Tag Archives: BK data

Report: Distressed private student loan borrowers driven into default

Interesting article from Central Valley Business Times on Student Loan borrowers.

Interesting article from Central Valley Business Times on Student Loan borrowers.

Struggling private student loan borrowers describe being driven into default with very little information or help when they get in trouble, no affordable loan modification options available, and alternatives to default that are temporary at best, read more here.

CPO Market Reaches Best Quarter Results

Joe Overby of Auto Remarketing shared that Certified Pre-Owned (CPO) vehicle sales climbed nearly 20% year-over-year in September! That’s the best quarter ever for the market, says Autodata Corp. Continue reading

Joe Overby of Auto Remarketing shared that Certified Pre-Owned (CPO) vehicle sales climbed nearly 20% year-over-year in September! That’s the best quarter ever for the market, says Autodata Corp. Continue reading

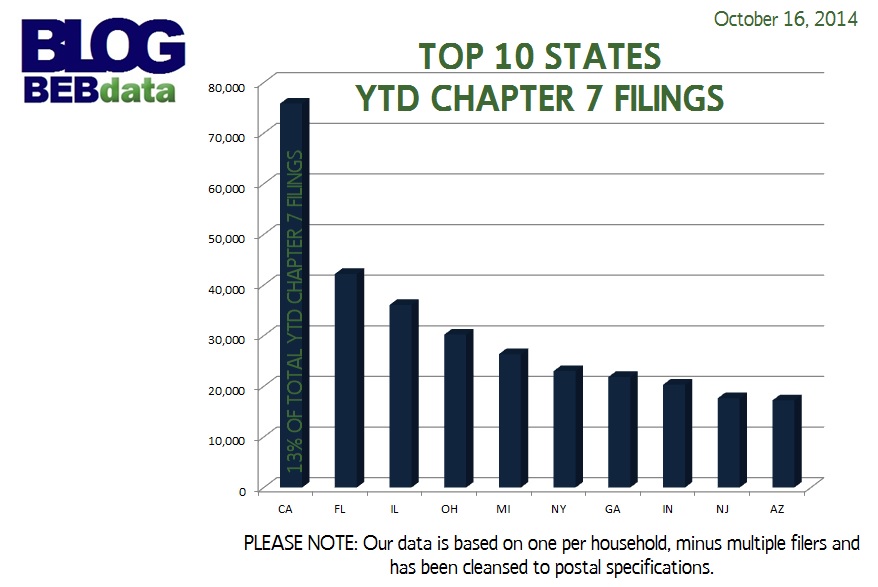

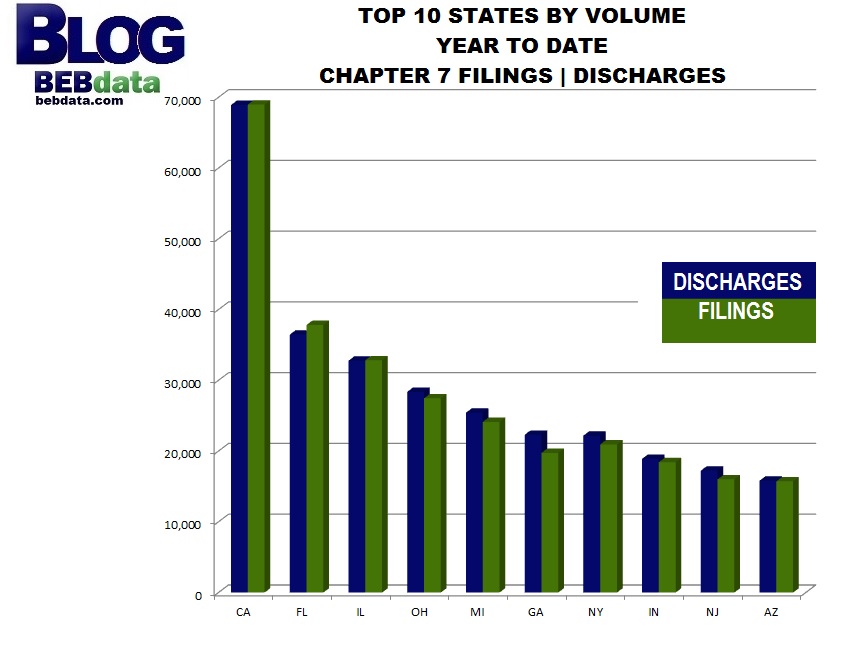

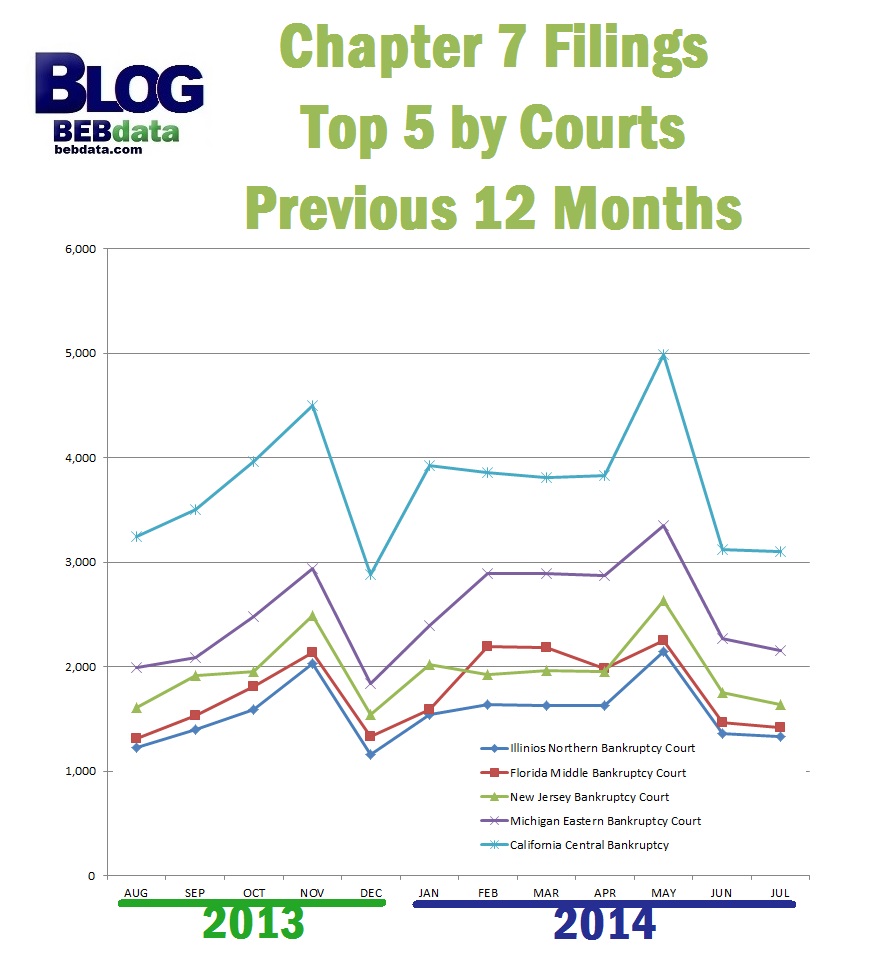

CHAPT 7 Filings & Discharges YTD

Can you answer this equation?

What is the sum of:

With Earvin “Magic” Johnson as a keynote speaker, marketers from 30+ countries and tons of sessions focused on data and marketing, the answer is DMA2014! Check out more about this fantastic conference by clicking here.

With Earvin “Magic” Johnson as a keynote speaker, marketers from 30+ countries and tons of sessions focused on data and marketing, the answer is DMA2014! Check out more about this fantastic conference by clicking here.

We’ll be there and in “full force”! Are you attending this year’s premier marketing event? Check out our short video on the show! Click on the icon below to view.

BEBdata DMA2014 BOUND

We’ll be attending the week-long celebration of data, art, and science also known as DMA2014. We can’t wait to see so many of our clients. The show (in San Diego this year), is a place were we share ideas and innovations. There will be over 200 global marketing leaders presenting at this must attend annual event. For more information regarding THE GLOBAL EVENT FOR DATA DRIVEN MARKETERS, click here.

We’ll be attending the week-long celebration of data, art, and science also known as DMA2014. We can’t wait to see so many of our clients. The show (in San Diego this year), is a place were we share ideas and innovations. There will be over 200 global marketing leaders presenting at this must attend annual event. For more information regarding THE GLOBAL EVENT FOR DATA DRIVEN MARKETERS, click here.

Be sure to join the amazing social conversations surrounding this premier event when you use #DMA14. Hope to see you there!

