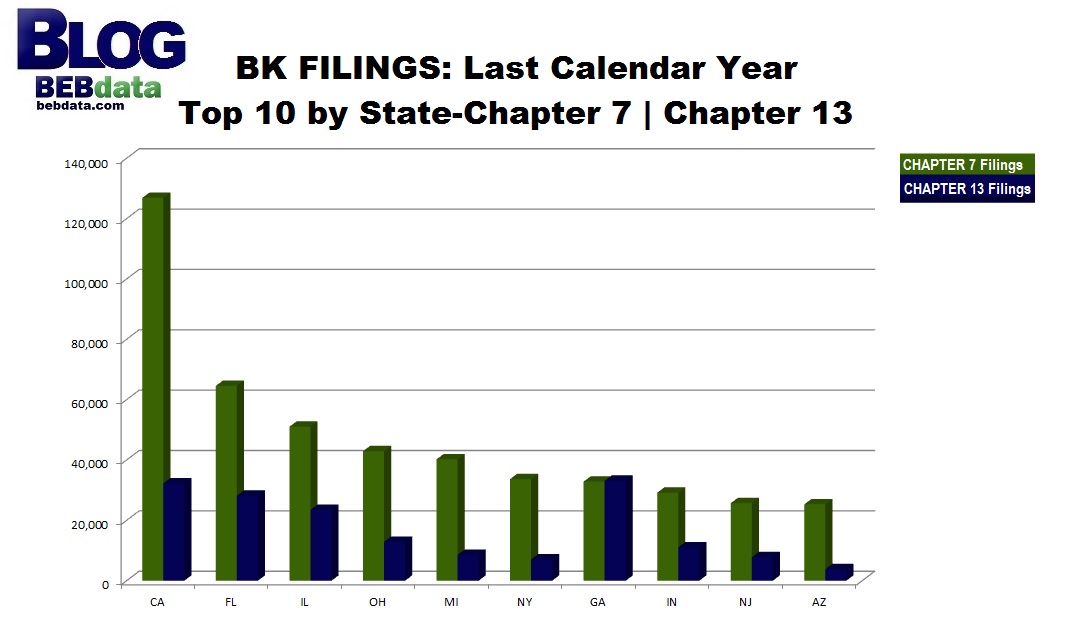

BK FILINGS: Calendar Year Top 10 Ch 7 |13

New Model Gives Indie Dealers Greater Leverage

One of the biggest problems independent auto dealers have is getting financing to run their credit operations. Now, a Milwaukee-area entrepreneur with a long auto sales pedigree has come up with a way to help dealers raise more money, and lower their financing costs while allowing a new group of investors to get into the auto finance business.

Read more from this great article by George Yacik by clicking here.

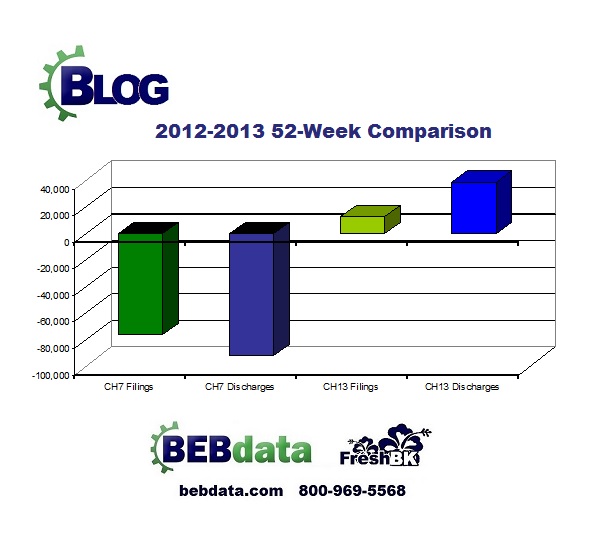

2013 – 2012 Bankruptcy Trends

Comparing 2012 to 2013 BK Filings & Discharges, our data shows that Chapter 7 Filings were down by 10.2% with almost 76,000 fewer filings in 2013. Chapter 7 discharges dropped by over 90,000 representing an 11.5% decrease from 2012.

Comparing 2012 to 2013 BK Filings & Discharges, our data shows that Chapter 7 Filings were down by 10.2% with almost 76,000 fewer filings in 2013. Chapter 7 discharges dropped by over 90,000 representing an 11.5% decrease from 2012.

Chapter 13 filings increased by over 13,000 to show an almost 5% increase (4.6%) while Chapter 13 discharges increased by 36.8% with 39,000 more in 2013.

Please note: Our data is based on one per household, minus multiple filers and has been cleansed to postal specifications

The new bebdata.com

Social Security Income and Banktruptcy

In October, the U.S. Court of Appeals, Tenth Circuit upheld the district court when it concluded that social security income should not be included in the calculation of projected disposable income for people filing for Chapter 13 bankruptcy.

In October, the U.S. Court of Appeals, Tenth Circuit upheld the district court when it concluded that social security income should not be included in the calculation of projected disposable income for people filing for Chapter 13 bankruptcy.

It was noted that “projected disposable income” is defined as “current monthly income” minus the amount needed for the debtor’s support in section 1325(b).

This gives people who are receiving social security the option to file for bankruptcy if they need to, without having to include the social security in their projected disposable income.

The second argument was over whether this exclusion would be in ‘bad faith’ or ‘good faith.’

The court stated, “When a Chapter 13 debtor calculates his repayment plan payments exactly as the Bankruptcy Code and Social Security Act allow him to, and thereby excludes SSI, that exclusion cannot constitute a lack of good faith.”

Several other circuits have the same issue pending and this decision may play an influential role.

Written by: Mary Ann Pekara of Total Bankruptcy