Wishing you a very safe and happy Halloween from all of us at BEBdata!

Tag Archives: consumer bankruptcy data

BK Reform

On January 7th, Senator Elizabeth Warren unveiled a plan to reform the consumer bankruptcy system. The plan provides for one chapter that everyone files, combined with a menu of options to respond to each individual’s particular needs. It also undoes some of the amendments that came with the 2005 bankruptcy law, including the means test. The bankruptcy means test determines who can file for debt forgiveness through Chapter 7 bankruptcy. It considers income, expenses and family size to determine whether one has enough disposable income to repay debts. In doing so, it sets new rules for the discharge of student loan debt, modification of home mortgages, and keeping cars.

The plan also tackles bad behavior that some big banks and corporations currently engage in once people file, like trying to collect already discharged debt and requires additional data collection including debtors’ age, gender, and race.

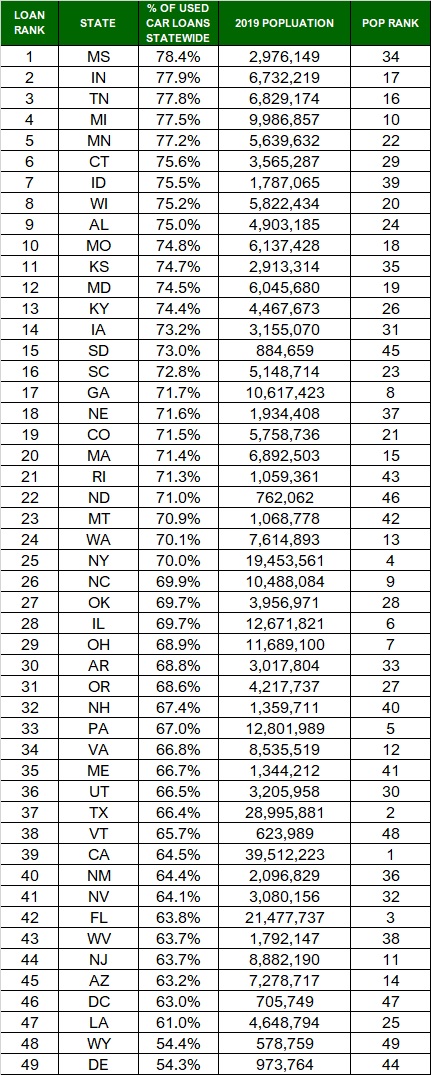

Top 10 States With Largest % of Used Car Loans

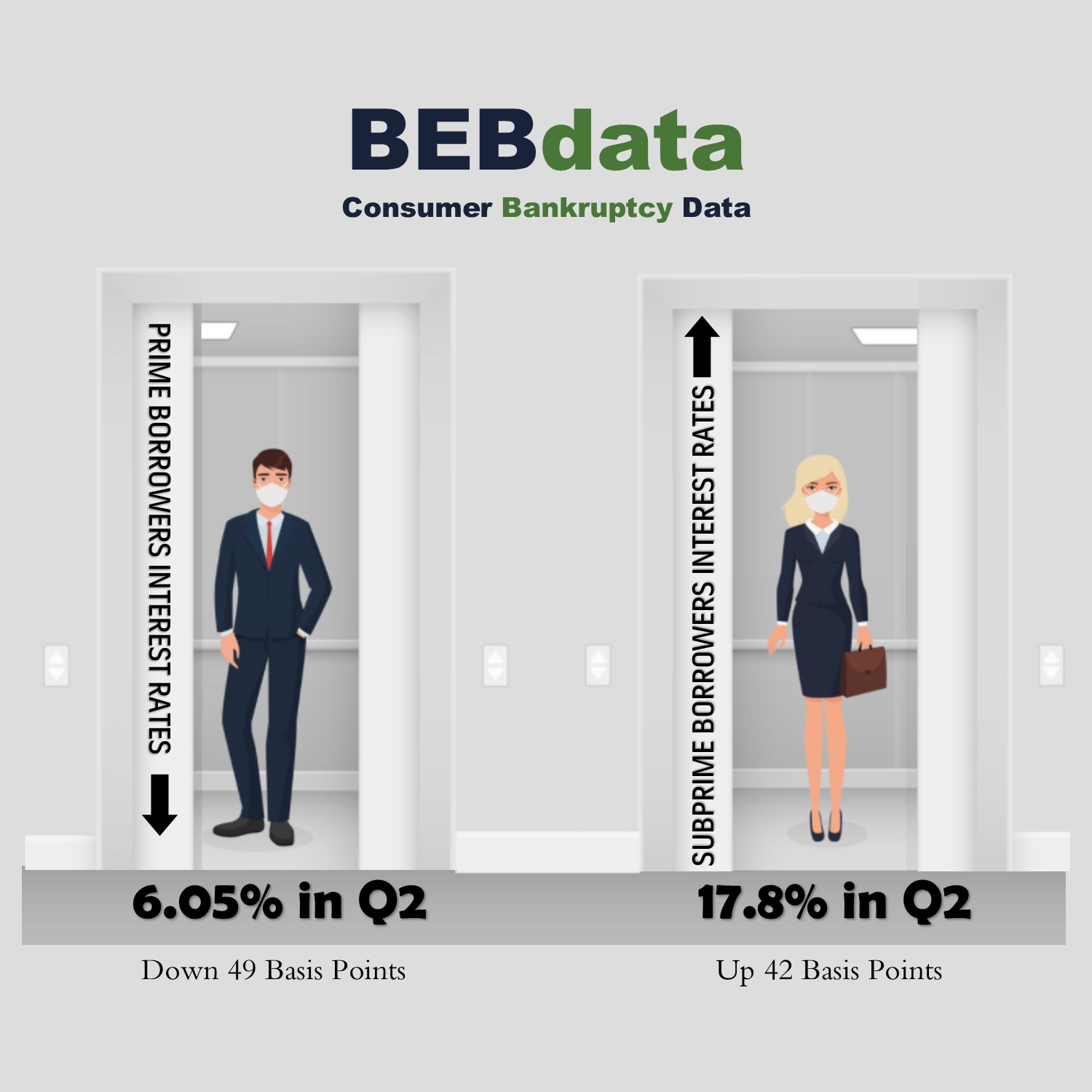

Used Car Interest Rates

During the start of COVID-19 stay-at-home orders, banks and credit unions began to tighten lending standards, while carmakers increased incentives for prime borrowers.

As traditional institutions such as banks and credit unions, became more selective about who they would loan money to, individuals with lower credit scores used finance companies or buy-here-pay-here car lots for used cars.

Prime borrowers with FICO scores of 661 to 779, paid an average interest rate of 6.05% in the second quarter on used cars. That’s down 49 basis points from a year earlier. Subprime borrowers, individuals with FICO scores 500 to 600, paid 17.78%, up 42 basis points from a year earlier.

As a result, bank and credit union market shares for used cars dropped sharply during the spring.

