In an era of data-driven marketing, leveraging consumer bankruptcy data can give businesses a competitive advantage. By understanding consumer behavior, identifying targeted segments, and creating personalized offerings, companies can enhance their marketing campaigns and achieve higher conversion rates. Moreover, utilizing bankruptcy data helps businesses mitigate risk, engage customers on a deeper level, and continually improve their strategies. Embracing this valuable resource can unlock new opportunities and ensure long-term success in an ever-changing marketplace.

In an era of data-driven marketing, leveraging consumer bankruptcy data can give businesses a competitive advantage. By understanding consumer behavior, identifying targeted segments, and creating personalized offerings, companies can enhance their marketing campaigns and achieve higher conversion rates. Moreover, utilizing bankruptcy data helps businesses mitigate risk, engage customers on a deeper level, and continually improve their strategies. Embracing this valuable resource can unlock new opportunities and ensure long-term success in an ever-changing marketplace.

Tag Archives: BEBdata

Is There A Credit Crisis on the Horizon?

It’s interesting to see the resilience of the US economy during the first half of the year, especially considering the expectations of economists who anticipated a recession. The second half of the year however, may present some challenges. Federal Reserve policymakers are indicating their intention to continue implementing interest rate hikes, which might introduce some volatility.

It’s interesting to see the resilience of the US economy during the first half of the year, especially considering the expectations of economists who anticipated a recession. The second half of the year however, may present some challenges. Federal Reserve policymakers are indicating their intention to continue implementing interest rate hikes, which might introduce some volatility.

Although inflation rates are gradually declining, price pressures persist, and the Fed has suggested that benchmark interest rates will remain elevated for a longer period. Banks are likely to continue tightening lending standards in the coming months, making it more challenging and costly for households, to secure funding.

Consumer debt delinquencies have risen across various categories. It’s crucial to consider these trends in the broader context of credit conditions.

Many analysts no longer predict an imminent recession. Growth prospects have slowed, and persistent inflation is eroding purchasing power, particularly for less affluent consumers who are relying on credit card debt. Households are depleting the cash reserves they accumulated during the pandemic, which will have an impact on corporate growth prospects.

Overall, while the economy is not on the brink of a recession, slower growth and economic challenges lie ahead, driven by factors such as inflation, tight lending standards, and rising consumer debt.

INTEREST RATES WEIGH HEAVY ON DEALERS

As Inventory Concerns Begin to Fade, Economic Uncertainty and High Interest Rates Take Center Stage for U.S. Automobile Dealers

Latest Cox Automotive Dealer Sentiment Index shows inflation, interest rates, and the economy continue to weigh on dealers and hold back their business.

Read more here…https://www.coxautoinc.com/news/q2-2023-cadsi/

BEBdata at NADA 2024

CAR SALES AND INTEREST RATES

It’s true that interest rates have been a challenge in the auto market lately. With rates steadily increasing and loans becoming more difficult to obtain, car buyers have faced obstacles in financing their purchases. On average, term lengths for car loans have been reaching 72 months, while rates for new and used cars are around 7% and 10.5% respectively.

Despite these challenges, auto sales have been surprisingly robust, which is encouraging. It seems that even with higher rates, customers have been finding ways to make their purchases work. It’s worth noting that the Federal Reserve has indicated a possible shift in their approach to rising costs. They may pause or even reverse their series of rate hikes, which could stabilize rates in the latter half of this year and potentially lead to a decrease in 2024.

AUTO MARKETING READY TO RISE

The Car Sales Industry in 2022 increased focus on branding and EV marketing. That combined with anticipated improvements in production this year, is looks like auto marketing is poised for growth in 2023. Experts predict that the automotive category will experience an increase in marketing spending for the first time in a few years.

Notably, commercials promoting EVs made up 24% of auto makers’ TV spending in 2022, up from 13.8% in 2021, indicating a greater emphasis on promoting electric vehicles. Kia, for example, continued its marketing spend in support of future demand, recognizing the ongoing transformation to EVs. They even utilized the Super Bowl to introduce their EV6, not for immediate high sales volume, but to establish themselves as a legitimate EV brand and generate interest in their forthcoming models like the EV9.

However, not all brands are adopting the same approach. Ford CEO Jim Farley, for instance, expressed skepticism about spending on traditional marketing, advocating for customer incentives and vehicle updates instead. Nevertheless, the focus on EVs has become more prominent, as automakers shift their advertising efforts towards vehicles that they want consumers to be aware of, given the decreased need for sales incentives.

Overall, with the importance placed on branding, the rise of EVs, and an anticipated rebound in production, the outlook for auto marketing in 2023 appears promising.

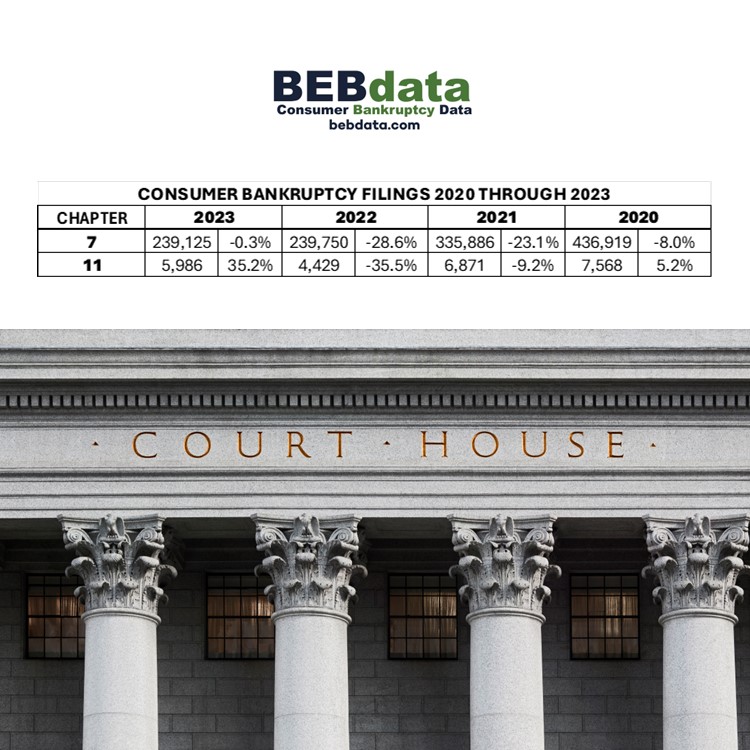

CONSUMER BK RISES 9.8%

Personal and business bankruptcy filings rose 10 percent in the twelve-month period ending June 30, 2023, compared with the previous year.

Business filings rose 23.3 percent, from 12,748 to 15,724 in the year ending June 30, 2023. Non-business bankruptcy filings rose 9.5 percent to 403,000, compared with 367,886 in the previous year.

MARKETING MAIL RATE COMPARISON CHART

Click below to see a chart showing Jan 2023 Marketing Mail rates compared to the upcoming July 9 rate change.

FIRST CLASS RATE COMPARISON CHART

Below to review a chart of First-Class mail rates from Jan 2023 compared to the July 9th rate request.

Proposed July 9 Postal Rates

The USPS has recently filed for a second postal rate increase to take place on July 9th. Click below to see a proposed rate chart.

The USPS has recently filed for a second postal rate increase to take place on July 9th. Click below to see a proposed rate chart.