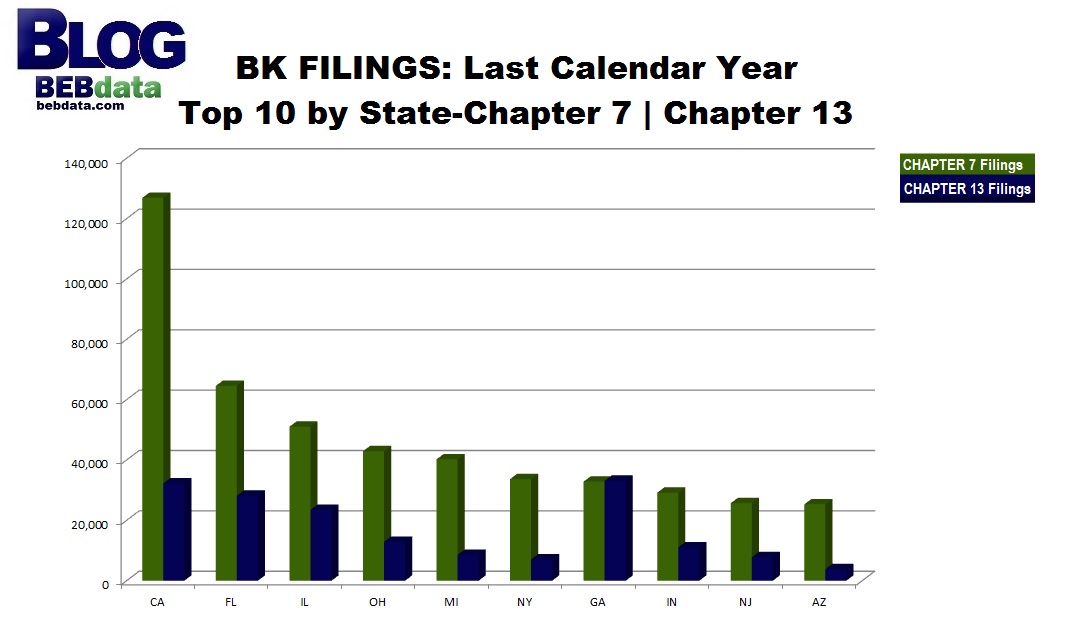

BK FILINGS: Calendar Year Top 10 Ch 7 |13

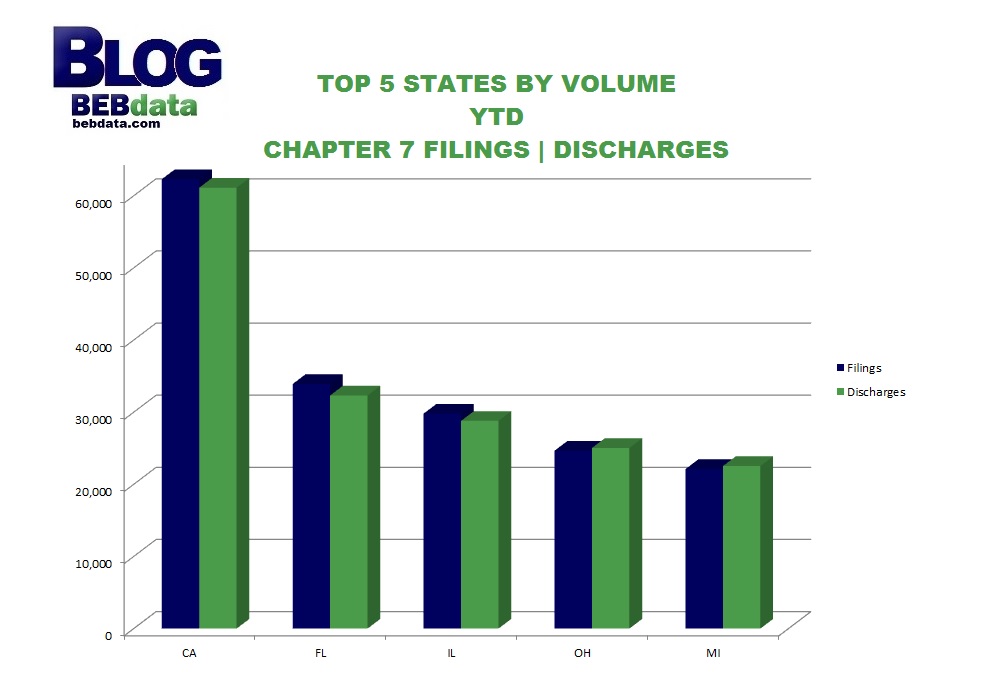

Bankruptcy Data: CHAPTER 7 FILINGS | DISCHARGES

Chapter 7 Filings: Top 5, by Court-Previous 12 Months

Financial Reform Reportcard from USA Today

With two A’s, one C, a D, and an F; the editorial board of USA Today isn’t giving Financial report the best grades. Check out this excerpt below or click here to read the report in its entirety.

With two A’s, one C, a D, and an F; the editorial board of USA Today isn’t giving Financial report the best grades. Check out this excerpt below or click here to read the report in its entirety.

When the credit bubble burst in 2008 and the world almost fell into another Great Depression, the public’s anger could be distilled into two demands: that the people responsible for the calamity should be brought to justice, and that the government should act to ensure that nothing like it happened again.

The first demand was never met. Although prosecutors have obtained large civil judgments against major banks — most recently a tentative $17 billion settlement with Bank of America — no top official at a major financial institution has been convinced of a crime. It can be hard to prove an intent to commit fraud with people who deceived themselves as thoroughly as they deceived others.