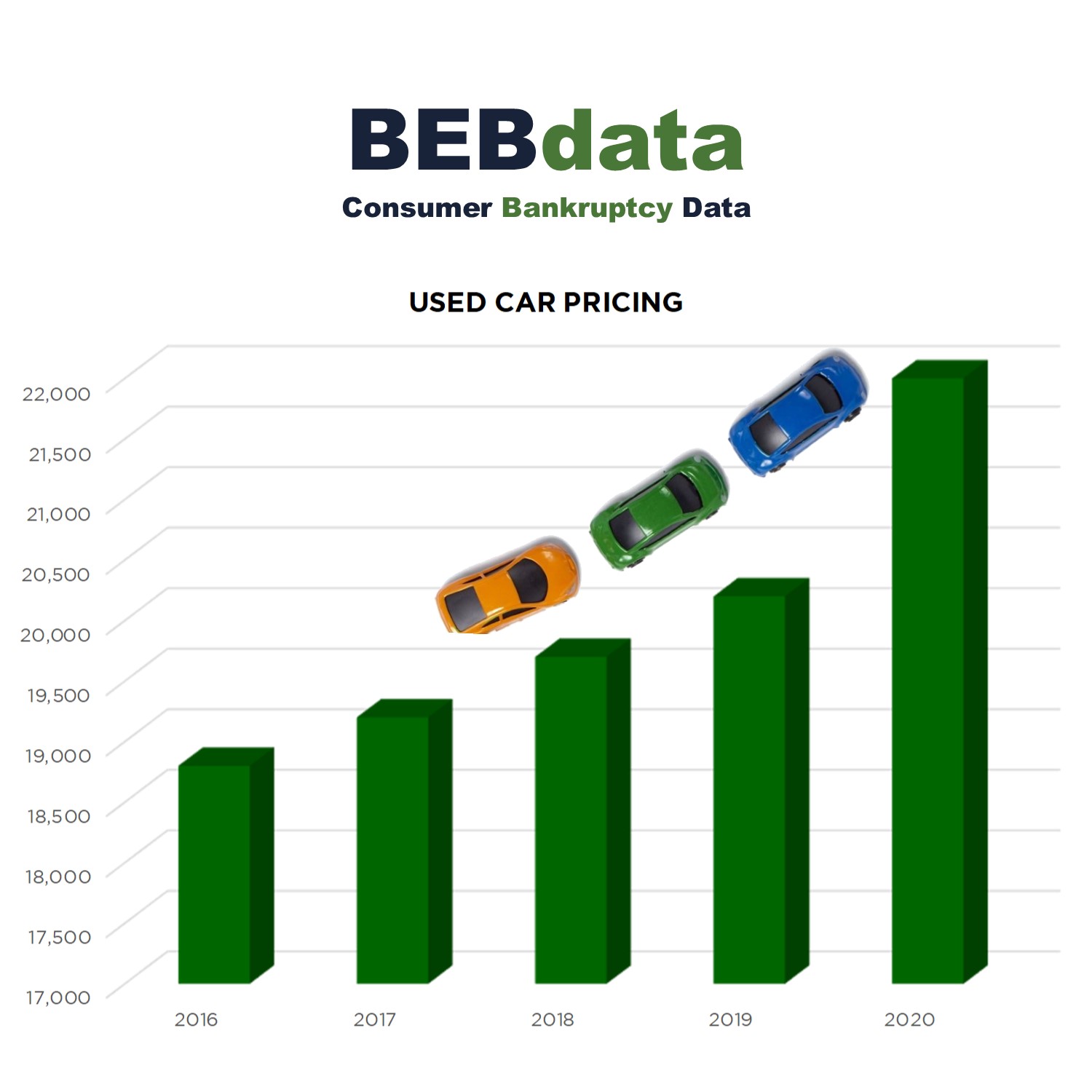

Used Car Prices on the Rise

On average, used car prices rose year over year by 2.4% from 2016 through 2019. Then the came the Corona Virus. U.S. factories shut down less than a week after COVID-19 was declared a pandemic on March 11, and slowly began reopening in June. As supplies of new cars fell, buyers were pushed into the used car market.

Based on Kelley Blue Book and CarMax numbers, the average cost of a used car today is $22,000. That’s up 17% from 2016. The growing crowd of used car buyers drove up prices.

As manufacturing plants continue to open and replete the inventory of new cars, this trend should begin to retract. But one thing we have learned in the year of 2020 – nothing is normal or as expected.

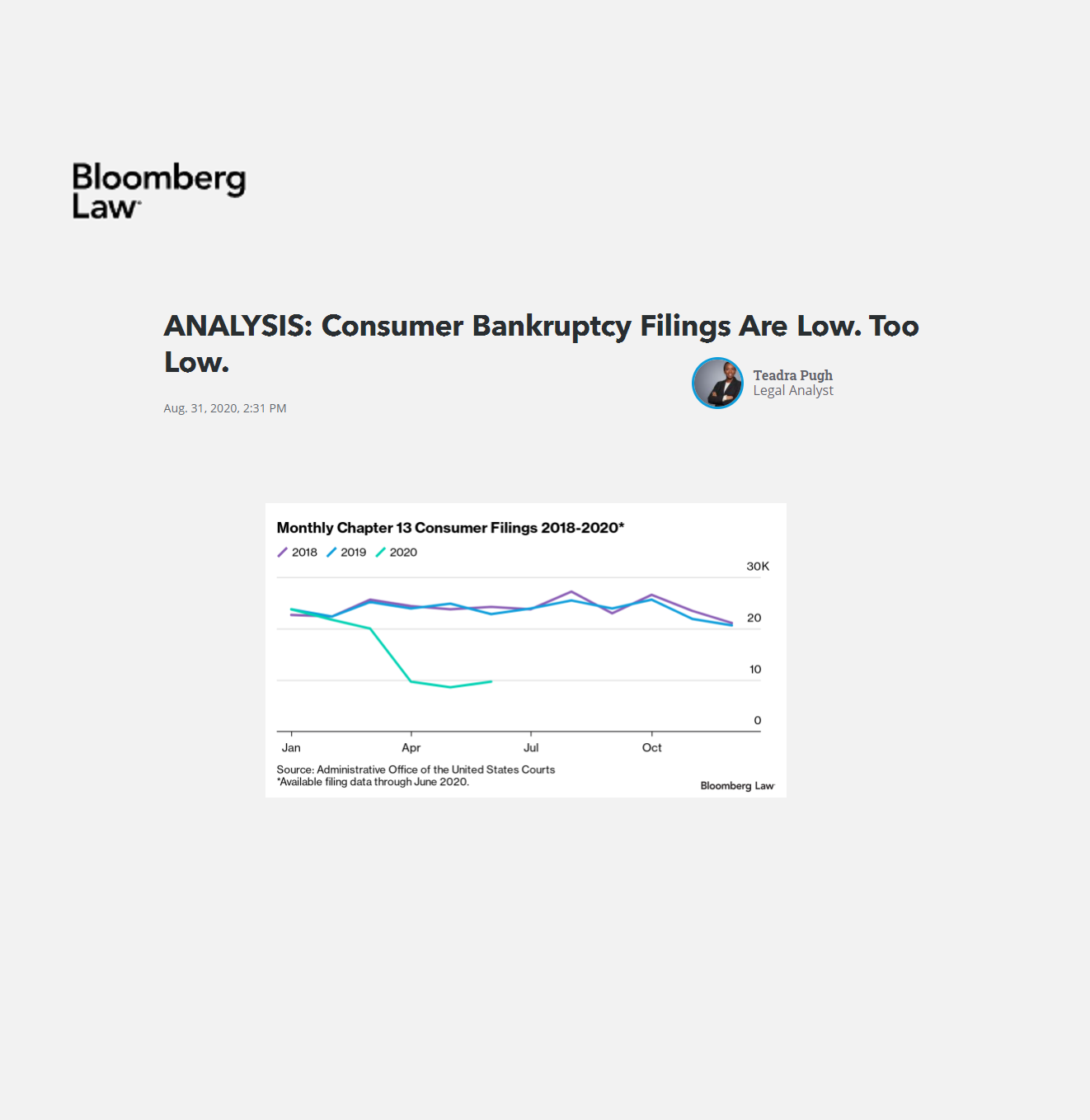

Consumer Bankruptcy Filings Are Too Low…

Read, “Analysis: Consumer Bankruptcy Filings Are Low. Too Low” here.

This is an excellent update on Consumer Bankruptcy filings by Teadra Pugh for Bloomberg Law.

Consumer Debt Going Up

U.S. consumer debt grew in February by the most in seven months with a rise in non-revolving loans, prior to the coronavirus pandemic.

U.S. consumer debt grew in February by the most in seven months with a rise in non-revolving loans, prior to the coronavirus pandemic.

Federal Reserve figures showed a $22.3 billion increase in total credit from the prior month. Non-revolving debt, which includes auto and school loans, rose by $18.1 billion — the most since 2015 — while revolving or credit-card debt was up $4.2 billion.

The pandemic has quickly spawned financial hardships for many in the US. Uncertain incomes means that consumers are likely to begin to cut back on purchases and borrow less.

Household credit has been expanding over the past few years at about the same pace as it was prior to the 2007-2009 recession.

Nearly 40 Percent of Americans Plan to Use Stimulus to Pay Debt

720 System Strategies surveyed more than 80,000 students in their credit-score improvement program, many of whom lost thousands of income dollars due to the Corona-virus. 34.95 percent plan to spend their one-time stimulus check and twelve-week unemployment benefits on paying down debt.

In a recent Yahoo! Finance blog, CEO and Founder of 720 System Strategies, Philip Tirone is predicting that the number of 2020 Consumer Bankruptcies will skyrocket past the 2010 high of 1.5 million.

Bankruptcies on the Rise

For the first time in a decade, bankruptcy filings are on the rise. Get more details from a Bloomberg blog called; “Bankruptcy Filings are Tiptoeing Higher. What’s Next?” Click here for the complete blog.

2020 Auto Trends – Download upgrades to your car

Automakers must invest in upgrades to the digital platforms within new cars. Earlier this year, BMW introduced a wireless service for some of its models. Just like regular software updates, the new service keeps the operating system up-to-date with the latest version.

This new service includes an intelligent personal assistant that can be expanded automatically and OTA (Over The Air).

Some other manufacturers also offer wireless OTA software updates that include Tesla, Audi, Volvo, and Ford. Most have updates that are focused on non-critical infotainment features or offed new applications and functions for the infotainment system.